Futures Tumble As Plunging Metals And Bitcoin Spark Global Selloff, Margin Calls

Stock futures slide extending Friday's rout, although are well off session lows, with aggressive unwinds across commodities and a crypto rout adding to the risk-off mood and sparking cross-asset margin calls. As of 8:00am ET, S&P 500 futures are down 0.4%, rebounding from a drop of as much as 1% earlier; Nasdaq futures drop 0.8%, also trimming the drop by half, and lag with focus on AI concerns a key theme for pre-market trading. European stocks were weaker in early trade but have since returned to a positive footing, Stoxx 600 is up 0.2% and just a few points away from its all-time-high. Asian stocks retreated for a second session as risk-off sentiment dominated markets, with high-flying technology names and shares linked to precious metals leading an early selloff in a data-heavy week. The biggest action is in metals, with gold and silver extending sharp declines, though big declines are seen here. Oil fell with other commodities, with easing US-Iran tensions also contributing. Bitcoin plunged to a 10-month low in Asia trading as Korean Kamikaze piled on the short side, before trimming losses. The US economic calendar includes January final S&P Global US manufacturing PMI (9:45am) and January ISM manufacturing (10am). Fed speaker slate includes only Bostic (12:30pm)

In premarket trading, Magnificent Seven stocks were all lower (Tesla -1.9%, Nvidia -1%, Meta -0.9%, Alphabet -0.7%, Amazon -0.6%, Microsoft -0.6%, Apple -0.5%)

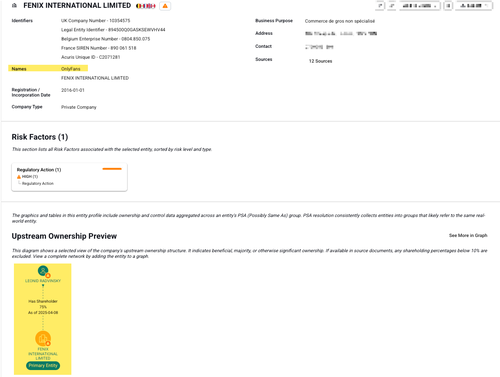

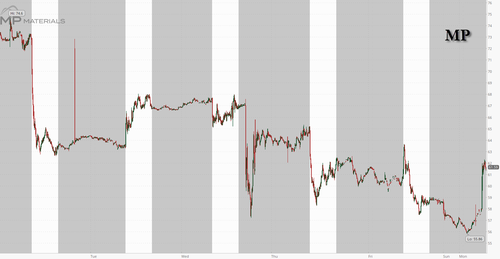

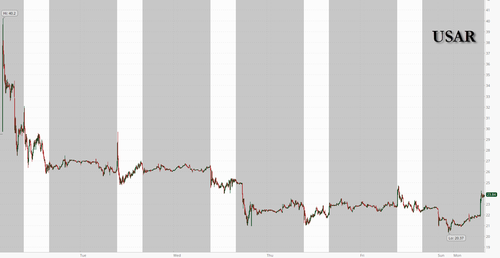

- US rare-earths stocks are rising as President Donald Trump is set to launch a strategic critical-minerals stockpile with $12 billion in seed money to lower reliance on China.(MP +4%, USAR +7%)

- Cryptocurrency-exposed stocks fall after Bitcoin tumbled over the weekend. Decliners include Coinbase (COIN), which is down 3%.

- Coterra Energy Inc. (CTRA) and Devon Energy (DVN) are combining to create a US shale producer with an enterprise value of about $58 billion, one of the largest oil and natural gas deals in years. Shares of Coterra are down 3%.

- Humana (HUM) falls about 2% after Morgan Stanley downgraded the health insurer to underweight, citing vulnerability in its Medicare Advantage business.

- Oracle (ORCL) climbs 4% after Fitch affirmed the company’s long-term issuer default rating at BBB. Oracle plans to raise $45 billion to $50 billion this year through a combination of debt and equity sales to build additional cloud infrastructure capacity.

- Walt Disney Co. (DIS) gained about 1% after reporting sales and profit that beat estimates in the first quarter of its fiscal year, boosted by a record $10 billion in revenue from the division that includes parks and cruises.

In corporate news, Oracle fell more than 3% in premarket trading before rebounding and turning green, after outlining plans to raise as much as $50 billion through debt and equity this year to expand cloud infrastructure capacity. As Wall Street braces for a borrowing binge to bankroll AI projects, investors are growing skeptical of the billions of dollars being spent, with little clarity on when returns will materialize. Nvidia CEO Huang said that a proposed $100 billion investment in OpenAI was “never a commitment,” although the company will participate in OpenAI’s latest funding round. Tech Watch looks at how concerns about the huge costs of AI are starting to boil over. Alphabet and Amazon report this week.

Extreme volatility across commodities continued to be the center of attention in markets. Gold pared losses after falling as much as 10%. At one point, silver sank 16% before reversing most of the retreat. Brent tumbled about 5% after US President Donald Trump said Washington is talking with Iran.

“Markets are nervous,” said Ulrich Urbahn, head of multi-asset strategy and research at Berenberg. “We see a broad selloff across markets in Asia, Europe and the US. With the volatility increase in gold, but also in silver, investors have to de-risk.”

