The Graveyard Of Destructive Ideas

Authored by Victor Davis Hanson,

How do destructive ideas and bouts of collective madness so quickly become policy, law, and the status quo?

After all, most have little public support—and are not Western nations supposedly rationally governed?

There is usually a multi-step process on the road to these self-destructive fits of society-wide insanity.

The suicidal impulse so often begins with left-leaning researchers in elite universities (i.e., the tenured in search of a novel, grant-getting theory). They begin insisting that a new existential threat requires immediate government intervention, novel legislation, ample funding, and public awareness of the impending danger.

So out of nowhere, the public is warned that the scorching planet will be inundated by rising seas in a mere decade. Or that millions of transgender youth are our next civil rights frontier, given that they suffer in silence without political advocacy, new laws, programs, and the chance for “life-saving,” powerful hormonal treatments and radical sex-reassignment surgeries. Indeed, the travel time from an outlandish idea by the faculty lounge to liberal status quo is a mere few years.

Next, the media, hand-in-glove with academia, springs into action to persuade the skeptical public to “follow the science” and “trust the experts.” It castigates any doubters as cranks or “conspiracy theorists” who spread “disinformation” and “misinformation”; or as racists, nativists, sexists, homophobes, and transphobes who must be silenced.

Hollywood and sports celebrities often piggyback on the frenzy, hijacking awards ceremonies and pre-game national anthems to out-virtue-signal each other, warning the public that they must adapt and change—or else!

Almost overnight—to take just one example—going to an isolated beach without a mask during the COVID pandemic, showing skepticism about the efficacy or safety of experimental mRNA COVID vaccines, or daring to believe that the Wuhan gain-of-function virology lab (in part aided and abetted by grants and support from Dr. Fauci’s National Institute of Allergies and Infectious Diseases and the National Institutes of Health) was the source of a manufactured COVID pathogen became heresies. And the perpetrators, as always, had to be punished either legally or through social ostracism and cancel culture.

Third, liberal foundations begin funding more “research” to “prove” that partisan “experts” should not be ignored. They also fund activist groups that hit the street to gin up popular support, which often results in the required tumult and occasional violence. They embrace the theory that any disruption will so bother the public that it will support almost anything if it just makes the bedlam go away.

New victims and their oppressors are created ex nihilo.

Yesterday’s radical new policy becomes today’s wishy-washy cop-out, as tomorrow’s once-unthinkable radical idea becomes commonplace and institutionalized. So it was that a few years ago, the public was told of a new and huge victimized group in the shadows, suffering from “gender dysphoria”—an age-old malady known to the ancients and, according to modern researchers before the millennium, affecting about one in 10,000–30,000 people.

No matter—almost overnight, transgenderism joined the gay and lesbian community to become the new LGB—T oppressed. Drag shows, once confined to enclaves in San Francisco or New York, were suddenly mainstreamed into military bases, children’s libraries, and cruise ships. Thirty percent of students on some campuses polled said that they might consider “transitioning.”

Abruptly, professors and students began reading emails appearing from their finger-in-the-wind administrators with strange new runes under their titles and names, identifying their “preferred pronouns”—sometimes the standard “she/her/hers” or “he/him/his,” and sometimes the unfathomable, such as “Ze/hir/hirs” or the plural “they/them.”

Groupthink and mob mentality prevail. Soon, not listing pronouns on correspondence indicts someone as a counterrevolutionary, a transphobe, or, worst of all, a Trump sympathizer.

Fourth, fence-sitting liberal and socialist officials and candidates equate the well-funded activism, the performance-art street demonstrations, and the media fixations on victims and victimizers with growing grassroots support for yet another cause.

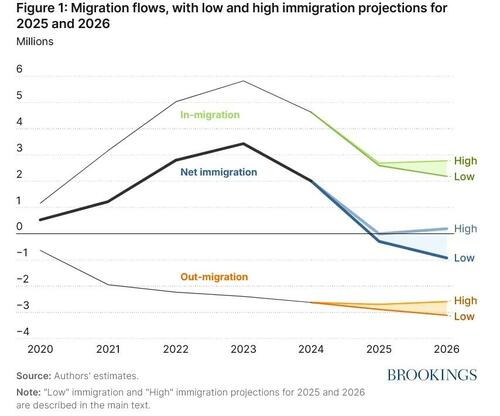

This is well illustrated by how initially liberal officials—stunned that 70 percent of the public wanted secure borders, no more illegal immigration, and deportation of the 10 million Biden-era illegal aliens—kept quiet about Trump’s crackdown on illegal immigration.

