When The Return Flight Is The Only Goal: Merz Ends China Trip

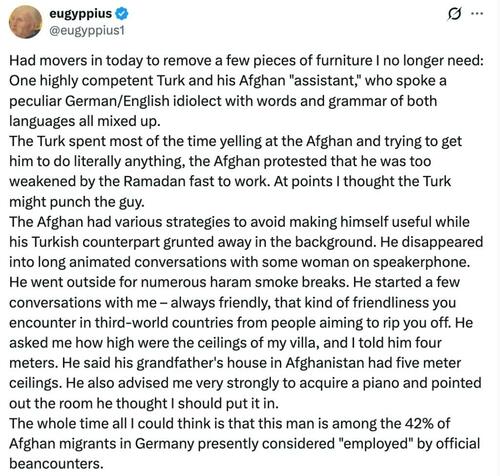

Submitted by Thomas Kolbe

It took some time for the supposed difference between Annalena Baerbock’s feminist foreign policy and the approach that the diplomatic corps under Chancellor Friedrich Merz would take to become clear. What has changed is less the substance than the performative act. Under the Sauerland-born Merz, tone and gestures shifted—the staging is meant to appear more masculine, sober in style, perhaps more professional, less embarrassingly activist—but the content remains largely unchanged.

Ironically, arch-enemy Donald Trump became the spiritus rector of a new theatrical element in the Chancellor’s media showcase. In Trump-style, Friedrich Merz announced on February 25 the climax of his China trip: the conclusion of a major order for the European aerospace giant Airbus. China will acquire 120 aircraft, models A320, A350—details to follow later—ordered from the company that has become the most successful “success child” of the European project.

The Chinese hosts are politely attentive: they don’t let the Chancellor return home empty-handed and grant him quick fame in the 2026 super-election year. Images, headlines, pathos—the stage is set. The Chancellor as doer, as promoter of German and European interests, as a foreign-policy acquirer in global competition—a German Donald Trump?

A sober look at the numbers puts the theatrics in perspective. Year after year, Chinese customers fill Airbus’s order books with hundreds of aircraft. Major orders from China are no exception; they are part of a long-established procurement rhythm. Demand is structural, not spontaneous—the production slots had long been planned and coincided with the Chancellor’s trip by chance.

A media storm in Trump-style, with the small but crucial difference that the U.S. president returns from foreign trips with real investments in his industry’s production capacity. Factories are built, sites expanded, capital flows measurably into American value creation. Whatever the magic formula—tariffs, deregulated economy, robust growth—America attracts real investments, binding capital and industrial substance domestically.

Friedrich Merz, by contrast, presents routine industrial orders as personal triumphs. He frames scheduled large orders as the result of his diplomatic prowess—a German deal-maker in action. But the crucial difference is that for career politician Merz, only media impact counts. One brings production capacity home; the other brings press releases.

Let’s credit Merz: his trip falls during a critical election phase. In such moments, images, gestures, and quickly digestible wins matter. Fleeting triumphs feed the narrative of the doer in the chancellery, regardless of catastrophic domestic performance.

It is also reassuring that Germany continues to receive the highest protocol honors in China and that Beijing evidently values German history more than the sad present. Reception in the Great Hall of the People by Premier Li Qiang, a personal audience with President Xi Jinping, evening dinner, military welcome at the airport. The choreography is flawless: flags, honor guards, carefully staged images. Protocol-wise, Germany still plays in the Champions League.

Geopolitically, however, the picture is different. Merz called China a “strategic partner” before the trip without defining what this means in the current world situation. Beijing firmly backs Moscow in the Ukraine war. How does the Chancellor think the EU’s 20 sanction packages against Russia affect relations with Beijing? Every new measure against Russia is not just a signal to the Kremlin but also a geopolitical marker toward China.

Merz could personally observe China’s perspective on Germany and the EU’s growing isolation in geopolitics. Protocol pomp does not reverse strategic erosion. From Beijing’s perspective, the question is simple: what offer should one make to a delegation from a country that has weakened its industrial base through self-inflicted dismantling while simultaneously complaining about trade disadvantages?