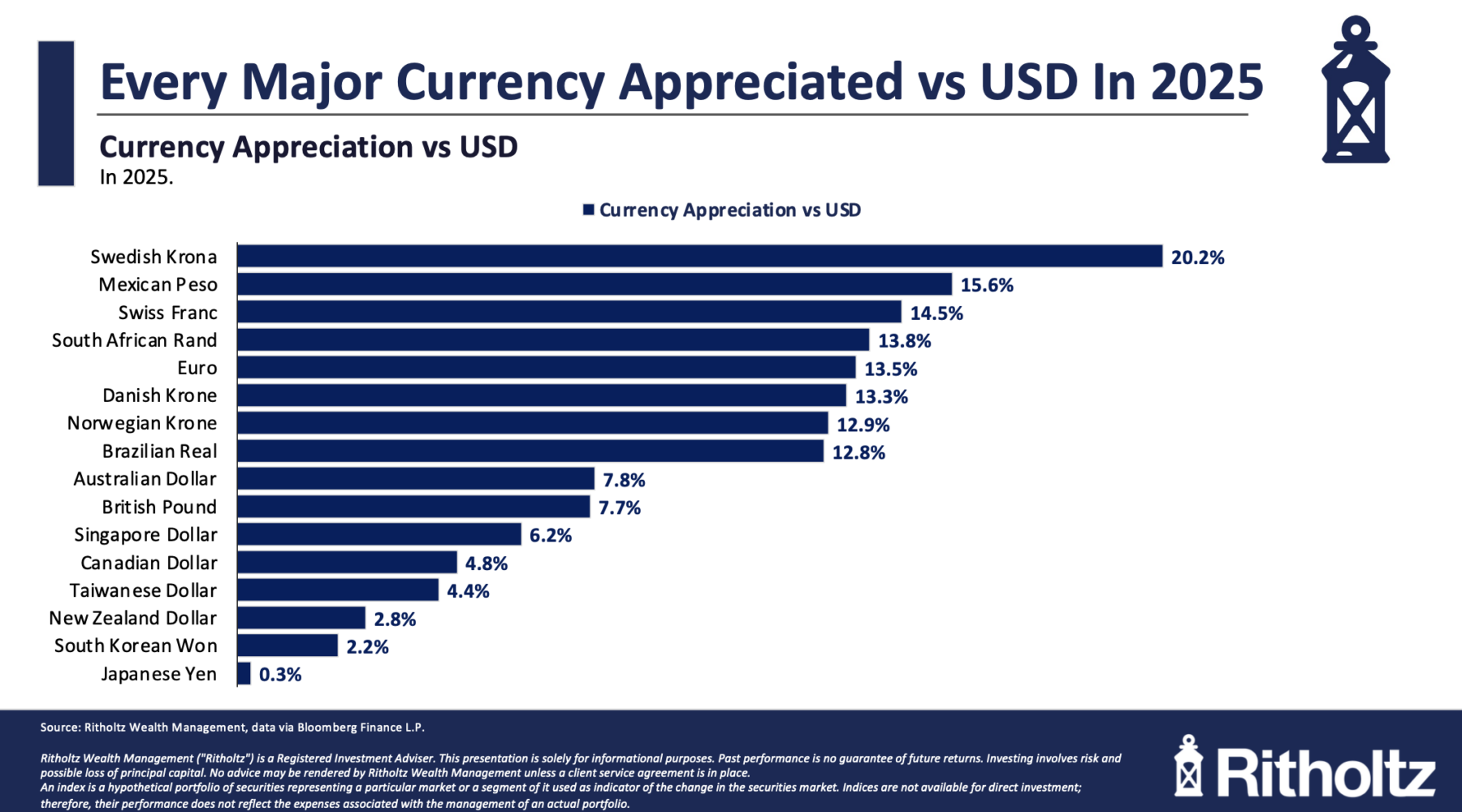

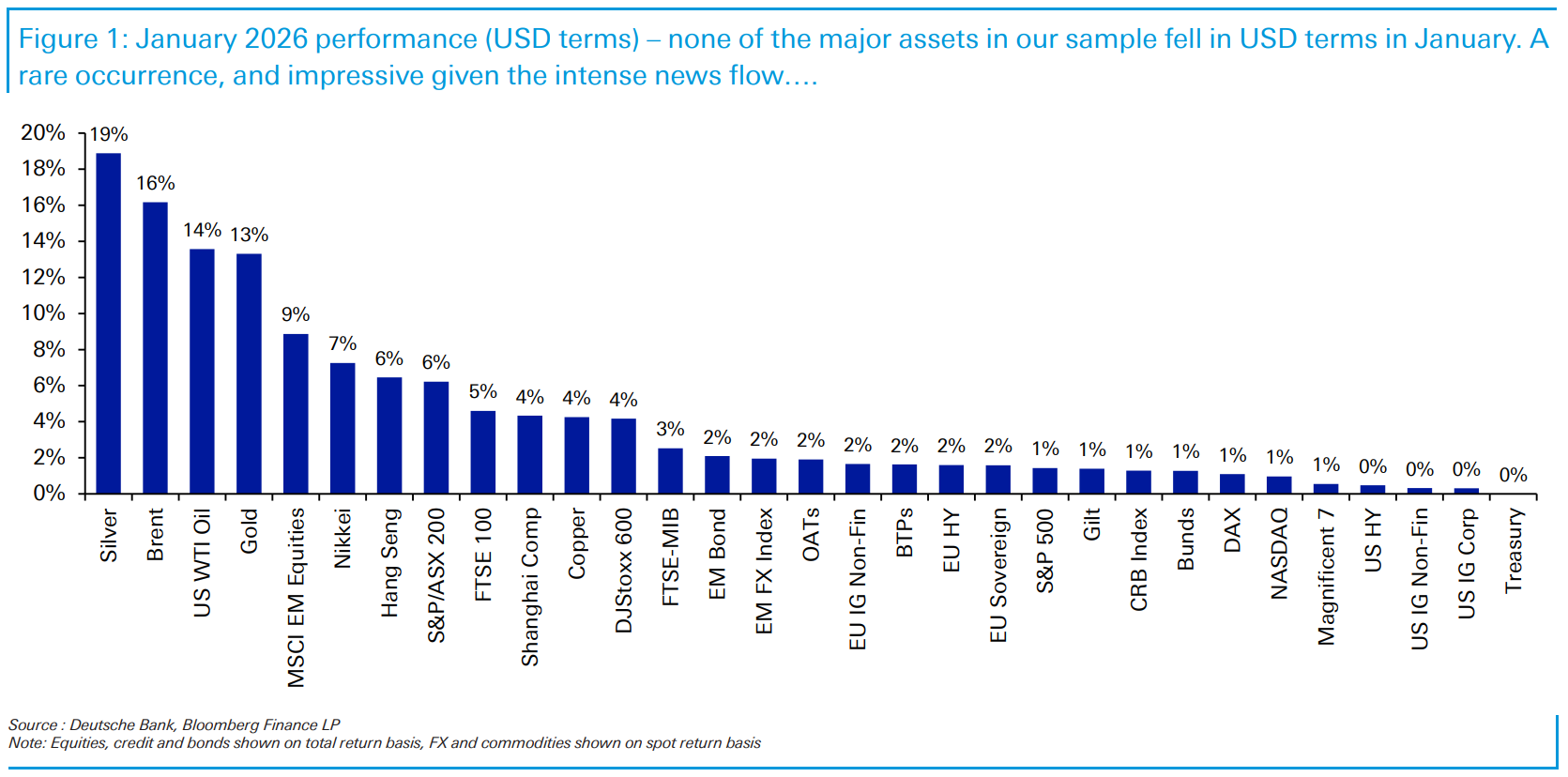

Monday’s moves are unwinding gains in some of the strongest performers of 2026, including Asian tech, emerging markets and commodities. The reversal was partly triggered by Trump’s pick of Kevin Warsh to lead the Federal Reserve, a move that supported the dollar as traders saw the former Fed governor as tough on inflation and less inclined toward deep interest-rate cuts.

Spot gold and silver remain in the limelight with both extending Friday’s rout, although the metals are well off the worst levels as some Asian buyers make a comeback. Silver is down about 1.9%; earlier it briefly went negative on the year. “The impact of 2x and 3x leveraged longs on assets falling 20-30% is undoubtedly going to trigger margin calls on a lot of other collateral,” said Panmure Liberum’s Mark Taylor.

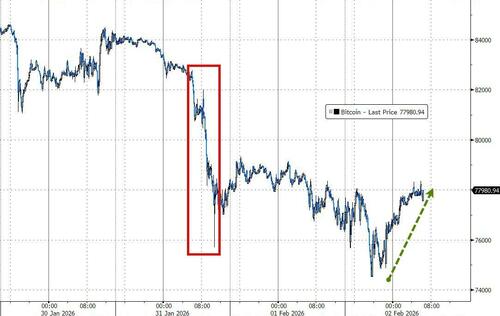

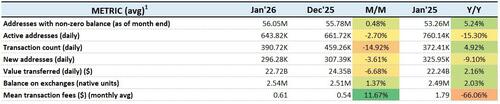

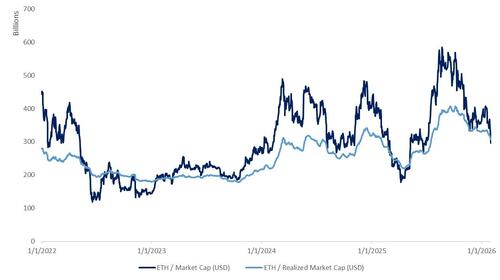

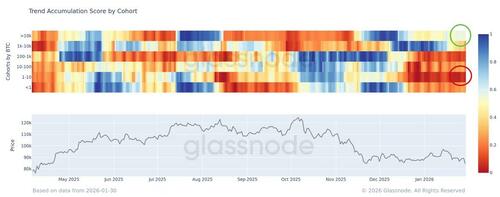

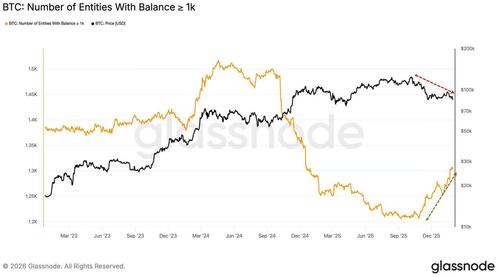

Bitcoin steadied after shedding nearly 13% since the start of the year, a plunge that briefly pushed it toward levels last seen when Trump retook the White House. The largest cryptocurrency has now fallen for four straight months, with the selloff shaped by an absence of buyers and waning conviction in its value as an alternative asset.

