In Friday's diary, Housing is Nowhere near Bottom, BUT ... I cited as I have several times previously a paper on housing cycles and recessions that was presented by Prof. Edward Leamer to the Federal Reserve at its Jackson Hole conference in 2007. The paper itself is an excellent, in-depth analysis and I highly recommend your reading it in full if you have an hour or so on your hands due to inclement weather, indolence, intellectual curiosity, or if you just generally have a pathetic life.

Unfortunately, many people are dismissing Leamer because even though the data in his paper led to a spot-on conclusion, namely:

The historical record strongly suggests that in 2003 and 2004 we poured the foundation for a recession in 2007 or 2008 led by a collapse in housing we are currently experiencing....

no doubt influenced by the sanguine outlook preferred by his audience, he disregarded that, and instead included the following paragraph:

But don't worry.... This time troubles in housing will stay in housing. It's because manufacturing has done an "L" of a job.... Though this is uncharted territory, it doesn't look like manufacturing is positioned to shed enough jobs to generate a recession.

as to which from the viewpoint of December 2008 he is undoubtedly beating his fist on his forehead and repeating NO NO NO NO NO NO NO NO NO !

As it turns out, this time it isn't different.

I initially discussed Prof. Leamer's paper over a year ago here. Too often economics is high theory and mathematics, utterly divorced from reality. It suffers from fudge factors ("utility" and "rationality") that render it non-falsifiable no matter what the data. Leamer, by contrast, did what most of us would prefer economists do; namely, assemble the data and only then consider a conclusion. As he said:

[All leading macroeconomic theories] all suffer from the same problem -- too much theory and not enough data. In particular, none of these comes to grips with the role of housing in modern US recessions...

I have not been able to find any macroeconomic textbook that places real estate front and center, where it belongs....

Something's wrong here. Housing is the most important sector in our economic recessions and any attempt to control the business cycle needs to focus especially on residential investment.

Therefore:

My goal is to provide unforgettable images that leave a lasting impression regarding the importance of housing to what we call the business cycle...

Leamer's (very extensive) exposition of the data led to the following conclusion:

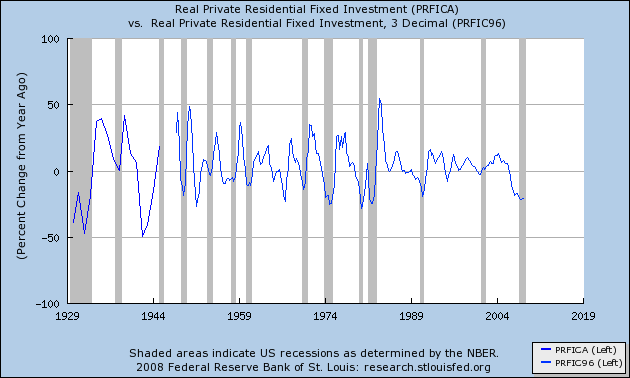

The first item to soften and the first to turn back up is residential investment:

The temporal ordering of the spending weakness is: residential investment, consumer durables, consumer nondurables and consumer services before the recession, and then, once the recession officially commences, business spending on the short-lived assets, equipment and software, and, lasst, business spending on the long-lived assets, offices and factories. The ordering of the recovery is exactly the same.

Leamer used a sophisticated mathematical "kernal" to calculate the relative contribution of housing to GDP during expansions and recessons, in order to arrive at his conclusions, but we can approximate this by looking at Real Residential Investment (i.e., normalizing for inflation) which was calculated annually until the post WW2 era, and quarterly since:

(note: I have omitted 1945-46 because investment soared at a 300% YoY rate, which would reduce the rest of the graph to squiggles!)

What is most noteworthy is that the %age increase in real residential investment has always peaked before the onset of the ensuing recession. Since the onset of the Great Depression in 1929, it has troughed at the end of the recession 4x, in advance of the end 7x, and before the onset of recession 2x -- i.e., either at or before recession's end. To put it simply, %age change in Real Residential Investment is confirmed as a major leading indicator.

Our current economy is such that statistics which only date from the post-WW2 inflationary era can be gravely misleading. In that regard, Leamer's aside to pre-WW2 housing data is most noteworthy, to wit:

