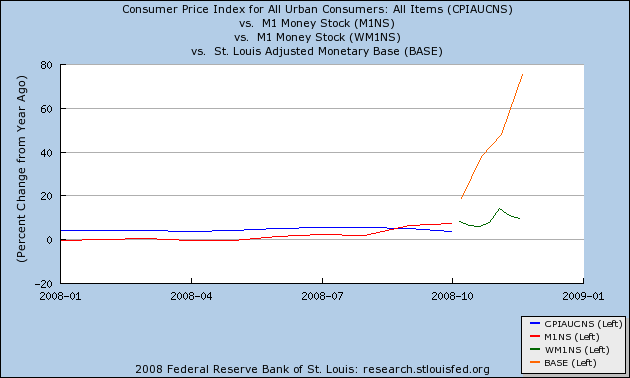

This is a follow up on my previous posts in which I discussed whether we were heading for a deflationary recession or a recovery in 2009. As we found out within the last couple of weeks, the deflationary recession is already here. But are there still grounds to believe a recovery in 2009 is possible? Money supply indicators (m1 [red, green] and monetary base[orange]) continue to indicate so as of this week's update:

It is now virtually certain that the Kasriel indicator will predict a recovery in the first half of 2009.

Against this, it has been argued, for example, here and by Mark Sunshine of First Capital that money velocity has slowed to a crawl due to banks' hoarding:

However, there was the new September/October surprise of liquidity hoarding and falling velocity of money. Lower velocity has the same effect as falling money supply; GDP is destroyed, commodity prices fall, deflation occurs, and credit is rationed.

But, the Fed’s effort to increase money supply doesn’t do anything to stop hoarding and maybe makes things worse. A better policy would be increased fiscal stimulus and qualitative adjustments to banking regulations. Qualitative regulatory changes that discourage hoarding include incentives for lending and disincentives for holding cash and Treasuries.

Certainly true, but the counter-argument imho is that this "hoarded" money has not disappeared into a black hole: when banks become more confident, all of this money being thrown at them will still be available to be lent out. Once a new Administration of authentic Grown Ups takes office in January, perhaps with a decent and large stimulus package, that confidence may well begin to appear. When the spigot opens, recovery may not be far behind at all.

Again, I caution that although the coincident data is just awful, showing a deepening recession, that does not mean that the indicators cannot reverse quickly, just as gasoline prices for example did in July.

So an (anemic) economic recovery is still possible in 2009.

Comments

I'm begining to wonder if M1

Really is M1.

Every new dollar printed, in theory, is either spent by the Fed buying bonds, or the Fed loaning it to a bank.

This is more debt overall. There is no real M1 here, just more debt.

Isn't debt what is causing the deflation to begin with?

I'd say what we need to combat it isn't loans, but grants; actually printing the money and either spending it on infrastructure or just giving it away; either method would create the hyperinflation we need to combat the deflation and kick start the recovery.

-------------------------------------

Maximum jobs, not maximum profits.

Question

Technically can a recovery occur with a 10-12% unemployment rate? (by the definitions).

How do you define "receovery"?

I think we might see a "recovery" in (highly dubious) statistical measures of the economy, such as GDP, capacity utilization, unemployment rate, and so on.

But I'm a nutcase. I'm not looking for a recovery. I'm looking for a complete revolutionary shift

- from a "post-industrial" consumerist society that consumes more than it produces without accounting for negative externalities such as environmental degradation, and counts in GDP the speculative frenzy of financial derivatives creation and trading,

- to a industrial-oriented society that producing the surplus of capital goods to truly develop the less-developed countries of Africa and elsewhere, beginning to rapidly wean itself off fossil fuels and has finally learned the difference between enterprise and speculation and reigned in financial markets accordingly.

Now you are talkin' the talk!

...check out this post for an alternative view of what 'the economy' is suppose to do.

When we get this sort of discussion 'on the table' we will be on the road to a better tomorrow. As long as the discussion is bounded by current ideas about how society works and why we need it we're not gonna get...

......'the change you've been waiting for'.

This is why Krugman, while doing yeoman work that is needed for our current survival, and the rest of the economic establishment are not helpful in planning, yes we need to plan all successful society's planned stuff, and preparing for tomorrow.

'When you see a rattlesnake poised to strike, you do not wait until he has struck to crush him.'

recovery, expansion

In answer to both your and Rob Oak's questions above, I am using "recovery" in the same sense as "expansion" or "positive GDP". For example, the period of 1933-37 was an expansion or recovery. There was positive GDP growth during that period, even though unemployment never went below 12%.

Here's what I see in your "recovery"

Most of the people who actually lived through 1933-1937 wouldn't consider it a recovery; but you're right in a way.

Here's a point of "personal economics" that I'm going to put out there because I do believe in your methods if not your definitions:

Watch NDD's figures very carefully. They indicate a once-in-a-lifetime deflationary depression opportunity coming. Keep a close watch on the PMI as well. You'll have about a month, maybe, or closer to a week between PMI increasing and the increase of the prices in the stores. This will be the bottom of deflation. This will be the time to buy durable goods for your household that have a 10-20 year expected lifespan. You won't see them this cheap for another 70 years.

-------------------------------------

Maximum jobs, not maximum profits.

No problem

Definitions frequently carry emotional "baggage" with them.

I try to keep to the usually dry academic definitions, but for example, for a huge minority if not the majority of people the recovery/expansion of 1933-37 still was a rotten time.

Tutorial, info

It might be useful to define, macro-economically, what constitutes a recovery, by economic indicators, for people.

Then, we might discuss what these metrics lag reality so badly and also how they defocus on working people.

I'm thinking of the jobless recovery, which if you're right on the tepid 2009 recovery will surely take place and the huge disconnect from main street.

35% risk of Global Depression

I was just reading about the increase in commercial CDSes and buried within is a Unicredit with a 35% chance of a global depression in 2009.