The Federal Reserve released their Federal Open Market Committee meeting minutes from last January 25th.

They believe GDP, or economic growth will be higher and of course, the jobs crisis will still be dismal.

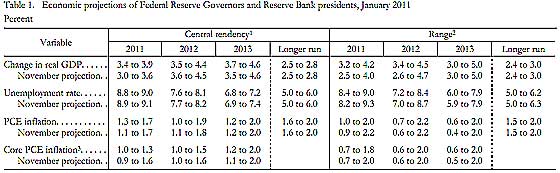

As depicted in figure 1, FOMC participants’ projections for the next three years indicated that they expect a sustained recovery in real economic activity, marked by a step-up in the rate of increase in real gross domestic

product (GDP) in 2011 followed by further modest acceleration in 2012 and 2013. They anticipated that, over this period, the pace of the recovery would exceed their estimates of the longer-run sustainable rate of increase in real GDP by enough to gradually lower the unemployment rate. However, by the end of 2013, participants projected that the unemployment rate would still exceed their estimates of the longer-run unemployment rate. Most participants expected that inflation would likely move up somewhat over the forecast period but would remain at rates below those they see as consistent, over the longer run, with the Committee’s dual mandate of maximum employment and price stability.

Below is their table of GDP, unemployment and inflation estimates.

There is also seemingly current attempts to dismiss the jobs crisis with claims of structural, otherwise known as Americans are fat, stupid, lazy and do not have the skills mantra, as well as somehow the ultra low labor participation rate is somehow normal.

This is what the Fed has to say about it:

Most of the research reviewed suggested that structural unemployment had likely risen in recent years, but by less than actual unemployment had increased. In discussing the staff presentation, meeting participants mentioned various factors that were seen as influencing the path of the unemployment rate. Several participants noted that estimates of the contributions of the individual factors depended importantly on the approach taken by researchers, including the models used and the assumptions made. Participants noted that many of the factors that contributed to the recent apparent rise in structural unemployment were likely to recede over time. Some participants stressed that certain determinants of the unemployment rate, such as mismatches in the labor market and firms’ hiring practices, were both difficult to measure in real time...

Paul Krugman has also been graphing his brains out, showing the main cause of the jobs crisis is weak labor demand, not structural. So now we have the BEA and the Fed saying the same thing.

Another element being used to dismiss the jobs crisis is the labor participation rate. Krugman:

There’s no question that right now, the demand side is what is constraining unemployment. What the SF Fed researchers suggest, however, is that given the level of unemployment, we might have expected to see even fewer job ppenings. And this suggests that if and when the economy recovers, we might start to face supply constraints sooner than one might otherwise expect.

The first point to make is that while it’s OK to make such estimates, they do involve a lot of inference — and beyond that, they involve inference into largely uncharted territory. We’ve now had unemployment of 9 percent or higher for 21 months — longer than any experience since World War II. How reliable are the usual relationships in this unprecedented situation?

and the Fed said this:

The unemployment rate decreased to 9.4 percent in December, but this decline in part reflected a further drop in the labor force participation rate. Long-duration unemployment remained elevated, and the employment-to-population ratio was still at a very low level at the end of the year.

and the Fed cut to the chase bottom line on unemployment:

The expansion had not yet been sufficient to bring about a significant improvement in labor market conditions.

So, some great news in that they expect greater economic growth and the usual news....America, guess what, you won't be sharing much in the benefits of that economic growth.

Recent comments