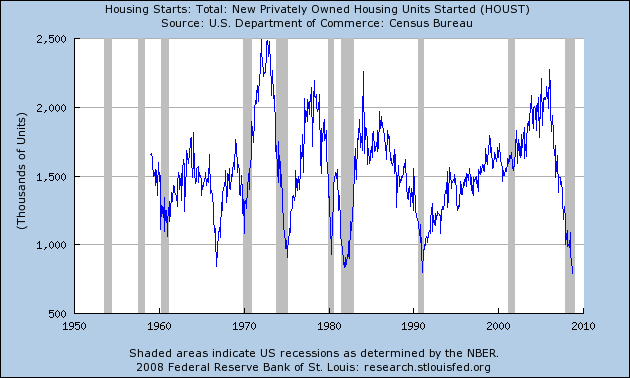

The housing starts data available from the Census Bureau begin in 1959 [but] ... the image [ ] of the earlier data in Ketchum (1954)... [shows that] ... housing starts declined beginning in 1925! .... Problems in housing led the great depression by a full three years. ...[I]t seems possible that the increase in the discount rate in 1928 was very hard on an already weakened housing sector, and set in motion the events that led to the Great Depression, dropping housing starts from around 850 thousand in 1925 to a meager 40 thousand in 1933.

Here is the image referred to in the above paragraph:

Approximating Leamer's ratio by comparing Real residential investment to GDP, I have been able to calculate that the previous two worst post-WW2 declines have been from July 1978 to July 1982, at ( -46.6%) from 6.35% of GDP to 3.39% of GDP; and from January 1973 to January 1975, at ( -38.6%) from 7.15% of GDP to 4.39% of GDP.

Although Leamer's ratio cannot be calculated on the same chain-weighted inflation basis for the pre-WW2 era, using regular norming for inflation, it appears that from 1929 through 1933, the ratio declined approximately ( -69.8%) from 5.61% of GDP to 1.71% of GDP. Since we know that housing starts declined over 50% from 1925 through 1929, it seems likely that the peak ratio was about 10%!

(As an aside, the ratio of new housing starts at their peak in 1925 of 850,000 units to 116 million population, almost exactly match that of 2005's 2.273 million to 300 million population, at .75%)

If this were a regular, "minor" recession like 1991 or 2001, by the time the service sector rolled over a couple of months ago, housing starts might already have bottomed and a nascent recovery might have started. Unfortunately, for reasons that need to be more fully explored in another diary, there was a singular decline in consumer spending that began in September and may be having the effect of an avalanche now. Indeed, the most recent housing starts data from October:

at an annual rate of 791,000 starts, is the lowest reading since the end of WW2. Leamer's ratio has declined from October 2005 through July 2008 ( -44.6%) from 5.43% of GDP to 3.01% of GDP. By now, the decline almost certainly exceeds that of 1978-82.

In short, Prof. Leamer's model shows that we are still firmly in recession. Leamer himself should have stuck with what his model concluded (which was absolutely correct) and not ventured into the "uncharted territory" of "this time it's different." This time it isn't different.

As my regular readers know, I like to follow the data and be alert to changes in trend. Friday's diary was about the change in the rate of a trend, i.e., the rate of decline in the volume of housing starts. I noted that even if, in terms of prices, Housing is Nowhere near a Bottom, in terms of volume of new houses started, we might be getting closer -- at very least, we might be near to the bottom of the waterfall decline, and in view of navigating the lower rapids. If this shows up in the next few months in real residential spending, that will suggest the free-falling economy of autumn 2008 is stabilizing. It isn't there yet.

Comments

It won't stablize

And here's why:

I don't believe this for a second. Thanks to the credit (not housing, though that was a part of that) bubble, this is MUCH bigger than just housing. We're now in a solvency trap- debt produces insolvency, which produces panic-sales of stock (not just stock market stock, but goods, durable and consumable), which produces deflation, which produces government bailouts, which are paid for with more debt, which produces more insolvency. It's already affecting *EVERY* sector of the economy. Without real M1 spending by the government, replacing debt with real money and hyperinflation, there's no "automatic" way out of this cycle.

Yes, we'll see individual industries such as housing recover- it's not like we can just send most of our population to live in caves, and houses, despite being durable goods, are affected by physics and the general thermodynamic law of entropy. But this will NOT be anything close to a general recovery, until we fix the basic solvency trap we're in.

I see signs now that the Obama Admin is indeed planing that type of infrastructure, M1 stimulus we need, and that might hasten the end, but these leading indicators will mean nothing without it.

-------------------------------------

Maximum jobs, not maximum profits.

I beg to differ

After 35 years in real estate and a recession the beginning of each decade where I worked and lived, this is the first time I have seen mortgages created by people who knew nothing about mortgages and have been exempted from both state and federal laws. Had I brokered mortgages of the type created especially by Wall Street, I would currently be in jail. The poor quality of the underlying paper would be obvious to anyone with common sense. Add in the side bets they placed and the lack of a legal paper trail for judges to follow in court in terms of who owns the mortgages and we have a global disaster. There is good reason these people playing at real estate knew they needed legal protection before they began their large game of "21st Century" financing. Main Street is now paying big time for their ideological idiocy and greed. I see no end in sight.

But aren't housing prices too far out of line?

