In my recent series, Economic Indicators during the Roaring Twenties and Great Depression, I concluded that the indicators that were studied from the Deflationary period of 1920-1950 suggested that this recession might bottom out in about Q3 2009. But with anemic wage growth to say the least, such a weakly based recovery might be doomed at birth to be short-lived.

All the deflationary recessions from 1920 - 1950 followed a pattern. The CPI declined from the beginning of the recession and its YoY rate of decline bottomed immediately before the recession's end. M1 money supply followed a similar pattern, sometimes coincidentally, sometimes leading slightly. In all 6 of the deflationary recessions during the period of 1920-50, once M1 and CPI both declined at a decreasing rate, the recession was about to end.

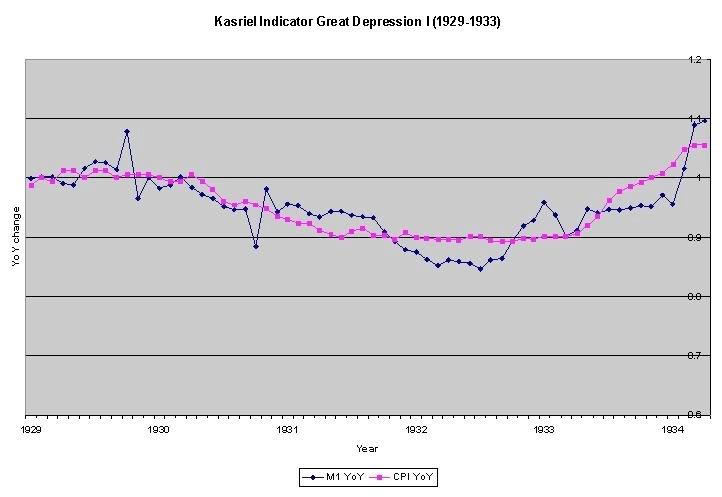

For example, looking at the Great Depression of 1929-32:

we see that in this, the biggest of all economic contractions of the last century, like all other deflationary recessions, there is a clear pattern of M1 and CPI on the graphs --both turn down, then sometimes sideways, before simultaneously or with M1 leading the way before CPI, both turn back up near the end of the deflationary recession.

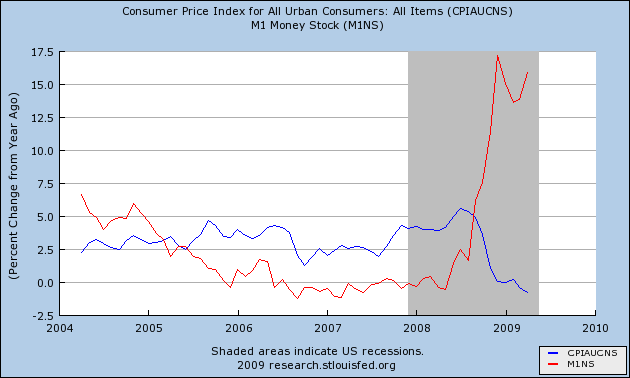

Turning our attention to our current financial crisis, which also features a debt deflation, here is the graph of the same indicators (M1 and CPI):

As I noted in the earlier series, this graph indicates that it is very unlikely that YoY CPI -- which shows no signs of having bottomed yet -- will bottom out before the middle of 2009, although under the optimistic scenario in particular it appears the bottoming will at least take place shortly before or after. Thus, if M1 continues to expand, in the face of the positively sloped yield curve from 2008, the indicators we have studied from the earlier Deflationary period suggest that the recession (in terms of negative GDP) might bottom out in about Q3 2009.

But then what?

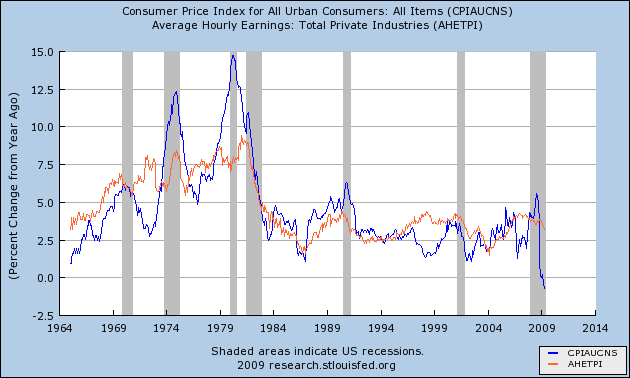

I ask this question because wage growth, currently running at about 3% YoY and declining, stinks. Here is a graph going back over 45 years (as long as the series exists), comparing wages (in orange) with CPI inflation (in blue):

It's pretty easy to see that the only time there was sustained wage growth in excess of inflation was in the post-war economic golden era of the 1960s and early 1970s; and during the tech boom of the 1990s. In the inflation and recession plagued later 1970s, wages failed to come anywhere near runaway inflation. And with the aforesaid exception of the tech boom, ever since the Reagan revolution, almost all growth has been vacuumed up by the very top of the income scale. Wages did not exceed, and frequently lagged, inflation. In short, Americans have had largely stagnant wages since 1974.

