There are those that honestly think you can make a sustainable economy based on people buying things they don't need with money they don't have. Then there are those who just want to sucker in the sheeple so they can fleece them one more time.

Finally, there are the sheeple themselves - so scared that they will buy into any feel-good message about Green Shoots that the politicians and media sells them, and even defend it.

What none of these three groups want is for the general public to know what the actual numbers really are.

They don't want me to show you what I am about to show you.

There's been two studies done recently that put things into perspective. One was done by Barry Eichengreen and Kevin O’Rourke, both professors of economics. The other was done by Paul Swartz for the Center of Geoeconomic Studies.

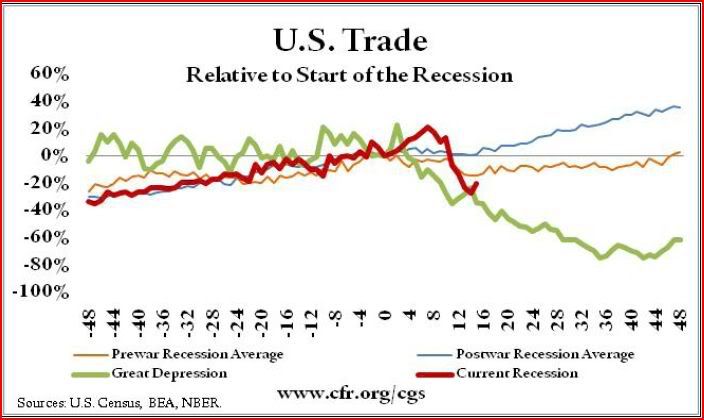

As you can see, worldwide industrial output is dropping as fast as it did during the Great Depression, while world trade is dropping even faster (which makes one wonder if Smoot-Hawley really wasn't as big of a deal as some make it out to be).

The other two charts show monetary inflation and massive government deficits. The two are directly related.

Those academics who are afraid of deflation think that these are good things. Consumers that are trying to stretch their meager paychecks think otherwise.

On a worldwide level, the recent stock market rally still doesn't come close to bringing us back to the disastrous level of the Great Depression.

Focus on America

Some will try to write off the charts above that this doesn't reflect what is happening in America. As if America is some sort of island disconnected from the rest of the world.

For those people I want to present a few other charts.

US Industrial Output

The drop is America's industrial output mirrors the drop in the world's industrial output, as well as the Great Depression experience.

It's a similar story for the stock market.

...and for our trade with the rest of the world.

As mentioned above, we have managed to avoid deflation with our massive deficit spending, but that also means the prudent are being punished in order to bail out the debtors.

Meanwhile the crash in home prices puts the Great Depression experience to shame. The consequences of this cannot be understated.

Finally we have unemployment. The common refrain from the Green Shooters is that the unemployment rate isn't nearly as bad as during the Great Depression, when unemployment hit 25%.

While technically true, it is also dishonest for two reasons.

#1) Unemployment didn't suddenly jump up to 25% overnight. It took four years to get there.

If you start counting from April 2008 (around the time that Bear Stearns went under), like most of the charts above do, then we are only 14 months into this Depression. The equivalent period of time during the Great Depression would take you to the fall of 1930.

So what was the unemployment rate in 1930? 8.7% What is the unemployment rate today? 9.4%

#2) The unemployment rate was measured differently during the Great Depression. For instance, there was no "discouraged workers" category. You were either employed, or not employed. You didn't fall out of the ranks of the unemployed because you didn't send someone a resume that week. Thus the unemployment numbers of today will understate real unemployment in a way that they wouldn't during the Great Depression.

Comments

Smoot-Hawley

is something those Corporatists jumped on but it's not the cause of the Great Depression.

unlawfulcombatant did an analysis in a little more detail, but basically the U.S. was mostly a domestic economy, trade had little impact and the results from Smoot-Hawley were not that severe. Also previous to Smoot-Hawley tariffs were fairly high already.

This is the first of a series

Next in line will be me attacking the defenders of the bailouts who are Keynesians and Monetarists. Both for how they were proven lacking in the past, and for how what is being tried today doesn't reflect them anyway.

exercise for the writers

I'm beginning to think we need some Economics department and some sort of Professor adopting us for this is a lot of work! Shame we can't get course credits here and btw, where are others trying to do the same thing?

I'm right now swimming through various papers on regulatory reform and here is what I have found so far:

1. they have not diagnosed the real causes, thus real solutions are lacking and also all of the Proposals are not really analyzed due to not understanding the dynamics of what happened, the interactions in full.

