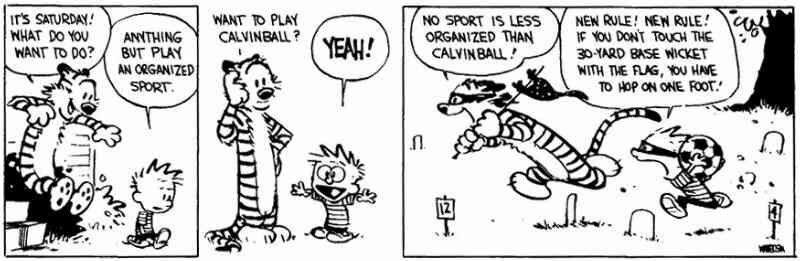

Both national and international finance over the last few weeks have appeared to degenerate into what could be called "Global Financial Calvinball":

For those of you who may not be familiar with the comic strip, "Calvin and Hobbes", Calvinball is an imaginary sport where the rules were made up on the fly by the players, and always of course to the detriment of the other player.

Whether it is the SEC in the US suddenly deciding that shorting financial stocks is not allowed, or the Irish and Greek governments insuring unlimited bank deposits, or the Dutch bailing out Fortis Bank, or the Chinese disallowing lending to US banks,not to mention the gargantuan, ill-thought-out $700 billion Wall Street bailout, national and international financial regulators are making up the rules week by week, and sometimes changing them day by day.

Recent comments