"Unknown Projectile" Strikes Container Ship In Strait Of Hormuz As Maritime Crisis Explodes

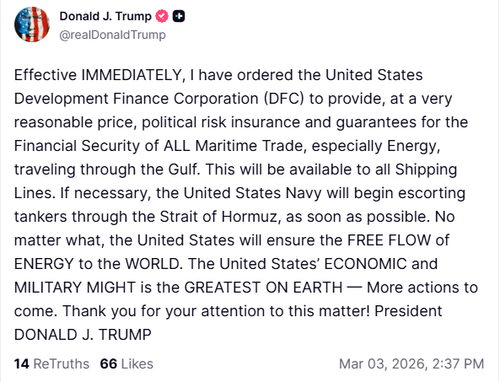

This morning has been very active on the maritime security front. The latest incident involves a container ship that was struck by a projectile while transiting the Strait of Hormuz.

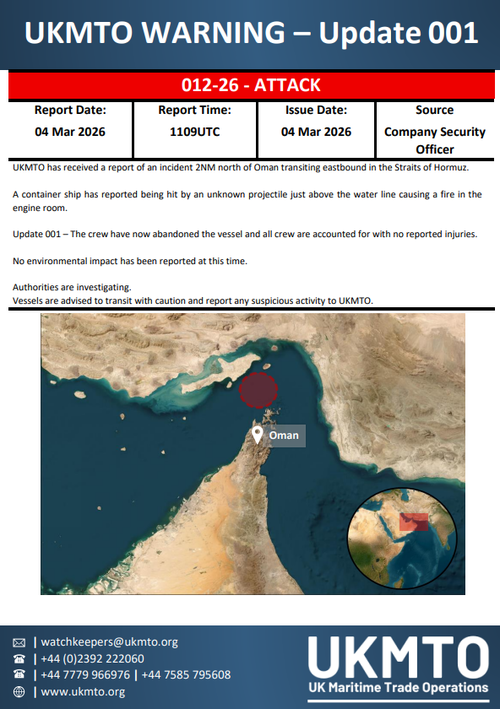

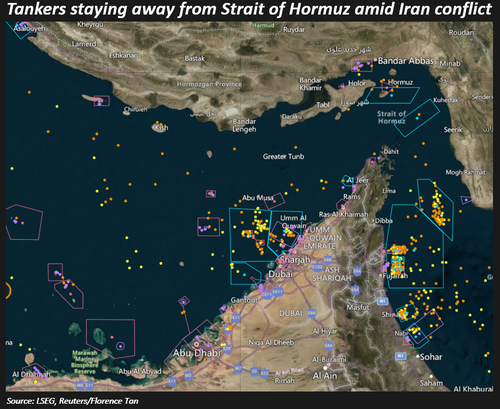

United Kingdom Maritime Trade Operations reports that a container ship about two nautical miles off Oman, transiting eastbound through the critical and narrow waterway, was "hit by an unknown projectile just above the waterline, causing a fire in the engine room."

"The crew have now abandoned the vessel and all crew are accounted for with no reported injuries," the maritime security center wrote in an update on X.

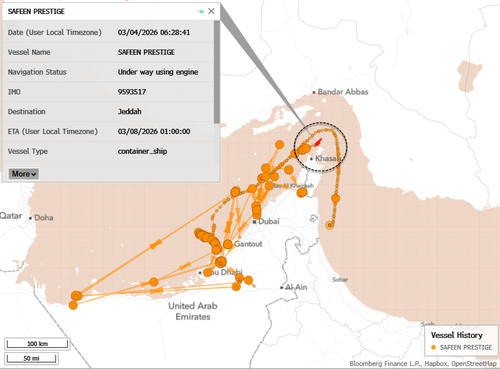

UKMTO's alert did not identify the container ship by name, but there are currently three transiting the paralyzed waterway. We suspect that the vessel hit was "Safeen Prestige," though there is no official confirmation.