2. there is so much opinion out there by various people wanting to say something when we really need a much more thorough research mentality of the economics writers on this topic. It's a lot of boilerplate with gems in the mix, but it's adding to the massive "read through" requirement to figure out enough to write up something intelligent or have insight.

You can see in the other comments what kind of exercise for the reader questions I already have...

the biggest is how the unemployment rate amplifies a bad situation into a disastrous situation. I think we're about to hit a threshold. People can hang on for a time on savings (myself included) but they are assuredly running out (myself included). (BTW: should we put up a jobs board on here? @@&*)#&*)!!!)

Jobs Board

You IT folks ought to think about the benefits of going for a guild.

With so much contract work, having an organization that could verify that workers possess the necessary skills for the job, and providing access to guild sponsored health insurance and other benefits limited to members could be attractive to companies.

The idea is that you have a limited membership, which own the guild in common, and elect a leadership, that companies are able to come to to find contract labor.

It's the model that has prevailed in building trades for the better part of the last century.

Collective organization of this type can do a great deal to ease the burden of periods of unemployment, and can provide individual workers greater leverage.

I am not personally "I.T."

but that said, getting these people to organize is like pulling teeth. I put together a techie community site, similar to EP @ www.noslaves.com and believe this or not, they are refusing to use it.

I'm actually not a "techie" by skill, but STEM, which is Science, Technology, Engineering, Mathematics. This area really does seriously need labor representation, organization and it's beyond unreal trying to get people to join up and do something.

but I.T. is related and truly the worst area under attack for labor arbitrage but so is STEM and this is all the way to PhD level skills, years of expertise, education, training...

it's just unbelievable considering the level of difficulty in these occupational areas.

BTW: anyone reading this in the above occupational categories, noslaves.com is there for people to use to try to create a community space.

We tried that

During the last recession. My programmer's guild membership # is 1113.

Didn't help much then- might help some now.

-------------------------------------

Maximum jobs, not maximum profits.

-------------------------------------

Maximum jobs, not maximum profits.

1920's excesses caused Great Depression

There is no possible way smoot-hawley had anything to do with causing the Great Depression. It was not put into place until the early 1930's, long AFTER the economy/stock-market crashed. It is not possible for the cause to occur after the effect!!

Instead, the excesses of the 1920's (credit/banking/wall street excesses) are the primary cause of the Great Depression (sounds familiar - eh?).

Brad Delong graph on unemployment projections vs. reality

Chart from Delong's post Comment for the Economist on Christina Romer (2009), "The Lessons of 1937":

This was left in middle's unemployment analysis from yesterday over at DK. It's shockingly enlightening.

more industrial production

More graphs here on the latest industrial production and capacity crash & burn.

While I attempt to navigate more detailed papers on financial regulation (I am believing if I'm having a rough time delving into these details and it takes a 20 year career as an economics professor at Yale to even get a clue on what the hell just happened, we're in for bad juju on regulatory reform that addresses the real underlying causes!)...

over and over again what strikes me is how the United States poo poos, ignores, sells out the United States manufacturing and small business sectors. Notice that? When it comes to real jobs which produce real things...

pretty much all we see is Politicians, the Obama administration handing even more of our real economy over to China, India...pretty much any nation who flies over here and demands it.

unemployment rates of Great depression

NDD wrote up a great reference post here on U3/U6 est. for the Great Depression.

So, question now is does this actually scale correctly and also, what is the slope during the start of the Great Depression (i.e. rate of change) of unemployment stats and does that correlate to DeLong's slope (which looks like a rocket)?

This is an exercise for the reader, need to take the table data and create a graph, calculate up the slope as well as examine a threshold level when unemployment begats unemployment begats macro economic collapse begats unemployment (I believe this is in the book of Economic Genesis: Ch. 5)

I couldn't find monthly numbers

I checked three different book stores and the main library in San Francisco. I couldn't find monthly unemployment numbers for the Great Depression anywhere.

If I could then I could scale these pretty well.

data sets

He has some references to where he got his numbers:

N. Andrews.

NDD's Great Depression series part 2 here (there are 4 parts) he pulled up a lot of raw data and has references in these posts.

I know NDD hunted high and low for raw stats before 1947, so he might have additional resources. He even pulled some from an appendix in an old Milton Friedman text. I'll look around in my cabinets too.

there is definitely a

there is definitely a recovery coming by the end of year. Just past has shown that it is coming.

Under what theory?

We still have two days to go before we can check my prediction that will give us how bad it's going to get. What's your definition of recovery, and how shall we measure it?

-------------------------------------

Maximum jobs, not maximum profits.

-------------------------------------

Maximum jobs, not maximum profits.