"This pullback looks healthy to me, there was really some excess across gold, silver and some tech stocks too,” said David Kruk, head of trading at La Financiere de l’Echiquier. “My take is that there will be a bounce back in the coming days.”

Equity volatility remains below its average over the past year, while the gold rally has shown a so-called vol-up/spot-up dynamic similar to what’s seen in AI and other frothy parts of the equities world. Retail traders had piled into the iShares Silver Trust (SLV) in the largest one-day net inflow on record last Thursday.

Investors continue to parse what a Warsh-led Fed may mean. The selection of the economist known as much for his fierce criticism of the central bank as his changing views on monetary policy has shifted the debate to the Fed’s $6.6 trillion balance sheet and its very role in markets.

Meanwhile, the US government stumbled into a partial shutdown Saturday while waiting for the House to approve a funding deal Trump worked out with Democrats. The funding lapse is likely to be short, with the House returning from a week-long break on Monday.

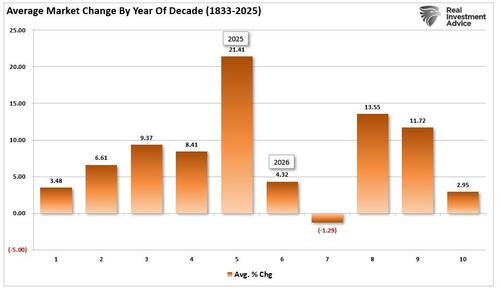

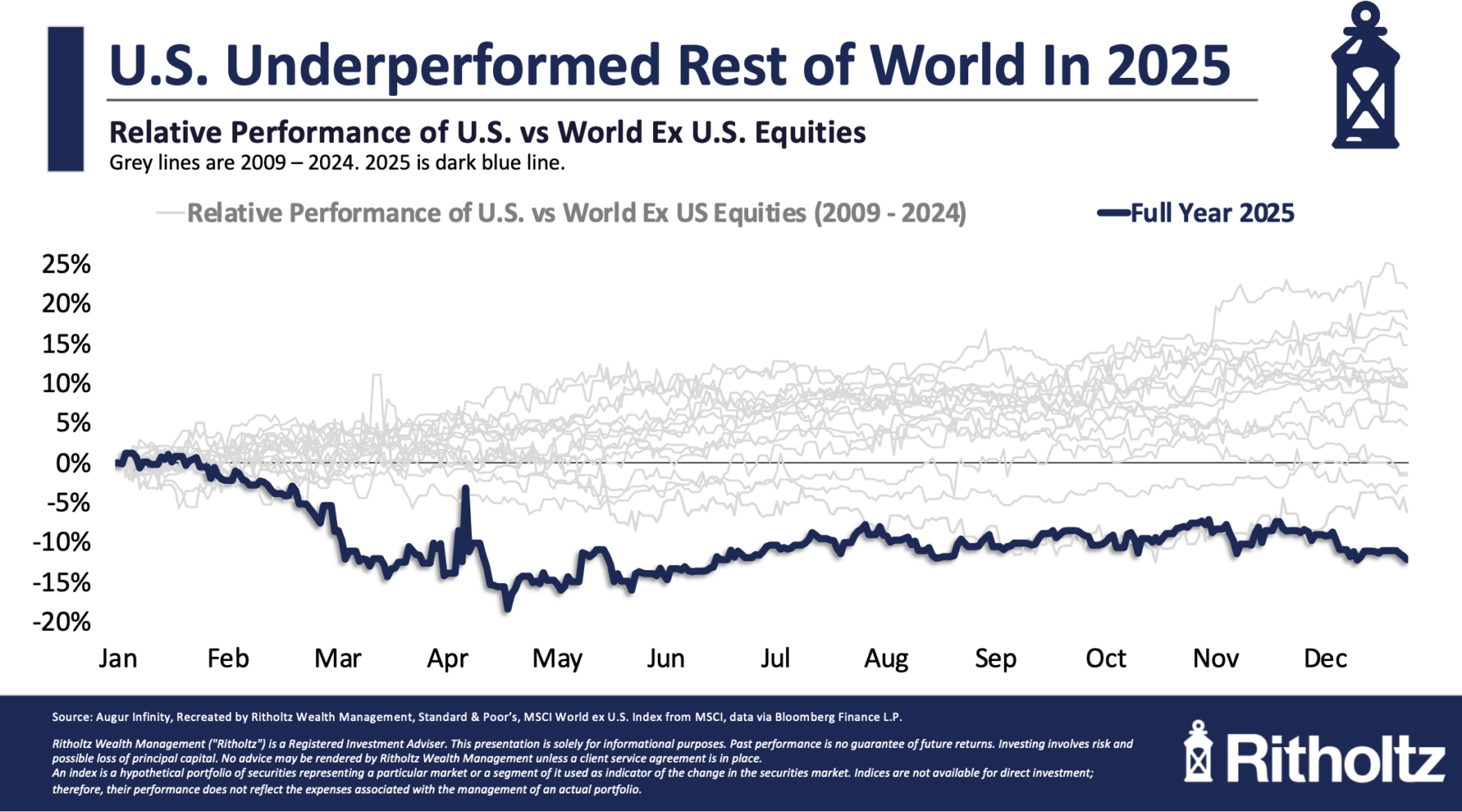

“It’s typical of the 2026 constant stream of complicated news flow,” wrote Jim Reid, global head of macro research and thematic strategy at Deutsche Bank AG. “This follows a January that managed to both shock and awe in various ways, yet still delivered broad-based gains across all global assets.”

Not everyone is bearish: Robust earnings and well behaved inflation should counter geopolitical and other risks, JPMorgan strategists led by Mislav Matejka write. Traditional growth factors have been among the weakest-performing characteristics in US equities so far in 2026, a development “we view as healthy for the broader bull market,” notes Bloomberg Intelligence analyst Christopher Cain.

With another busy week of earnings on deck, the current market correction isn’t about earnings, Goldman strategists said, pointing to solid guidance from companies so far in the season. Out of the 167 S&P 500 companies that have reported so far, 78% have managed to beat analyst forecasts, while 16% have missed. Disney, Idexx Labs and Tyson are among companies expected to report results before the market open. Disney signaled in November that profitability will take a hit of hundreds of millions of dollars in the quarter, due to marketing expenses tied to the release of the film Avatar: Fire and Ash and the launch of the Destiny cruise ship. Earnings from Palantir and NXP Semi follow later in the day.

European stocks were weaker in early trade but have since returned to a positive footing, Stoxx 600 is up 0.2% and just a few points away from its all-time-high. Here are some of the biggest movers on Monday:

- Pandora jumps as much as 9.9% as silver prices extend their slide.

- European miners fall as copper extends a slump from a record, while gold and silver fall again.

- Julius Baer shares fall as much as 5% after reporting lower profit. KBW said the results were “mixed and messy” and that revenue missed the consensus estimate because of “mild weakness across all key lines.”

- European oil stocks fall along with crude prices after OPEC+ kept March output plans unchanged and geopolitical risk eased, with President Donald Trump saying Washington is talking with Iran.