My impression is that, if you look at the Schiller index (and think about how much housing prices skyrocketed the past few years), that there is no way that prices will start going up for many years, if not for over a decade. I remember, at least in NYC, when a real estate bubble popped at the end of the 1980s it took about 10 years to recover. So I don't see how to force housing prices to recover; the recovery will have to come from some other sector (er, manufacturing, for instance).

JR on Grist

Jon Rynn

When I brought this up before

NDD mentioned that he's talking about construction volume recovery, not price recovery. While they are linked, price recovery's going to lag behind volume recovery by quite a bit. Easily a decade or longer.

If you think about it a little- you'll see why. Housing is subject to entropy, which means eventually we'll see a turnaround on construction volume if for no other reason than to tear down all of those crappy McMansions that went up. But this won't exceed necessary maintenance and replacement- there's not going to be a huge number of buyers until the credit bubble finishes popping and all of the bankruptcies are discharged- which will take a decade or more.

-------------------------------------

Maximum jobs, not maximum profits.

Population growth and the need for new houses

US population is a little over 300 million and growing by about 3,3 million a year.

Average household size is about 2.6 people per household.

Only about 2/3 of residences are houses vs. apartments.

Put those figures together and we can estimate that about 1.2 million new places for shelter are needed each year to keep up with population growth, of which about 800,000 would be new houses (see my prior diary where I drew a trend line about this through Mike Larson's graph).

At peak, about 3 years ago, nearly 1.4 million units a year were being constructed. Now only 450,000 per year are being constructed. At some point in the not distant future, the glut will have been worked through and an upturn will commence. Ironically, the more new home sales continue to cliff-dive now, the sooner that date - where volume, not price of new homes turns up - will be.

Will it be next year? Possibly, but I won't disagree with those commenting here saying that's not going to happen. And it wouldn't surprise me if prices declined for another 5 years -- although, again harkening back to Russ Winter's guillotine, then sandpaper analogy -- I suspect the transition from the first phase to the second may happen in the next 12-18 months.

Also I don't disagree with LillithMc's point, but I think her point explains the tremendous collapse in both volume and price, without negating the essence of Leamer's timing argument. Residential investment is still most likely to be what turns up first before the end of the recession.

I lived it in Va.

Bought our first house in 1991. It never regained its value until after we sold in 1998. We lost 10% not counting the realtors cut.

Leamer

NDD, I like the fact that you do your best to see the good in people like Leamer. You make valid points about him, ie: "divorced from reality". Regarding housing, I think the term "bottom" is relative in some respects. Yes, we could be getting close to a bottom, but as referenced earlier, that "bottom" will likely be long and drawn out. Unfortunately, housing starts are a leading indicator which means more economic woes ahead. Hopefully, this does not cause a snowball effect (which I think is likely to happen). I don't have the case-shiller index, but my friend said that Schiller said that we must get back to '85 prices or something to that nature. Then he went on to say that if that is true, look for another 30% decline. Ouch. I hope my friend is wrong, or reading the index wrong.

Both might be right

See my explanation above on why price recovery is going to lag construction volume recovery in housing.

On a personal note, I'm hoping I'm able to keep my job over the next two years- if so, I'll get to take advantage of cheap labor to get my master bath renovated (and it needs it, we're battling mildew in there constantly).

-------------------------------------

Maximum jobs, not maximum profits.

re: Both might be right

I agree that this could take a decade or longer. Pricing will only go up if the demand exceeds consumption. If inventories continue to swell, there is very few ways that pricing will move higher.

How will inventories shrink? Here are a few possibilities. Credit (lending liquidity) is the first step as you pointed out. Next, buyers will have to be qualified...but, many have ruined credit now due to walk outs. Next, an influx of foreigners causing a housing demand. Next, people must have jobs. So on and so forth. So, right now the situation looks bad and no end in sight. The obama admin won't be able to keep up with the lack of demand for production. We don't produce anything like we used to. White collar jobs are now shipped overseas.

Obama wants to add 2.2 million jobs by 2011. Well, that is still eclipsed by the 3 million jobs that will be lost by 2010. Talking about creating 2.2 million jobs and doing it are 2 different things. We shall see.

--------

Obama wants to save or create 2.2M jobs

December 7, 2008

WASHINGTON --President-elect Barack Obama told the nation Saturday that he has asked his economic team for a recovery plan that saves or creates 2.2 million jobs, a day after the Labor Department announced the economy is losing jobs at an alarming rate....

Some analysts predict 3 million more jobs will be lost between now and the spring of 2010 -- and that the once-humming U.S. economy could stagger backward at a shocking 6 percent rate for the current three-month quarter.

http://www.montgomeryadvertiser.com/article/20081207/NEWS02/812070323/10...