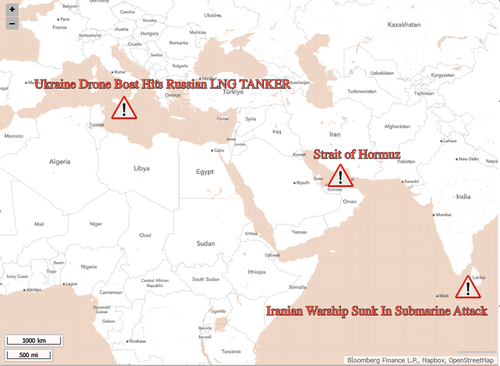

Latest maritime incidents we are tracking:

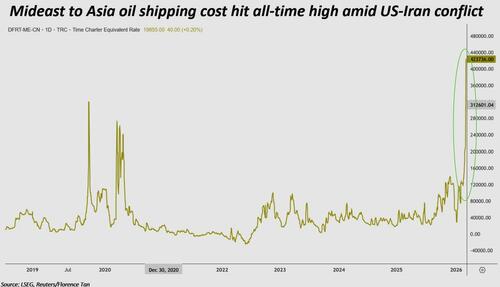

UBS analyst Cristian Nedelcu provided clients with a clearer picture of the logistical nightmare unfolding due to disruptions in the Strait of Hormuz:

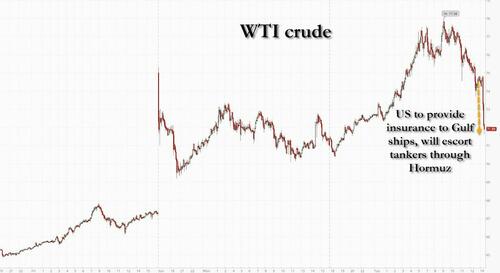

Rising uncertainty, however a potential prolonged disruption could push rates up

We note that since the end of November, the EU logistics and shipping sector share prices were up on average ~18%, outperforming Stoxx 600 by ~5%. We believe this mainly reflects expectations for an improvement in the European and US economies in 2H 2026. In the context of the escalation in the Middle East, a potential prolonged and significant increase in oil prices could represent a headwind to demand raising question marks around global freight volume growth going forward.

Nevertheless, we believe a potential prolonged disruption could also bring upwards pressure on ocean and air freight rates on some routes. We believe a scenario of continuous disruption in the Strait of Hormuz and Middle Eastern air space would bring upwards pressure to ocean and air freight rates touching Middle East and Asia-Europe, with potential for temporary incremental profits for ocean carriers, dedicated freighters operators (DHL Express), and increased complexity that could lead to some benefits for freight forwarders operating on these routes.

A potential prolonged disruption could lead to upwards pressure on ocean rates

According to CTS c.3.5% of global container capacity is using the Strait of Hormuz. In particular, the large transshipment hub Jebel Ali could be affected. In a scenario of prolonged closure of the Strait of Hormuz or capacity restrictions it is likely that cargo would be moved via alternative transhipment hubs leading to potential congestion in other major transhipment hubs. The few services passing through the Red Sea have been directed back to Cape of Good Hope leading to further small declines in effective container capacity to reflect longer voyages. Altogether we expect this could lead to upwards pressure on ocean rates, mainly on: i) routes touching Middle East/Indian subcontinent (c.13.8% of global container according to Linerlytica); ii) on Asia-Europe (c.24.5% of global container movements). According to Linerlytica, Maersk and Hapag Lloyd deploy circa 15% of total container capacity to routes touching Middle East/Indian subcontinent and ~25% of capacity on Asia - Europe routes. Zim deploys circa 3% of capacity on routes touching the Middle East and 15% on Asia - Europe.

Prolonged potential constraints at Middle Eastern airports could push rates up

Air space closure during this weekend for Middle Eastern airports also brings disruption for air freight touching the Middle East or air freight transiting from Asia to Europe. According to IATA, Middle Eastern carriers operate circa 13% of global air freight capacity while Asia - Middle East represents 7.4% of cargo tonne km transported globally and Middle East - Europe 5.7% (in 2024). In a scenario of prolonged disruption, we expect to see upwards pressure on air freight rates for routes touching Middle East and Asia-Europe. In a scenario of capacity constraints for passenger/cargo flights at Middle Eastern airports, we expect constraints related to freedom of the skies agreements and longer distance journeys to lead to a reduction in effective capacity.