- BFF Bank shares slide as much as 33% after the Italian financial services firm cut its 2026 outlook and announced a change in CEO.

- European chip stocks fall, tracking declines in Asian and US peers, as momentum trades unwind globally along with gold and silver.

- Carl Zeiss Meditec shares slip as much as 2.4% after Barclays downgraded its rating on the stock to equal-weight from overweight, citing continued downside risks which are only “partially priced into the stock.”

- Auction Technology Group shares drop as much as 11% as FitzWalter Capital says it will not make another offer for the London-listed firm after its 400p per share bid was rejected last week.

- Pharming shares sink as much as 20% after the FDA requested additional data as part of the Dutch biopharmaceutical company’s supplemental new drug application for Joenja in children with a rare primary immunodeficiency known as APDS.

Earlier in the session, Asian stocks retreated for a second session as risk-off sentiment dominated markets, with high-flying technology names and shares linked to precious metals leading an early selloff in a data-heavy week. The MSCI Asia Pacific Index slumped as much as 2.1%, the most since Nov. 18. Tech-heavy benchmarks in South Korea and Taiwan fared worse and the Hang Seng Tech Index lost more than 3% in Hong Kong. An Asian gauge of the materials sector was down 3.6% as gold declined further following Friday’s plunge that was its biggest in more than a decade, and silver whipsawed in choppy trading. Stocks in Indonesia also resumed their selloff Monday, weighed by weaker commodity prices, complicating efforts by regulators to shore up confidence in Southeast Asia’s biggest equities market. Japanese equities outperformed as exporters got a boost from a decline in the yen. Meanwhile, Indian stocks tumbled during Sunday’s special session following a budget proposal to hike taxes on equity derivatives trades. In the week ahead, traders will be watching for central bank decisions in Australia and India, while Indonesia is due to release gross domestic product figures.

In FX, the Bloomberg Dollar Index is down 0.1% after an overnight bid faltered. The euro and pound sit near the top of the G-10 leaderboard but still have some way to go to claw back Friday’s losses versus the greenback.

In rates, Treasuries are off session highs, hold small gains led by long-end tenors, with support from bigger rally in gilts. TSYs are higher by 5 ticks with yields 1-2bps lower across the curve amid a big flight to safety amid cascading margin calls, especially in Korea. Front-end yields are little changed with long-end tenors about 1bp richer, flattening 2s10s spread by around 1bp. US 10-year near 4.23% trails UK counterpart by about 1bp. Bunds are down 7 ticks and gilts up 27 as the slump in commodities helps underpin the latter. US session highlights include manufacturing PMIs and a speech by Atlanta Fed President Bostic. Treasury coupon auctions resume next week with 3-, 10- and 30-year supply, starting Feb. 10; department is scheduled to release quarterly borrowing estimates at 3pm

In commodities, WTI oil futures are down around 5% amid positive recent geopolitical developments surrounding Russia/Ukraine and Iran. Bitcoin is now up 1.8%, after looking like at one point it could make a run at the April low.

US economic calendar includes January final S&P Global US manufacturing PMI (9:45am) and January ISM manufacturing (10am). Fed speaker slate includes only Bostic (12:30pm)

Market Snapshot

- S&P 500 mini -0.4%

- Nasdaq 100 mini -0.8%,

- Russell 2000 mini -0.6%

- Stoxx Europe 600 little changed,

- DAX +0.2%,

- CAC 40 little changed

- 10-year Treasury yield -2 basis points at 4.22%

- VIX +1.7 points at 19.11

- Bloomberg Dollar Index little changed at 1187.5,

- euro +0.1% at $1.1867

- WTI crude -4.6% at $62.22/barrel

Top Overnight News

- House lawmakers are returning to Washington today to pass a funding deal that Trump worked out with Democrats last week. Approval would fund the Department of Homeland Security for two weeks, and the rest of the government through Sept. 30. BBG

- US Senate voted 71-29 to pass the USD 1.2tln government funding deal, and the House is expected to vote as soon as Monday on the plan after a brief government shutdown.

- Trump launches a strategic critical-minerals stockpile with $12 billion in seed money to insulate manufacturers from supply shocks.

- The venture, dubbed Project Vault, will marry $1.67 billion in private capital with a $10 billion loan from the US Export-Import Bank to procure and store minerals for manufacturers: BBG

- Iran signaled it hopes diplomatic efforts to avert a war with the US will bear fruit within days, after Trump said he is hopeful “we’ll make a deal.” BBG

- Oracle plans to raise up to $50 billion this year through a mix of debt and equity to expand cloud capacity. BBG

- Kevin Warsh’s nomination as Fed chair is reigniting debate over the central bank’s $6.6 trillion balance sheet. White House economic adviser Kevin Hassett told Fox that it should be “as lean as possible.” BBG

- Trump said Fed Chair nominee Warsh may get Democrat votes, and he hopes that Warsh will lower interest rates. In relevant news, Trump said on Friday that Warsh did not commit to cutting rates and he will probably talk about cutting rates with Warsh, while Trump also stated that Warsh will cut rates without White House pressure.

- China’s manufacturing activity unexpectedly improved in January, with the PMI rising to 50.3 from 50.1 a month earlier, according to a private survey. BBG

- Japanese Prime Minister Sanae Takaichi's party is likely to score a landslide victory in next week's lower house election, a survey by the Asahi newspaper showed, heightening the chance the country will continue to pursue big spending and tax cuts. RTRS

- Narendra Modi unveiled a budget aimed at shielding India’s economy from Trump’s tariffs and providing fresh backing for strategic sectors such as rare earths, critical minerals and chips. Bond yields rose to a one-year high on the government’s record debt-sale plan. BBG

- Oil prices fell more than 4% on Monday after U.S. President Donald Trump said Iran was "seriously talking" with Washington, signalling a de-escalation of tensions with an OPEC member, while a stronger dollar also weighed on prices. RTRS

- SpaceX is in advanced talks to combine with xAI, people familiar said. The two firms could announce an agreement as soon as this week. BBG

- Fed's Bowman (voter) said on Friday that she supported a rate pause as inflation remains elevated, while she added that downside risks to the labour market have not diminished and that policy is modestly restrictive. Bowman also said that they should not imply that they expect to maintain the current stance of policy for an extended period of time, and noted she projected three rate cuts for 2026 in the December SEPs.

- Trump picked Brett Matusmoto to head the BLS: WSJ

Trade/Tariffs

- US President Trump warned of a very substantial response if Canada enacts a trade agreement with China, while he added that the US does not want China to take over Canada, which would happen with the deal that they are looking to make.

- South Korean Industry Minister Kim said they will speed up the implementation of investment legislation after returning from talks with the US, which he said cleared up misunderstandings regarding tariffs.

- EU industry association said on Friday that China proposed final anti-subsidy duties on EU dairy products at lower levels than in provisional duties with the final Chinese anti-subsidy tariffs on EU dairy products to go up to 11.7% vs. a maximum 42.7% in provisional duties.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were pressured amid several recent bearish themes, including the partial US government shutdown and surprise contraction in Chinese official PMIs over the weekend, while sentiment was also not helped by the recent historic collapse in precious metals and with tech-related weakness after reports that NVIDIA's plan to invest USD 100bln OpenAI stalled. ASX 200 retreated with underperformance in the mining sector after a tumble in metal prices, including last Friday's biggest intraday drop for gold in four decades, while sentiment was not helped by wide consensus for a looming RBA rate hike. Nikkei 225 initially bucked the trend with early support from a weaker currency and with the Takaichi trade in play after a poll showed that the ruling LDP is likely on course for a landslide victory at the snap election this upcoming Sunday. However, the index gradually wiped out its gains and more alongside the broad risk-off mood across the region. Hang Seng and Shanghai Comp suffered after disappointing PMI data over the weekend, which showed official manufacturing and non-manufacturing PMI unexpectedly slipped into contraction territory, while the private sector RatingDog manufacturing PMI data matched estimates and continued to show an expansion, but failed to inspire risk sentiment. Furthermore, Chinese telecom names were among the worst performers after Beijing notified about raising telecom services VAT to 9% from 6%.

