Treasury Secretary Timothy Geithner testified today before the Banking, Housing & Urban Affairs Committee. The headlines blaze with a Geithner quote, it is past time for China to move on Yuan re-evaluation, as if some sort of action might actually happen against China and their currency manipulation.

In reading Geithner's hearing testimony, we have this:

We have very significant economic interests in our relationship with China. With over 1.3 billion people and an economy continuing to grow at or near double-digit rates, China is our fastest-growing major overseas market. China’s record of bringing hundreds of millions out of poverty, building a rapidly growing middle class, and now its efforts to encourage growth led by domestic demand, ultimately mean more demand for American goods and services. Increasing opportunities for U.S. firms and workers through expanded trade and investment with China will be an important part of the success of the President’s National Export Initiative and our efforts to support job growth more broadly.

Did you know that? Did you know the U.S. supports expanded trade with China? Did you know the United States falsely believes China will eventually demand our goods and services when it is clear China is simply capturing much of the U.S. economy and jobs? The reality is many U.S. multinationals are using China's cheap labor for manufacturing and for cost savings. That isn't the American worker, that's our globe hopping, multinational corporations. GM maybe selling more cars in China than in the United States, but it's also employing more workers around the globe, instead of the United States.

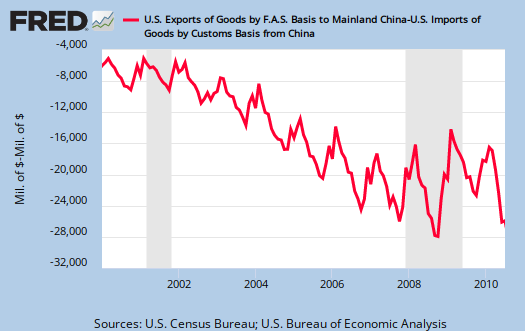

Look, here is the graph of the trade deficit with China. That downward projection is our never ending and increasing trade deficit with China. Yes, the U.S. is in the red in more ways than one with China and trade.

Geithner then testifies more about touting China as a U.S. export market. This is inane, more like export of U.S. jobs. China is the destination of many U.S. companies. Manufacturing exclusively in China and Asia by U.S. multinationals is routine.

On the other hand, while the Obama administration and Congress have sat on their hands with regard to China, especially their currency manipulation, today we have this from Geither's written testimony:

On June 19, 2010 China took a very important step when it announced that it would renew the reform of its exchange rate and allow the exchange rate to move higher in response to market forces.

In the roughly three months since that announcement, however, the Chinese have allowed their currency to appreciate against the dollar by only one percent, and the currency has actually depreciated against the weighted average of the currencies of its trading partners.

During this same period, China has had to continue to intervene in the exchange markets on a very substantial scale to limit the upward pressure of market forces on the Chinese currency.

Even with the appreciation of the renminbi against the dollar that has taken place since this process began in 2005, China’s real trade-weighted exchange rate is now only 4.9 percent stronger than it was on average from 1998-2002, an unjustifiably small change given that China’s productivity doubled during that time.

It is the judgment of the IMF that, in view of the very limited movement in the Chinese currency, the rapid pace of productivity and income growth in China relative to its trading partners, the size of its current account surplus, and the substantial level of ongoing intervention in exchange markets to limit the appreciation of the Chinese currency, the renminbi is significantly undervalued.

We share that assessment.

The question is will Geithner finally label China a currency manipulator? Geithner mentions the next foreign currency exchange report.

We will take China’s actions into account as we prepare the next Foreign Exchange Report, and we are examining the important question of what mix of tools, those available to the United States as well as multilateral approaches, might help encourage the Chinese authorities to move more quickly.

Yet we have heard repeated claims, rumblings, implications this administration will finally do something about China's undervaluing their currency, yet when it's time to pony up, the U.S. ....does nothing.

Meanwhile Congress has done some soap box rhetoric on China, including bills in Congress.

So, is this yet another delay tactic by the Obama administration, refusing to really confront China and take action? A wait for the foreign exchange report, we're doing something, really (not)?

We need action now. Just look at the above trade deficit graphs with China (not adjusted with price indexes) and you get the real juice and magnitude of the problem.

Comments

China captured advanced R&D too

I'll have more on these events but of course China is out to capture advanced R&D. Anyone visiting China's trade areas, it looks modern, the U.S. looks like decay.

I should mention India also stops at nothing to try to capture all I.T., Tech, engineering and services.

Basically China is trying to capture advanced manufacturing, R&D while India is trying to capture all engineering related and I.T. related services, as well as professional services.

Meanwhile the U.S. hemorrhages and the government does nothing except maybe proclaim how great it is the U.S., by exporting jobs, is helping other nations create middle classes while we all sink into poverty, the proletariat.

Obama now talking Chinese currency manipulation

Of course Obama thinks Geithner/Summers are doing a "fabulous" job, yet for the President to mention China is deliberately undervaluing their currency usually implies something.

Bloomberg has the story.

We can only hope. This never ending inane labor arbitrage going on in the U.S. is in part caused by the never ending access to cheap labor.

Also, corporations do not have to do the right thing and realize part of their responsibility is provide Americans jobs....because it is not enacted into law, or if it is, it's not enforced.