By now you all saw the headlines, 12 pct. are behind on mortgage or in foreclosure, but what is behind these numbers?

Firstly the foreclosures are expected to reach an all time high next year.

Now people cannot pay their mortgage simply because they lost their jobs, businesses and income.

Some facts:

- Currently mortgages in foreclosure: 3.3%

- Delinquencies: 7.9%

The New York Times Foreclosure map (05-25-09):

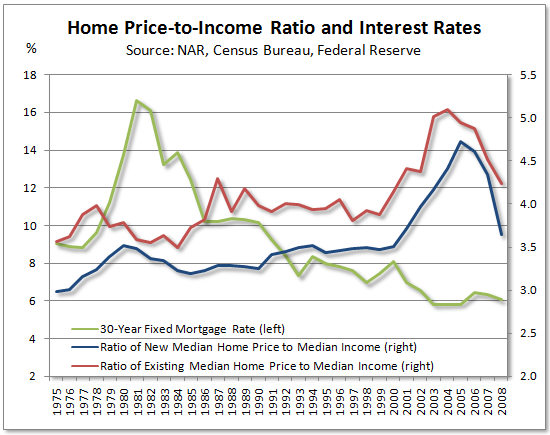

Will this trend convergence of housing prices to income ratio reverse even while prices drop?

So we are back to the same chant, the same mantra being raved and raged on The Economic Populist: jobs, jobs, jobs, jobs, jobs, jobs.

Show me the money!

Strategy should have been from the beginning

at least when President Obama took over a complete emphasis on improving the job situation and keeping people in their homes - WPA-like, more stimulus money over tax cuts.

Sad reality is that we, consumers, drive the economy not the financial sector. If we have work then this mortgage/foreclosure crisis doesn't spread.

What happened to "bottom up" approach that was talked about?

I ask the question again: Did Fed and Treasury waste $12 trillion?

RebelCapitalist.com - Financial Information for the Rest of Us.

Question: Can we really have an economic

recovery w/out jobs and a horrible housing market?

What 'green shoots' (h/t Calculated Risk)?

That doesn't sound like a recovery to me.

RebelCapitalist.com - Financial Information for the Rest of Us.

recovery, EIs and what's on the ground at main street

I think Roubini called the green shoots, yellow weeds.

On the other hand EIs (economic indicators), and patterns, correlations, are very real in terms of measuring the overall economic health.

That said, when keyword jobless recovery pops up, that to me says no economic recovery because I am on the ground, in the real world, trying to pay the rent.

So, I think we need to amplify the economic recovery for MNCs (multinational corporations) versus the U.S. middle class....and by that metric, labor, jobs, the U.S. middle class has been sliding to shit for years.

But as we can see (from NDD's posts to others who cover EIs) income, labor is now directly affecting the other major EIs so we have bubble up disaster because the U.S. middle class has been tapped out.

This would make a great original post, to correlate the tapping out of the U.S. workforce, the U.S. middle class to overall macroeconomic indicators being repressed.

I swear to God there is this major disconnect between these corporate elites, globalists and how screwing the American people directly affects their bottom line over a long term period.

I think they have deluded themselves into believing somehow they will simply replace the U.S. middle class with some mythical 2.3 billion consumer market in India and China.

Seriously and they are smokin' crack.

Or could it be that corporate elite don't care

about long-term. Most have more money then they need to survive for the rest of their lives. What do they care if in the long-term the "race to the bottom" destroys the middle class? All they know or care about is the short-term.

RebelCapitalist.com - Financial Information for the Rest of Us.

long term/short term Business school

I'm not sure because I am not in B school, others with MBAs can comment, but my impression is as a rule they believe if one just takes care of the next quarter, the long term will take care of itself.

Now that is quite short sighted. Japan, China are notorious for long term strategy sessions at both the micro economic (each corporation) and macro economic level.

I also think they are operating on some serious mistakes of assumptions....i.e. if they do the China PNTR they will make billions financing it all, with the additional free movement of capital, la de da....(now we are owned by China, that worked out well), or say labor arbitrage. It's like they are looking at head count as "cattle count" in their labor stats, not getting that the more workers are treated as disposable, the longer the quality will suffer and it gets really bad once one gets into the production and innovation skill sets.

Or they think wages and no one bothers to check "income" and the effect on a macro economic scale...

or say they think "minor regional economic disruptions" that are "temporary" not thinking all of these add up to economic Armageddon and in a graph "temporary" is actually 50 years.

I'm wondering if B school takes people out back and beats out of 'em any common sense. ;)

Dairy farm vs. cattle farm

I like the cattle farm analogy. Too many businesses look at employees as liabilities (as do modern accounting methods). If dairy farms looked at cattle that way, they would end up selling all of their cows and go out of business. One of the things that made the US great was the idea of employees making companies better. Employees are assets to a company, not liabilities. When companies and the government start realizing this, they will grow stronger and the economy will improve.

We're all subprime now

h/t CR

from Bloomberg

"The three-year housing decline is proving resistant to efforts by the Federal Reserve and the Obama administration to keep homeowners current on mortgages by allowing them to refinance or sell to buyers enticed by affordable terms. Prime fixed-rate home loans to the most creditworthy borrowers accounted for the biggest share of new foreclosures at 29 percent, MBA said, a sign job losses are hurting homeowners."

The solution is in job creation and wage stabilization - not pushing real estate.

More on the housing distress

The NY Times article has a little more information.

May Housing Indicators

at Calculated Risk with chart porn.