However, after massive and violent demonstrations in major blue cities—with the deaths of two protestors who confronted ICE officers and tried to impede their efforts to detain illegal aliens—biased media blared out that officers were manhandling “mere bystanders.” ICE is now routinely likened by Democratic politicians to the Nazi Gestapo, well beyond the usual boilerplate smears as “pigs” and “fascists.”

The public buys into the fable that ICE agents were not arresting some 4,000 criminal illegal aliens in Minnesota while elected officials were siccing protestors on them, but were instead “murdering” innocent unarmed bystanders, who were harmlessly protesting ICE’s “goon” tactics.

Fifth, once the delusion—whether it is of a doomed sizzling planet, a utopian open border, the systemic oppression of a huge transgendered victimized class, or the habitual and flagrant shooting of innocent unarmed black males by predatory racist police—is institutionalized, then the government and institutions, public and private, ignore public opinion. And they begin passing laws and protocols once deemed unthinkable.

The once-meritocratic SAT, originally aimed at nullifying the old-boy admissions network at the Ivy League, becomes “racist” and is dropped. “Defund the Police” becomes the elite white activist mantra.

Soon, the politicians’ talking points become gospel, as formerly crackpot “critical legal theory” and “critical race theory” are used to “prove” that police hunt down minorities rather than the criminals among them.

Productive, safe nuclear clean-energy plants are shut down. Billions of dollars are invested—and lost—by government mandates aimed at phasing out internal combustion engines and subsidizing unpopular electric vehicles. Government-built high-speed rail boondoggles waste billions before laying a foot of track.

Schools and public offices must suddenly install “gender neutral” bathrooms. What follows is the surreal sight of biological men competing in women’s sports and undressing with teen girls in locker rooms—acts that just a few years prior would have landed someone in jail.

However, there sometimes occurs a sixth stage, which we might call the “Emperor Has No Clothes” wake-up call, that occasionally stops the lemmings in their mad dash over the cliff.

Gradually, the public wonders why it pays twice as much for electricity as it did a mere few years earlier. Supposedly doomed polar bears appear to be thriving in the Arctic. John Kerry is routinely spotted on a carbon-spewing private jet to get to climate change conferences abroad. California’s “permanent” drought strangely ignores near-record wet years and snowfall. Too little rain proves global warming; too much is proof of “climate chaos.”

Barack Obama, the Cassandra of rising seas, nonetheless prefers to buy and live in multimillion-dollar mansions on the Hawaii beach and Martha’s Vineyard seaside.

A few brave reporters cite China building two coal plants a month, even as it brags about the Paris Climate Accords and urges the West to embrace “clean energy.”

The public begins to wonder why, after mass shootings, authorities mysteriously conceal the transgender status of the shooter or suppress the perpetrator’s incriminating target list and diary.

Quietly, university studies start citing the cardiac, pulmonary, and hematological side effects of the mRNA vaccines.

Some universities, without much fanfare, begin to reintroduce the SAT after remedial math courses have had to expand to accommodate nearly half the entering class.

Economists at last come out of the shadows to cite data that shows the massive COVID lockdowns were a catastrophic blunder that permanently stunted the education of millions of youths and birthed an epidemic of psycho-social maladies that disrupted entire communities.

Accusations grow that the architects of Black Lives Matter embezzled millions of dollars in donations and spent freely on upscale homes for themselves. Data drips out that police shoot no more unarmed black suspects than white, when compared to the relative rates of arrests by race. The Somali community—the supposed DEI face of the new Minnesota Democratic majority—is found to be at the heart of a $9 billion fraud epidemic. And so it is revealed as most ungracious, treating its hosts’ magnanimity as naivete to be exploited rather than as generosity to be appreciated.

On the border, the old mantra that the crime rate of illegal aliens is well below that of citizens is revealed as politically tainted. Estimates emerge that 500,000 criminals or more swarmed the border, as the body count of U.S. citizens murdered and assaulted by illegal aliens grows daily.

In sum, just five years ago, when Joe Biden and his masters took control of the government, the orthodoxy was that we were to restructure the entire economy along failed European lines in order to save the planet.

There were no longer to be the two age-old sexes, but a dozen or more in 2021 America.

“Men” could become pregnant (but only if they were born as biological women).

Tampons were politically correct in male bathrooms.