Top Asian News

- Japanese PM Takaichi said in a speech on Saturday that the yen’s recent depreciation boosted exporters and returns from the government’s foreign exchange fund, while she failed to address concerns regarding the effect on consumer prices. However, she attempted to clarify on Sunday that she was referring solely to the need to build an economic structure that can withstand currency fluctuations, and not to stress the advantages of a weaker currency.

- Japan’s ruling LDP party is likely to win a landslide victory and exceed a majority of 233 seats, while the ruling bloc may win more than 300 seats in the 465-seat parliamentary snap election on February 8th, according to an Asahi survey.

- Chinese President Xi called for China’s renminbi to attain global reserve currency status, according to FT.

- India increased infrastructure spending in its annual budget with the capital spending target for the upcoming fiscal year lifted by around 9% to INR 12.2tln, while it proposed to boost manufacturing in strategic sectors including rare earths and semiconductors, as well as proposed a tax holiday up to 2047 for foreign cloud companies making data centre investments in India. Furthermore, it strongly emphasised fiscal restraint and targeted reducing the debt-to-GDP ratio to 50% (+/-1%) from 56% by 2030/2031 and estimates the fiscal deficit will decline to 4.3% from 4.4% of GDP, while it is to raise the Securities Transaction Tax on futures and options trading.

European bourses (STOXX 600 -0.1%) opened broadly on the backfoot, but have since gradually moved higher to display a mixed picture. European sectors are mixed. Insurance leads whilst Basic Resources and Energy are the clear laggards, driven by significant pressure across the underlying commodities space.

Top European News

- UK PM Starmer said the UK should consider re-entering talks for a defence pact with the EU, while he added that Europe needs to step up and do more to defend itself in certain times, according to The Guardian.

- UK and Japan agreed to deepen defence and security cooperation.

Central Banks

- BoJ's Summary of opinions noted that one member said financial conditions remain accommodative even after a rate hike in December. One member said no need to worry too much about impact on corporate profits as long as rate hike pace is not too fast. One member said appropriate to continue raising policy rate if economic and price projections materialise. A member said current financial conditions still significantly accommodative judging from economic strength and fallout from recent weak yen. A member said if overseas rate environments change this year, there is risk BOJ may unintentionally fall behind a curve. A member said that the bank has been examining response of economic activity and prices and financial conditions to each rate hike and has been raising the policy interest rate, while it is appropriate for the bank to continue to do so. One member said BoJ should raise the policy rate at intervals of a few months. One member said some indicators of long-term inflation expectations have already started to show stability.

- ECB SAFE: "Inflation expectations were broadly unchanged across horizons, with firms continuing to report upside risks to their long-term inflation outlook.". Firms reported a net tightening in bank loan interest rates and in other loan conditions related to both price and non-price factors. Financing needs rose modestly, accompanied by a small perceived decline in availability. Inflation expectations were broadly unchanged across horizons, with firms continuing to report upside risks to their long-term inflation outlook. The use of artificial intelligence is widespread among euro area firms, though most firms use it very infrequently or moderately.

FX

- The DXY is essentially flat and trades within a very narrow 92.17-97.29 range. Newsflow over the weekend has been light from a Dollar perspective, so attention will be on a data-packed week ahead (incl. ISMs, PMIs & jobs data) and on developments related to the current partial US government shutdown. On the latter point, lawmakers managed to work out a deal on Friday – the House is now set to vote on either Monday or Tuesday; House Speaker Johnson predicts the partial shutdown will end by Tuesday.

- G10s are mostly losing vs the USD (ex-GBP & EUR), which are currently incrementally firmer. Nothing is really driving things for the GBP this morning (PMIs were revised a touch higher). In Europe, EZ PMIs were broadly subject to mild upward revisions, and this was reflected in the EZ-wide figure – nonetheless, it still remains in contractionary territory. CHF initially flat, but now underperforms as the risk tone improves.

- Focus this morning has also been on the Aussie & Kiwi, which are currently posting mild losses vs the USD. Downside comes amidst the continuation of pressure seen in underlying metals prices; XAU -4.5% this morning. From a central banking perspective, the RBA is set to give a policy announcement on Tuesday. Markets currently price in a 76% chance of a 25bps hike, a recent shift from expectations of a pause – traders cite strong jobs data and inflation remaining above target.

- Volatile trade for USD/JPY. Initially gapped higher (154.84) and gradually rose towards a session peak (155.51) within an hour, before paring that move. Since, trade has been rangebound. The earlier bout of weakness in the JPY comes after Japanese press circulated comments via PM Takaichi, where she seemingly talked up the benefits of a weaker JPY – but this was later clarified by the PM. On the subject of Takaichi, recent polls suggest that the ruling LDP is likely on course for a landslide victory at the snap election this upcoming Sunday. In more detail, Asahi reported that the LDP-JIP coalition could “secure more than 300 seats”, far surpassing a simple majority of 233.

Fixed Income

- JGBs began the week on the backfoot, down to a 131.32 low, amid the latest election polling. Asahi's poll has the LDP on track for a standalone majority and, when combined with JIP, to over 300 seats and by extension within reach of the 310 super-majority level in the 465-seat Lower House. However, the pressure proved somewhat fleeting given the global risk-off move and as XAU remains for sale, fixed has benefited. Action that been sufficient to lift JGBs into the green with gains of c. 10 ticks and the 10yr yield below 2.25%; however, the 40yr yield remains firmer and holds at highs of 3.94%.

- USTs are being dictated by the risk tone. Just off a 112-02 peak, firmer by c. five ticks as things stand. The tone is driven by the continued pullback in metals, weak Chinese PMIs, NVIDIA reporting, the likely temporary US government shutdown and as we await the first remarks from Trump's Fed Chair pick and any potential SCOTUS update re. tariffs. While there is no schedule for the latter two points, today's docket does have the S&P Final Manufacturing PMI and then the ISM figure.

- EGBs are contained this morning. Bunds found haven allure overnight and got to a 128.36 peak, with gains of 20 ticks at best. However, the benchmark has gradually come off best into the European morning as the region's risk tone inches higher, and equities go from being well in the red to somewhat mixed. No move seen to Final Manufacturing PMIs. As it stands, Bunds are near-enough unchanged but around 10 ticks off their 128.04 trough.

- Gilts lead this morning. Catching up to the overnight bid seen in peers. Since, in limited newsflow but as the tone continues to recover, Gilts have pulled back from their 91.21 peak to just above the figure, though it continues to outperform with gains of c. 20 ticks. Not driving price action but a narrative to keep an eye on is a piece in The Telegraph that Labour's Rayner is constructing a war chest and has begun offering Cabinet roles to her supporters, as part of a plot to succeed PM Starmer.

Commodities

- Crude benchmarks have slumped at the start of the new week following geopolitical headlines over the weekend that have eased rising tensions in recent weeks. Axios' Ravid reported that a US-Iran meeting could take place this week, after weeks of potential signs of a strike in Iran. US President Trump also told reporters that Iran was seriously talking with Washington. WTI and Brent began trade just shy of USD 65/bbl and USD 68/bbl, respectively, before steadily falling lower throughout the APAC session to a low of USD 61.44/bbl and USD 65.45/bbl as markets price out the potential of further escalation. Benchmarks have rebounded slightly but remain near session lows.