And jobs alone won't cut it

Unless, of course, housing prices fall to around 3x poverty level. Which is what I see as the natural bottoming out.

-------------------------------------

Maximum jobs, not maximum profits.

New Deal Democrat's math points to the underying cause of...

....this bubble and it's resolution.

In no year since WWII have enough new living units, apts. plus SFR, come on line to meet the demand for same created by that year's growth in households.

This is why folks were willing to sign 'bad' paper to get into a house. They viewed it as their only chance to own a home. Locked out of the market by corporate America's refusal to share a fair share of the profits by paying a fair income to folks since 1972, real income has dropped every year since then, they jumped at the chance.

If the mortgages had not be 'financialized' much of this mess might have been avoided.

Be that at is may two things are evident. The nation needs more housing and much, not all, of that housing that is in place is located on land that is irreplaceable. Close in to business centers, cities and existing towns. I contend that housing values will stabilize and start to rise one the large numbers of foreclosures work themselves out of the system and credit becomes available. I do not believe, given the attitude so far shown by the Obama admin, that this will take that long.

The need for new housing is there and the value for existing housing continues to rise as long as there is a deficit in production. This may sound nuts but it has been ever thus and this downturn will not last.

In my area people are still breaking ground on units that are in highly urban areas. Are these folks nuts. I doubt it.

'When you see a rattlesnake poised to strike, you do not wait until he has struck to crush him.'

I think they're nuts

And here's why: Housing is just the straw that broke the camel's back. The *real* problem is a solvency trap: the world's assets are worth about 120 times the amount of actual *real* money out there, and we've borrowed 600 times that in interest payments to get those assets.

What that argues for is *either* massive deflation all around, or a MAJOR need for M1 stimulus to the tune of about 10x the United States's GDP.

While yes, there's a deficit in production, that deficit will NOT affect housing values one whit, not until the debt bubble has been destroyed.

At which point, the house that I paid $142,000 for in 1998, will be worth about $60,000.

-------------------------------------

Maximum jobs, not maximum profits.

re: I think they're nuts

Seebert,

You and I are either both off or both on. Which is true, I don't know, but I see things just as you do. We are seeing the highest consumer debt since the 40's.

The optimists must realize one thing...you CAN'T buy a house if you are in hock up to your ears! So many people on my street bought SUVs...big ones may I add...8 cylinder gas guzzlers by taking equity out of their house. They bought swimming pool and took vacations. Now they are upside down. No, they are not going to be buying a house anytime soon. Nothing that Obama can do to change that. I hate to be negative, but I call the shots as I see them.

This system is built on a house of cards. Now the piper has come to ask for his wages.

The actual house is not

The actual house is not declining in value, the value of dirt underneath the house is declining. Without the land cost, the cost of replacing the house would be about the same, no matter where you put it.

The dirty little secret that economists can't seem to fathom is that immigration was used/pushed to create the housing bubble, sure as hedging drove oil towards $150.00 a barrel, population increases cause housing inflation. (10% annual is inflation not appreciation.)

Meanwhile, U.S. job creation stagnated.

Demand for housing will not return until housing is affordable -- housing valuation is based upon what amount the wage earner can afford to pay and the interest rate.

Flattening wages through population increases (working age immigrants) will not improve the housing market -- it depletes the pool of qualified buyers. Let's not forget that there are millions of full time vacant homes that are not for sale and not for rent. The declining economy will cause many of these 7.6 million units to be introduced back into the for-sale inventory.

http://www.census.gov/hhes/www/housing/hvs/qtr308/files/q308press.pdf

re: The actual house is not

And just wait until the 5 year re-adjustables kick in. It's not going to be pretty.

Actually the value of the land is going up...

...they are not making any more of that and specifically. Certain land, say within 20 miles of downtown anywhere is increasing in value because of increasing transportation costs. This assumes that existing urban centers will remain existing centers of employment. A pretty safe bet as every effort to create 'work centers' in the countryside will run up against transportation costs. Gas will be $4.00/gal next year.

I agree that the underlying problem is not enough income. Corporation income has risen quite nicely the last 40 years of 'conservative' economic 'free market' looting.

The worker's income...

Not so much.

That is about to change big time for two reasons: the workers have finally figured out the scam, getting foreclosed upon or laid off will do that for ya; and, the system as currently built won't work unless the consumer can consume so the corporate scum will have to let go of some of their swag.

Noting new just the 'growth economy' cannibalizing itself.

'When you see a rattlesnake poised to strike, you do not wait until he has struck to crush him.'

I thought that was just a trick of the tax man

I noticed that on my recent tax assessment- my house lost $20,000 in value as expected, but my land went UP $15,000.

-------------------------------------

Maximum jobs, not maximum profits.