In particular, we believe owners of dedicated freighter capacity (DHL Express) are likely to benefit as cargo flows are redirected. Air cargo will also become an alternative for some of the ocean cargo impacted by the disruptions. Increased complexity of moving cargo may bring benefits for large freight forwarders that have access to capacity. Looking at direct exposure to Middle East we note - DSV recognised 7% of 2025 Group EBIT from MEA region and 36%/42% of air /ocean volumes on Asia-Europe; DHL recognised 5.3% of FY24 revenues in Middle East/Africa.

The latest and most critical maritime incidents and developments over the last 24 hours:

-

Russia Says Ukrainian Drone Boat Blew Up Shadow LNG Tanker In Mediterranean

-

World At War: Iranian Warship Reportedly Sunk Off Sri Lanka In Submarine Attack

Expect more maritime attacks. Also, supply chain snarls could materialize.

Tyler Durden Wed, 03/04/2026 - 08:30

The F.B.I. raided the home of Alberto M. Carvalho, superintendent of the Los Angeles Unified School District, and the district offices on Wednesday. Credit...Philip Cheung for The New York Times

The F.B.I. raided the home of Alberto M. Carvalho, superintendent of the Los Angeles Unified School District, and the district offices on Wednesday. Credit...Philip Cheung for The New York Times

The manufacturing facilities of the Independent Can Company in Belcamp, Md., on June 25, 2025. Ryan Collerd/AFP via Getty Images

The manufacturing facilities of the Independent Can Company in Belcamp, Md., on June 25, 2025. Ryan Collerd/AFP via Getty Images Traders work on the floor of the New York Stock Exchange during morning trading in New York City on Feb. 24, 2026. Strong corporate earnings, technological innovation, and a positive economic outlook have contributed to the US stock market’s appeal. Michael M. Santiago/Getty Images

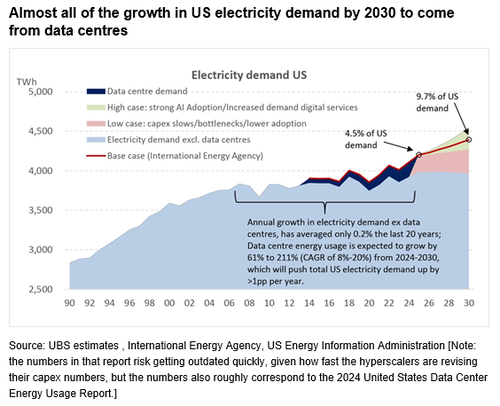

Traders work on the floor of the New York Stock Exchange during morning trading in New York City on Feb. 24, 2026. Strong corporate earnings, technological innovation, and a positive economic outlook have contributed to the US stock market’s appeal. Michael M. Santiago/Getty Images A technician works at an Amazon Web Services AI data center in New Carlisle, Ind., on Oct. 2, 2025. The United States has outpaced many advanced economies in growth and productivity over the past year, with some analysts describing the momentum as the start of a new industrial revolution. Noah Berger/Getty Images via Amazon Web Services

A technician works at an Amazon Web Services AI data center in New Carlisle, Ind., on Oct. 2, 2025. The United States has outpaced many advanced economies in growth and productivity over the past year, with some analysts describing the momentum as the start of a new industrial revolution. Noah Berger/Getty Images via Amazon Web Services European leaders take part in a meeting as they attend the Informal EU Leaders’ Retreat in Alden Biesen, Belgium, on Feb. 12, 2026. While US productivity has increased rapidly since 2019, productivity growth in the UK and eurozone has remained mostly stagnant, recent data shows. Ludovic Marin/AFP via Getty Images

European leaders take part in a meeting as they attend the Informal EU Leaders’ Retreat in Alden Biesen, Belgium, on Feb. 12, 2026. While US productivity has increased rapidly since 2019, productivity growth in the UK and eurozone has remained mostly stagnant, recent data shows. Ludovic Marin/AFP via Getty Images US Vice President JD Vance (3rd L) tours Hatch Stamping in Howell, Mich., on Sept. 17, 2025. US manufacturing activity expanded in January for the first time in 12 months. Jeff Kowalsky/AFP via Getty Images

US Vice President JD Vance (3rd L) tours Hatch Stamping in Howell, Mich., on Sept. 17, 2025. US manufacturing activity expanded in January for the first time in 12 months. Jeff Kowalsky/AFP via Getty Images

Cue death squads. Illustrative Fallujah fighting, via EPA

Cue death squads. Illustrative Fallujah fighting, via EPA

Recent comments