- Nat Gas futures continue to pare back the rise in prices following the Arctic storm, with Dutch TTF now trading below EUR 35/MWh after topping at EUR 43.38/MWh at the peak of the storm worries. Overnight, Russia announced that it will permit gasoline exports for fuel producers through to the end of July to avoid overstocking.

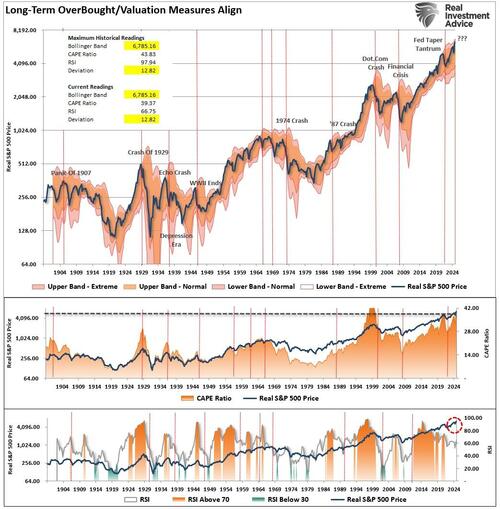

- Precious metals continue to slide, with spot gold and silver falling as much as 10% and 16%, respectively. The initial selloff was initiated early last Friday on the possibility (and then confirmation) of Kevin Warsh being announced as the new Fed Chair.

- During the APAC session, XAU steadily trended lower as Chinese participants took the opportunity to lock in profits, falling just shy of USD 4400/oz. As the European session continues, the yellow metal continues to rebound and is returning back to USD 4700/oz; but ultimately, remains lower by over 4%. Similarly, after falling to a trough of USD 71.40/oz, silver prices have rebounded to USD 80/oz.

- Alongside precious metals, 3M LME Copper gapped below USD 13k/t and drove to a low of USD 12.43k/t, weighed on by the broader risk-off tone and weak Chinese PMIs. Copper prices remain below USD 13k/t but have recently rebounded just shy of session highs of USD 12.95k/t.

- Turkey raises lower price limits on some gold and silver funds.

- OPEC Secretariat receives updated compensation plans from Iraq, the United Arab Emirates, Kazakhstan, and Oman.

- Eight OPEC+ members agreed on Sunday to maintain the pause in oil output hikes in March.

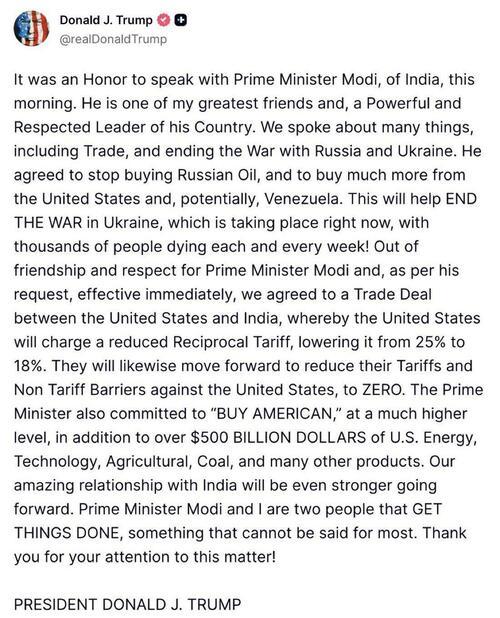

- US President Trump said he welcomes investment from China and India in Venezuelan oil, while he announced that they have already made a deal for India to buy Venezuelan oil.

- Russia will permit gasoline exports for fuel producers through to end-July to avoid overstocking, although it extended the ban on exports for non-producers, as well as the ban on diesel and other types of fuel for non-producers until end-July.

Geopolitics: Ukraine

- Russia's Kremlin said that they have narrowed their differences on some issues with Ukraine but not on complex issues, next round of trilateral talks on Ukraine will take place in Abu Dubai on Wednesday and Thursday.

- Ukrainian President Zelensky said Ukraine is ready for substantive discussions and is interested in results, while he announced the next trilateral peace talks between the US, Russia and Ukraine will take place in Abu Dhabi on Feb. 4th-5th.

- US envoy Witkoff said he held constructive talks with Russian special envoy Dmitriev on Saturday in Florida as part of the US effort to end the war in Ukraine.

- Russia’s Medvedev said victory will come soon in the Ukraine war, but it is equally important to think about how to prevent new conflicts, while he also commented that US President Trump is an effective leader who seeks peace and that they never found the two nuclear submarines Trump spoke about deploying closer to Russia.

Geopolitics: Middle East

- Iranian Supreme Leader Khamenei warned that if the US launches a war, it won’t stay confined to Iran and would likely escalate into a broader regional conflict, according to Iran International. It was separately reported that Iran renewed its threat to strike Israel in which Iranian army chief Major-General Amir Hatami warned that “If the enemy makes a mistake, it will without doubt endanger its own security, the security of the region, and the security of the Zionist regime”.

- US officials said a meeting between the US and Iran could take place in Turkey this week, according to Axios’s Ravid.

- Iran's foreign Ministry said US President Trump has not set a deadline for negotiations, via Alhadath on X.

- Iran announces it has summoned all the EU ambassadors in the Islamic Republic to protect the bloc's listing of the paramilitary Revolutionary Guard as a terror group.

- Persian Gulf states are warning US officials that Tehran's missiles program remains capable of inflicting significant damage to US interest in the region, via X.

US Event Calendar

- 9:45 am: United States Jan F S&P Global US Manufacturing PMI, est. 52, prior 51.9

- 10:00 am: United States Jan ISM Manufacturing, est. 48.5, prior 47.9

DB's Jim Reid concludes the overnight wrap

Welcome to February with another big sell-off in Gold (-5%) and Silver (-10%) overnight, and a partial US government shutdown that isn't as severe as the record one before Xmas, and is expected to get resolved soon. Nevertheless it's typical of the 2026 constant stream of complicated news flow. This follows a January that managed to both shock and awe in various ways, yet still delivered broad based gains across all global assets in our monthly performance review when measured in USD terms—a genuinely rare occurrence. It was perhaps fitting then, that the month ended with extraordinary volatility: Silver saw its largest daily fall since 1980 (36% at the intraday lows, 26.3% at the close), while Gold recorded its biggest one day decline since 2013 ( 8.95%). With the overnight moves, Silver is now around $5 below its real adjusted level from 1790—something we explored in last Monday’s CoTD here. As we noted, even incorporating the dramatic 1980 boom and bust and the recent surge, Silver has failed to outperform inflation over more than 230 years of data. So while I’ve long been a bit of a gold bug given my strong views on the inflationary consequences of fiat money, the recent run up in precious metals feels to have an enormous speculative element. Friday’s moves, almost certainly driven by positioning and margin dynamics, only reinforced that impression.