So, if our current -0.7% inflation bottoms out and turns up within the next 2-4 months, how could there possibly be any significant expansion, if once again wages fail to keep up? Any such recovery would be short lived, strangled by the inflation caused by its own increase in demand. If the graph immediately returns to how it looked earlier in our decade, where the inflation rate exceeded wage growth, consumers would simply cut back again, plunging the economy into the second half of a "W"-shaped recession.

The problem is, the same argument was true all during the 1980s and early 1990s, and for much of our own decade. Why didn't a recession persist throughout the 1980s? Why didn't it persist into the middle of our own decade? In this case, the past answer may be prologue to the future one.

Back in August 2007, I wrote a piece called Are Hard Times Near? The Great Decline in Interest Rates is Ending At that time, I pointed out that,

[w]hile from 1980 through 2006, the median income of an American household has risen only from $39,700 to $48,200 in real terms, house prices for example have shot up form nearly $125,000 to $246,500. Consumers have responded generally by taking on more and more debt. Total household debt service has risen from 16% in 1980 to 19.4% in 2006:

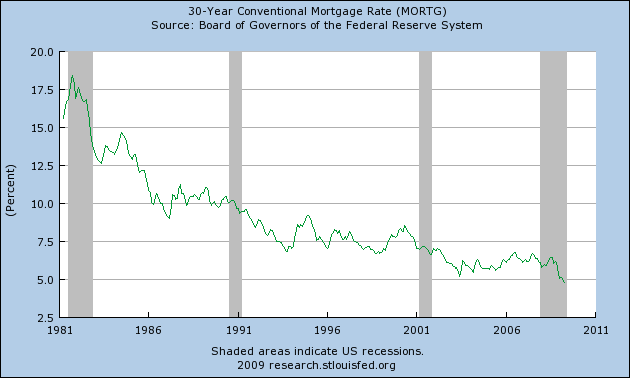

Fortunately for consumers, there has been a generation-long decline in interest rates since they peaked at 15.21% for the 30 year US Treasury bond in October 1981. This has allowed consumers to refinance their debts at ever lower rates every few years:

They have also been assisted by a bull market in stocks that took the S & P 500 from 102 in 1982 to 1553 in 2000, and the subsequent housing boom/bubble [that topped out by January 2006].

There are signs that this "Great Disinflation" of declining interest rates is coming to an end. Only twice in the last 27 years has the consumer been unable to refinance debt or tap into his or her stock or house ATM. ... [T]he 3rd and final time is almost certainly near.

In other words, since 1980, the only way American consumers have been able to significantly improve their lifestyles is either to take on debt, using assets which have appreciated in value as collateral, or to refinance their existing debt at lower interest rates. When consumers were unable to tap the increasing value of assets, or to refinance at lower interest rates (for longer than a 3 year period), then without improvements in wages, they cut back on spending, triggering consumer-led recessions. Since 1980, this confluence of negative factors had only happened twice: in the deep Reagan recession of 1981-82, and again briefly from July 1990 to March 1991.

As of 2007, household income was still below 1999 levels. Interest rates had not receded to their 2003 levels, so refinancing activity could not increase. House prices were already in marked decline. Consumers were already starting to cut back, albeit not yet that significantly (as of June 30, 2007), on debt. Only stock prices, by the barest of margins (.02%), were positive. I concluded that "In order to avoid a recession, house price declines must stop, stock market gains must accelerate, or household income must increase significantly. Failing at least one these three things, if households have continued to cut back on debt, as appears likely, America will probably enter (or may already have entered) only its 3rd consumer recession since 1980."

That last conclusion was certainly true! With a declining 401k value, crashing house prices, increasing Oil-fed inflation, and paltry wage gains, the recession started just a few months later in December 2007.