Preferred pronouns dotted memos.

A swarm of 10,000 illegal aliens a day proved America was compassionate and caring while creating a “new Democratic majority,” given that “demography is destiny.”

Blue-city prosecutors released thousands of criminals either without formally charging them or after merely fining them for lesser crimes.

Racial obsessions destroyed merit-based hiring of everyone from air traffic controllers to pilots to professors to museum docents.

And then abruptly in 2025, these destructive manias began shriveling up and were destined for the graveyard of forgotten collective lunacies.

Tyler Durden

Thu, 02/26/2026 - 17:40

Japanese Prime Minister Sanae Takaichi raises her fist as U.S. President Donald Trump speaks aboard USS George Washington on Oct. 28, 2025, in Yokosuka, Japan. Tomohiro Ohsumi/Getty Images

Japanese Prime Minister Sanae Takaichi raises her fist as U.S. President Donald Trump speaks aboard USS George Washington on Oct. 28, 2025, in Yokosuka, Japan. Tomohiro Ohsumi/Getty Images

Oil facilities on Kharg Island in the Persian Gulf about 1,250 km south of Tehran, NurPhoto

Oil facilities on Kharg Island in the Persian Gulf about 1,250 km south of Tehran, NurPhoto

The logos of Google, Apple, Facebook, Amazon and Microsoft displayed on a mobile phone and a laptop screen. Justin Tallis/AFP via Getty Images

The logos of Google, Apple, Facebook, Amazon and Microsoft displayed on a mobile phone and a laptop screen. Justin Tallis/AFP via Getty Images

The refinery El Palito in Puerto Cabello, Carabobo state, Venezuela, on Jan. 22, 2026. Ronaldo Schemidt/AFP via Getty Images

The refinery El Palito in Puerto Cabello, Carabobo state, Venezuela, on Jan. 22, 2026. Ronaldo Schemidt/AFP via Getty Images

Former Secretary of State Hillary Clinton in Munich, Germany, on Feb. 14, 2026. Johannes Simon/Getty Images

Former Secretary of State Hillary Clinton in Munich, Germany, on Feb. 14, 2026. Johannes Simon/Getty Images

Former President Bill Clinton and former Secretary of State Hillary Clinton arrive for former President Donald Trump's inauguration as the next president of the United States in the Rotunda of the United States Capitol in Washington on Jan. 20, 2025. Shawn Thew/Reuters

Former President Bill Clinton and former Secretary of State Hillary Clinton arrive for former President Donald Trump's inauguration as the next president of the United States in the Rotunda of the United States Capitol in Washington on Jan. 20, 2025. Shawn Thew/Reuters

School buses bring in players from the Burbank Bulldogs and the Pasadena Bulldogs before their game at the Rose Bowl in Pasadena, Calif., on March 19, 2021. Harry How/Getty Images

School buses bring in players from the Burbank Bulldogs and the Pasadena Bulldogs before their game at the Rose Bowl in Pasadena, Calif., on March 19, 2021. Harry How/Getty Images

Matt Murray at an earlier meeting with Washington Post staff. Robert Miller/Washington Post/Getty Images

Matt Murray at an earlier meeting with Washington Post staff. Robert Miller/Washington Post/Getty Images

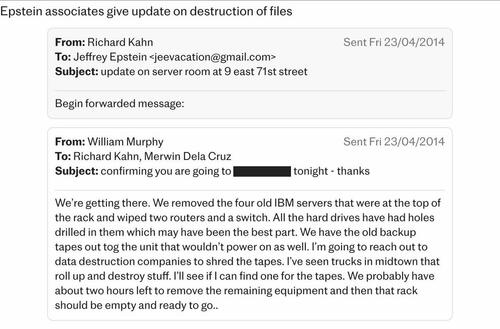

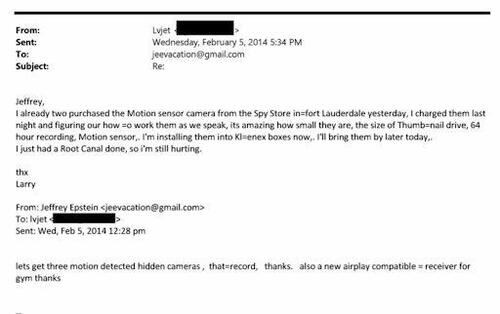

Pictures released by police show Epstein’s Paris home

Pictures released by police show Epstein’s Paris home

Recent comments