I'm going to make a diary for this, but I thought I would put it up for discussion in the meantime.

WASHINGTON – The government, raising cash to pay for the array of financial rescue packages, said Monday it plans to borrow $550 billion in the last three months of this year — and that's just a down payment.Treasury Department officials also projected the government would need to borrow $368 billion more in the first three months of 2009, meaning the next president will confront an ocean of red ink.

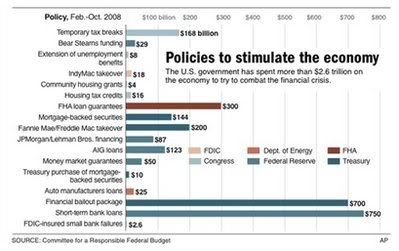

The nonpartisan Committee for a Responsible Budget estimates all the government economic and rescue initiatives, starting with the $168 billion in stimulus checks issued earlier this year, total even more — an eye-popping $2.6 trillion.

...

In addition to the borrowing numbers, Treasury released estimates by major Wall Street bond firms projecting that total borrowing for this budget year, which began Oct. 1, will total $1.4 trillion, nearly double the previous record.Major Wall Street firms were equally pessimistic about the size of the federal deficit this year. They projected it will hit $988 billion for the current budget year, more than twice the record.

looking forward to it!

Just a FYI, for graphs, you can use the zoom on EP.

I couldn't read this image and while the zoom is yes more work, it's really handy for those complex graphs.

All are completely focused in on this election so robbing the people blind can go on with this almost as a distraction.

Federal deficit at $2 trillion? Be real.

It will be much more than that. Consider that the Treasury borrowed $880 billion between Sept 15 and Oct 27. That extrapolates to a brisk $8.8 trillion per year. Were those exigent circumstances? Yes, but what evidence is there that we should expect significant changes? The Treasury took a break last week, but there's precious little news to suggest that borrowing won't take off again. A huge recession is steaming down the pike so Federal receipts should be taking a dive, the official Bailout has yet to commence in major form, Federal guarantees of the money market have not been invoked, the Banks are only just beginning to deal with the underwater option-ARMs that will be bleeding off for the next 3 years, etc., etc. I certainly hope it won't reach the $9 trillion a straightline projection suggests, but it is very unlikely that the real deficit (not Enron.gov calculations) will be 2 trillion or less. Only the famous Wall Street firms that got us into this mess could project a deficit of $980 billion when the government has already borrowed $500 billion in the first month and is planning to borrow an additional $920 billion in the next 6 months! And the Wall Street Bond firms, being so much better with their math, are projecting $1.4 trillion, which is what the Treasury says it will borrow by the end of March. With math skills like that, it's no wonder we've had an epic fail on Wall Street. Is anyone watching the numbers?

good question

you would think the CBO would have issued a major report and they really haven't. Probably muzzled.

Welcome to EP seed!

Probably confused

All of the CBO's projections from July and August were blown out of the water in a matter of weeks. I suspect they're a bit shell-shocked. Also, it's hard to make accurate projections when the Fed and Treasury are playing Calvinball.

I've reread the Treasury statements about their borrowing needs and noticed that they claimed they would need $550 billion for the entire three month period from October through December. I originally interpreted it as being the remainder of the three month period. I should have known better. If there's one thing the Bush Administration has taught us, it's "don't trust the government". As of October 31, they passed the $550 billion mark. I suppose that politically, it's a bad idea to tell Congress that you're not going to be able to make it to Christmas without raising the debt ceiling. But honestly, this is just weird. They've already borrowed the entire amount they said they're going to need. In the last two months of calendar year 2007 they borrowed 150 billion. Somehow, this year, it's magically not going to happen?. Or for that matter be much, much worse? Of course they are smart people and there is Calvinball; they could just put it "off the books".

Calvinball Accounting

NDD has a post on here about Calvinball economics. Maybe a tracking post on what they have spent. I know the CBO got into seemingly a little political stink for they implied the bail out might exasperate financial turmoil.