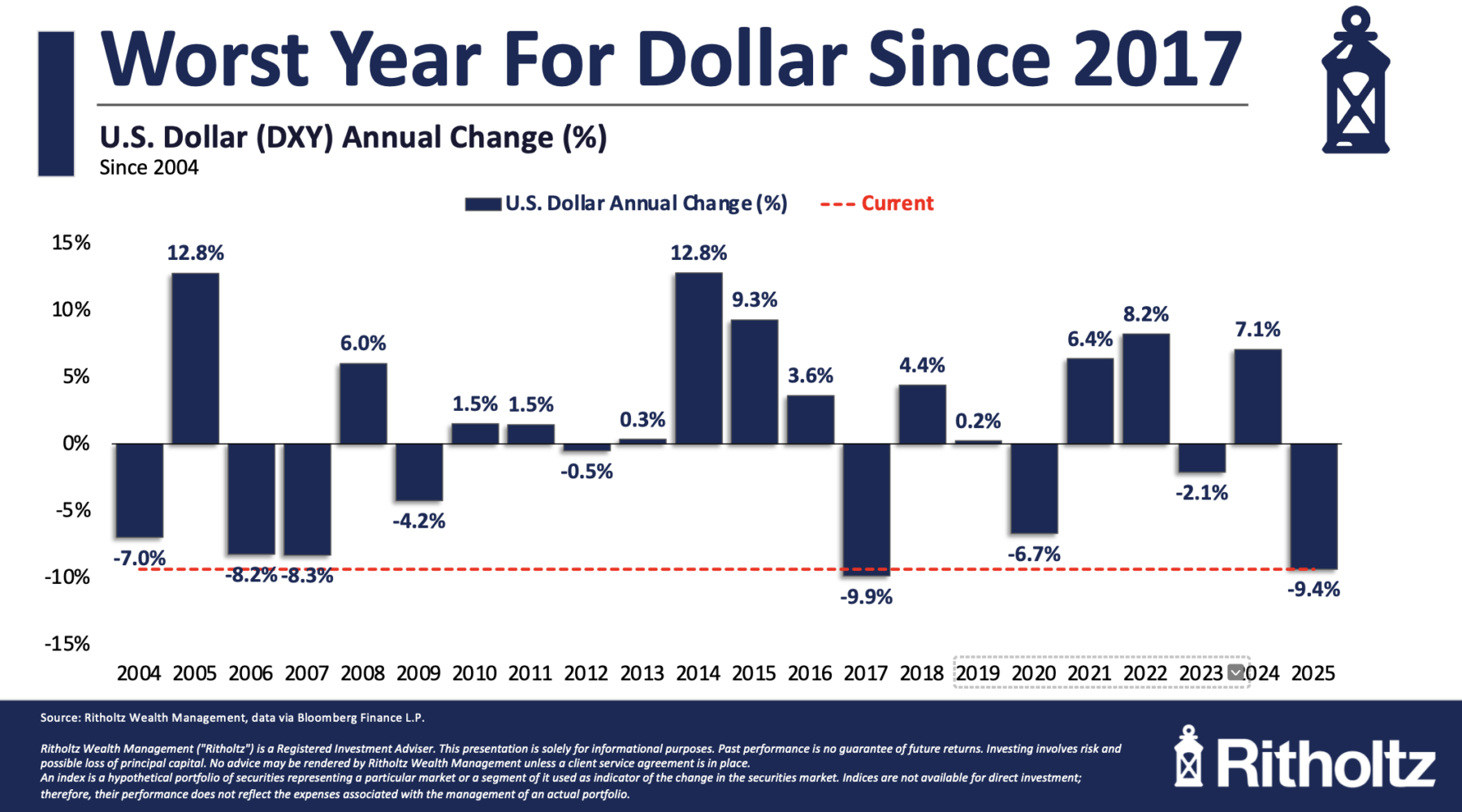

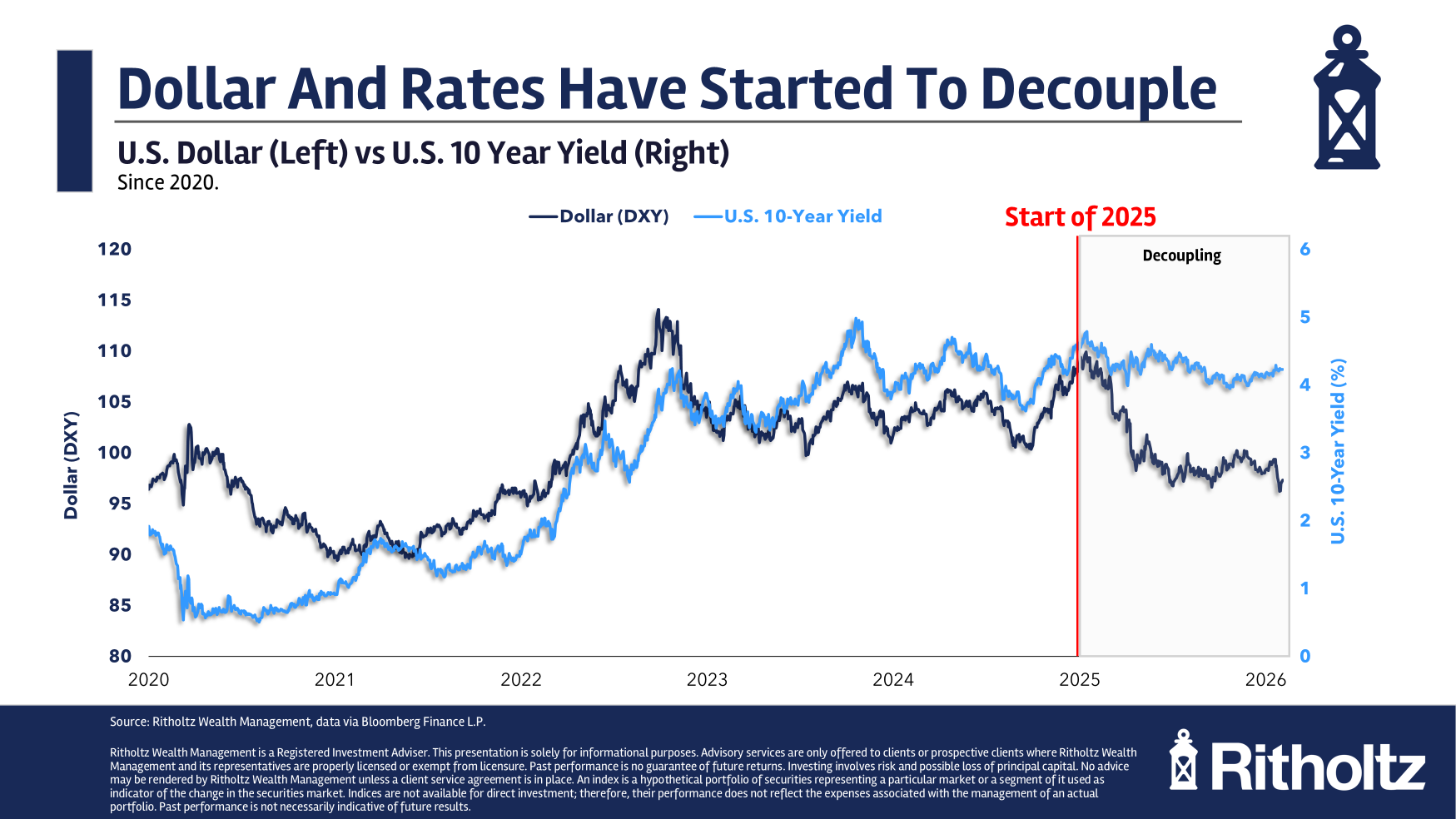

Volatility began to build on Thursday, but the clear catalyst for Friday’s sell off appeared to be news in the early UK hours that Kevin Warsh had secured the nomination for Fed Chair. Warsh is known to be more hawkish on the balance sheet than other candidates, pushing back against the prevailing debasement narrative that has supported precious metals. That said, price action had long since detached from any sane discussion on debasement, but it often takes only a small ripple to trigger a broader correction, especially when there is leverage around. Our economics team explored the implications of Warsh’s nomination in detail on Friday here. The Dollar responded to the news with its strongest day since May, while EM assets—after an excellent month—saw sharp reversals across equities and FX.