Unfortunately, the neoliberal economic paradigm is still embraced in a bipartisan fashion in Washington DC. We need not recapitulate the pedigrees of the most powerful economic advisors to the new Administration. So it does not seem that the productivity of American workers is suddenly going to be reflected in wage increases. No new asset bubble is on the horizon. On all of those counts, the news is bleak. There is no upsurge in wage growth lurking on the horizon - or even seriously considered as a public policy desideratum inside the Beltway.

But there is one single ray of hope that a recovery might be sustained at least for a while. A window of oppotunity in interest rates has just briefly opened. In the same August 2007 story, I concluded that there was "a first-order danger signal for the long term future is that long term interest rates seem unlikely to move lower ... soon." But "[i]f long term interest rates do decline again, consumers may yet have one more chance to refinance their spending for the next few years."

That last point may be pivotal now. Here is a graph of mortgage interest rates, showing the recent record decline to near 4.5%:

This interest rate (currently at 4.81%) is slightly less than the previous record low since 1980 (of 5.23%). Already it is estimated that up to 15% of all mortgages might be refinanced this year. For example, a family with a $200,000 6% mortgage, who refinance at 4.5%, will save $3000/year. Such a refinancing would be seriously stimulative to household finances.

While if lower mortgage rates persist, there will be space for an economic breather, the paradigm of my 2007 piece remains true. So long as real wages remain stagnant, any recovery which might start will be vulnerable to every uptick in inflation and interest rates, and will be shallow, weak, and probably short-lived. The Great Disinflation of Interest Rates is Ending, the long-term structural problems of our economy have become immediate problems as well, and no long-term recovery can take root without real wage growth.

------------

Updated note: I must have good timing. This morning CNBC reports:

The mortgage business is booming—70 percent in refinancing and 30 percent in new home purchases,” Kelly King, CEO of BB&T told CNBC. “On the low end of the houses, we’re beginning to see some movement…There’s a long way to go, but there’s definitely activity.”

Comments

glad to see this analysis

It's high time someone focus on the ever eroding income.

Econbrowser has a great post on industrial production and there are now others focusing in on the trade deficit....saying (which is strongly connected to wages due to global wage arbitrage) if that is not reduced there will not be a real recovery.

Currently, the structure of our economic system

does not encourage wage growth. "American" Capitalism is strongest with low-wage jobs and high leverage.

NDD, you are on a role.

RebelCapitalist.com - Financial Information for the Rest of Us.

I wouldn't say that's always true

The U.S. economy was on a real roll from the New Deal until about the 1970's. Now Nixon (I'm sorry I have never seen him as the ultimate bad guy here, he looks like a Communist in comparison to policy today ;)) took the U.S. off of the Gold Standard, I believe started at that time, labor arbitrage trade but it's not clear to me precisely what policies were changed that started this downward spiral on wages. But it seems to spring from the 1970's time frame, when they were also fighting like mad inflation and the oil crisis.

So, I need an economic policy history lesson or need to find out for myself. If someone already knows I'm listening.

Nixon going to China

Sure seems to me to be a turning point against Labor in the United States. Took a while for that trade deal to work it's damage though.

-------------------------------------

Executive compensation is inversely proportional to morality and ethics.

-------------------------------------

Maximum jobs, not maximum profits.

I don't think that's it per say

although normalizing relations with China did open the door to really bad trade deals...but when trade deficits really kicked in was starting with NAFTA and then the WTO. That's 1993, with the China PNTR (disaster!) in 2000.

It's other things and this is the start of union participation decline. I'm missing something.

Bretton Woods

I think midtowng is right, it's Bretton Woods.

Nation-states can play a lot of games in international markets by devaluing their currency. This is what the Chinese Yuan is all about. China has it pegged to the dollar, not floating, which gives them an unfair advantage on a host of issues surrounding trade. By keeping their currency artificially low, they can be the ultimate cheap labor market, costs are much less to build factories, etc. in China.

Here are some references.

Dr. Ellen Brown wrote a book called The Web of Debt which gets into the history of banking and money. I haven't read the book but I have read a lot of essays of hers at www.globalreasearch.ca. Coincidentally, Steve Lendman published his sixth and final article just today, which has been reviewing the book. I had thought about writing a blog about money, the Federal Reserve Act and our troubles, but these people have done it much, much better than I can.

Also, I hope you have read Tyler Durden's fantastic article The Exuberance Glut Or The Dollar-Euro Short Squeeze Race about Global Liquidity, The Shadow Banking System and well, just how much of a shit hole the world is in. It has been making the rounds on a lot of financial blogs including TBP and NC. I don't read that many analysts, but this guy has to be one of the very best anywhere.