Henry has just published his usual performance review here, and despite the late month turbulence it was still a very strong January for global assets. Silver (+18.9%) and Gold (+13%) topped the performance tables, joined by oil (+16.2%), which posted its biggest monthly gain in four years. Outside our formal performance review, it’s also worth noting that Bitcoin is currently down about -14% year to date after a difficult few days. It now sits around -40% below its October 2025 peak and back at levels first breached in November 2024. Over that same period, Gold has doubled.

Elsewhere in Asia, Brent crude futures are down by -5.4%, also being impacted by the commodities deleveraging and news that Washington is in talks with Iran. S&P 500 futures are down by -1.21% and NASDAQ 100 (-1.59%) and DAX futures (-1.02%) are also lower. The KOSPI is at the forefront of the regional equity declines, plummeting around -5.0% as major chipmakers, Samsung Electronics and SK Hynix, saw their shares drop between -5.70% and -6.50% respectively. Moreover, the Hang Seng (-2.70%) and the Hang Seng Tech index (-3.87%) are also experiencing significant retreats as an AI-driven sell-off accelerates. In other markets, the Nikkei (-1.02%) is also trading in negative territory, with the CSI (-1.40%) and the Shanghai Composite (-1.64%) also declining amid a broader regional downturn. So a pretty uncomfortable start to February.

The coming week will revolve around a dense run of US macro releases, with the January jobs report set to dominate attention on Friday. We also have the ISM surveys, consumer sentiment and the latest Treasury’s quarterly refunding details. Central banks be in focus with decisions due from the ECB, the BoE (both Thursday) and the RBA (tomorrow). Elsewhere we have the latest global PMIs and inflation in Europe. Corporate earnings include Alphabet (Wednesday), Amazon (Thursday) and AMD (Tuesday). Remember that Meta (+6.56%) and Microsoft (-8.50%) saw big moves in either direction last week with both having a 10% plus intra-day rise and decline respectively.

Looking at more detail into the week ahead, Friday’s employment report is the highlight, with forecasts pointing to another modest payroll gain (consensus at +50k and +37k for headline and private respectively) and no change in either the unemployment rate (4.4%) or the pace of hourly earnings growth. Ahead of that, the JOLTS data tomorrow and the ADP report on Wednesday will give early clues on labour market momentum. The week also brings the manufacturing ISM on Monday and the services ISM mid week, followed by the University of Michigan’s February sentiment survey on Friday. Fixed income investors will also be watching Wednesday’s quarterly refunding announcement and today’s Treasury borrowing estimate closely.

Central banks will remain a major theme as well. The ECB and Bank of England both meet on Thursday, and neither is expected to adjust policy, with the ECB likely extending its on hold stance for a fifth straight meeting and the BoE seen keeping Bank Rate unchanged once again. The Reserve Bank of Australia is also expected to stand pat tomorrow. Additional colour on financial conditions will come from the Fed’s senior loan officer survey today and the ECB’s latest bank lending survey tomorrow.

Across Europe, the flow of flash January inflation reports continues, with France tomorrow and Italy and the broader euro area following on Wednesday. Sweden publishes its CPI on Friday. Several Eurozone economies will also release December retail sales and trade figures, while Germany rounds out the week with its factory orders and industrial production numbers. It'll be interesting to see if they show continued evidence of the fiscal stimulus.

The corporate earnings calendar remains active, with attention in the US turning to two members of the Mag-7 — Alphabet on Wednesday and Amazon on Thursday — alongside a range of other tech firms such as Palantir, AMD and Qualcomm. Major healthcare names are also reporting, including Eli Lilly and AbbVie in the US and Novartis and Novo Nordisk in Europe. Broader US earnings include updates from PepsiCo, Walt Disney and Uber. In Europe, several banks are scheduled to report, while in Japan, Toyota, Sony and Tokyo Electron will be among the key companies releasing results.

Over the weekend, data revealed that China's official PMI for January fell back below 50 again at 49.3, down from December's 50.1, and below expectations. The Manufacturing PMI has been in contraction for nine of the past ten months, reinforcing concerns that December's data may have been an anomaly rather than the beginning of a sustained recovery.

Simultaneously, the official non-manufacturing PMI decreased to 49.4 in January (compared to the expected 50.3), down from 50.2 the previous month, marking the lowest level since December 2022. This decline was attributed to weak post-holiday demand, cautious consumer spending, and ongoing challenges in the property sector. Conversely, a private survey presented a more positive outlook, indicating that China’s manufacturing activity improved to 50.3 in January (compared to 50.1 in December), and marking the strongest level since October.

Recapping last week, the biggest news happened on Friday when Trump announced Kevin Warsh as his Fed nominee. The confirmation led to a cross-asset sell-off amidst expectations that Warsh would be more hawkish than other candidates – particularly on the balance sheet. So that led to a global risk-off mood and triggered a sharp pullback in precious metals. On Friday gold (-8.95%) posted its largest daily decline since 2013 (-1.87% over the week). And silver registered its largest drop since 1980 at -26.36% (-17.44% over the week). To give some perspective, earlier in the week gold posted its best 8-day run since the GFC, rising to $5,417/oz on Wednesday, while silver also reached a new high of $116.70/oz before ending the week at $85.20. So some remarkable volatility playing out in precious metals.

Equities had also advanced earlier in the week, with the S&P 500 briefly surpassing the 7000 threshold on Wednesday, before ending the week +0.34% higher at 6,939 (-0.43% on Friday). The reversal in equities was partly driven by Microsoft results, which saw the software giant’s shares fall -9.99% on Thursday. Combined with the Warsh news, that left the NASDAQ slightly down on the week (-0.17%, -0.94% on Friday), although the Mag-7 managed to outperform (+1.02%, -0.32% on Friday), supported by Meta’s +10.40% surge on Thursday after its own results suggested AI was boosting ad revenue growth.

In bond markets, Trump’s Warsh nomination added to the steepening in the US Treasuries curve. While 2yr yields fell -3.7bps on Friday (-7.1bps over the week) amid the risk-off mood, 10yr (+0.4bps, +1.1bps over the week) and 30yr (+1.9bps, +4.6bps over the week) moved higher. On Wednesday, the FOMC had held rates steady at 3.50%-3.75% as expected, with Chair Powell offering little near-term guidance but suggesting that the next move is still likely to be a cut.

We also saw sizeable volatility in other asset classes. In FX, the dollar index fell by -0.62% over the week, despite a +0.74% rebound on Friday helped by Trump’s Warsh nomination. Elsewhere, oil prices continued to climb higher, with Brent (+7.30%, -0.03% Friday) rising to its highest level since July amid rising concerns that the US may pursue military action against Iran, with Trump saying that the next US attack would be “far worse” than the strikes last June if Iran did not reach a deal.

Finally in Europe, the mood was more positive with the STOXX 600 ending the week +0.44% higher (+0.64% on Friday), though the DAX (-1.45%, +0.94% Friday) and CAC (-0.20%, +0.68%) retreated after weak results from the likes of SAP and LVMH. We saw mixed economic data, with a soft German IFO expectations reading on Monday (89.5 s 90.3 expected) but a stronger Euro Area Q4 GDP on Friday (+0.3% q/q vs +0.2% q/q expected). We also got stronger than expected German HICP print (+2.1% vs +2.0% expected). Despite this, yields on 10yr bunds (-6.3bps, +0.3bps Friday) and OATs (-5.6bps, +0.6bps Friday) moved lower over the week

Tyler Durden

Mon, 02/02/2026 - 08:37

via AP

via AP

Source: Roscongress Photobank

Source: Roscongress Photobank

Recent comments