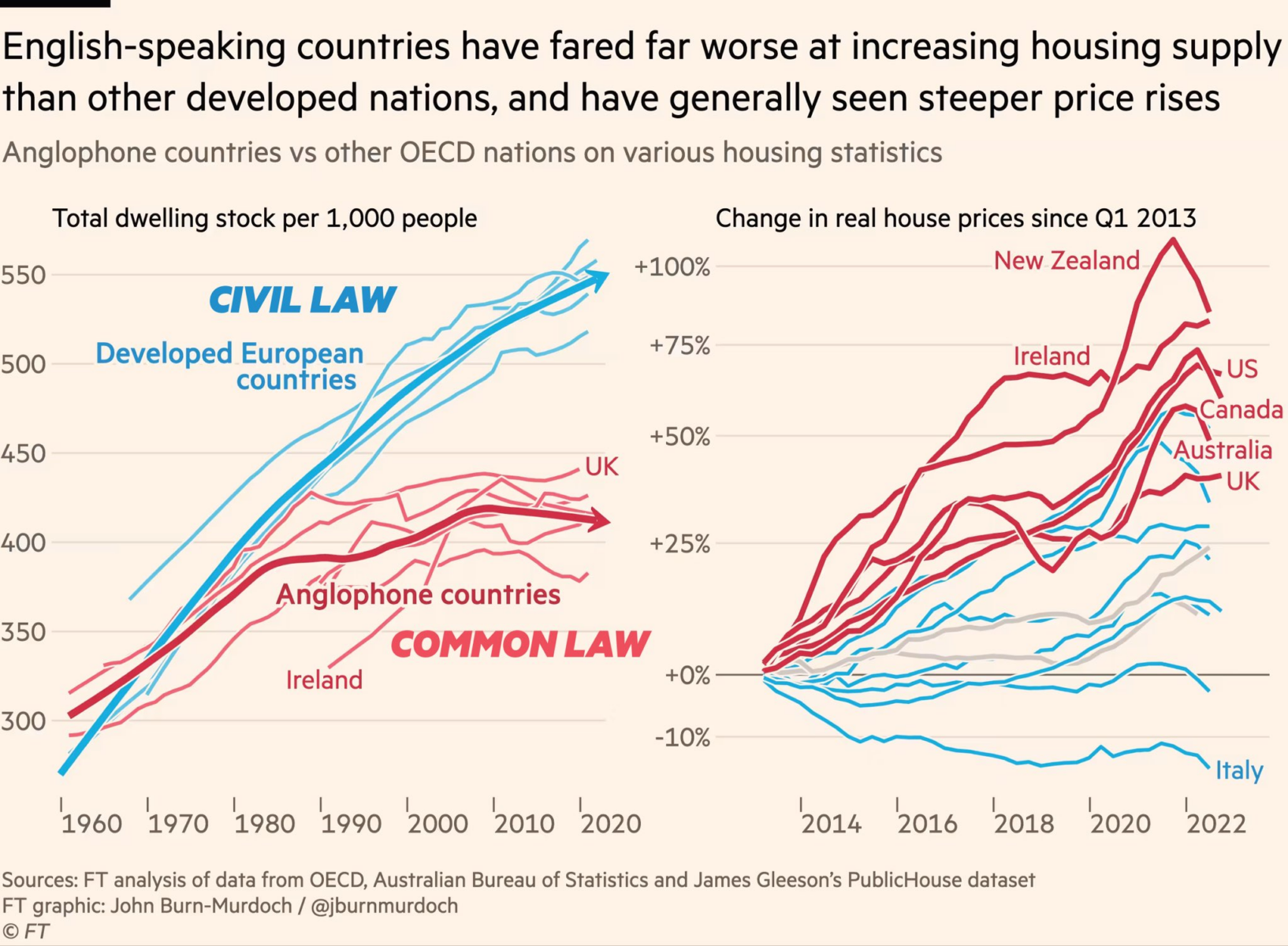

The consequences of European eco-socialism are immense. Germany has become a net importer of capital in trade with China. The trade balance increasingly tilts against it. In key industrial sectors, competitive advantages have eroded; energy-intensive value creation is under pressure.

Against this backdrop, sympathy for the Chancellor and his economic representatives is limited. The misery is homegrown. Every new regulation, levy, or transformation mandate tightens industry further, reducing Germany’s flexibility in global competition.

In China—a political dictatorship under a single party but economically largely guided by market efficiency—German-European moralizing meets maximum incomprehension. There, scale effects, productivity, market share, and technological sovereignty matter. Moral self-assurance does not replace industrial strength.

Merz lamented unfair Chinese trade practices given Germany’s deep trade deficit. Market access must be fair, disadvantages avoided. The words sound determined, aimed at reciprocity in global trade. And they sound naive.

Because isn’t it worth asking whether Europeans have long been world champions of hidden protectionism? Whether German and European policies repeatedly sparked the grotesque race toward emission-free economies via maximal repression? Regulatory hurdles, taxonomies, supply-chain laws, CO₂ border adjustments—all form a dense mesh of indirect market barriers.

It is by no means China’s fault that Germany’s economic propulsion—industry, engineering, machinery, automotive—has, under EU regulations and energy-transition fanaticism, disassembled at accelerated speed. Those who systematically eliminate their own cost advantages lose ground globally and geopolitically.

Merz exemplifies a European political class eager to blame external actors for structural weaknesses. He is living proof that Europe and Germany have a long way to go before a brutally honest assessment of problems.

Flattering China and the apparent alignment on population surveillance and censorship expansion makes Europe, at best, an unloved vassal of Beijing.

Europe, as a cultural entity, should seek salvation in alignment with Americans. In the bastion of free markets, deregulation, and rational energy policy—in the land of ICE and Christian-humanist cohesion—lies the most likely, only acceptable future for European policy.

China sees Europe as a dumping ground for surplus production—Europe as a decaying heir of the colonial era. European markets absorb domestic overcapacity. Structural dependency on resources like rare earths and energy grows. The leverage is not in Europe.

The era of European dominance is over. Moral self-assertion against factual dependence? Helpless. Puerile. Expensively paid.

Friedrich Merz’s visit to China was a campaign appearance for the CDU. He followed diplomatic protocols but was substantively unremarkable. The images were staged; strategic impact remains limited. Europe deserves better policy.

* * *

About the author: Thomas Kolbe, a German graduate economist, has worked for over 25 years as a journalist and media producer for clients from various industries and business associations. As a publicist, he focuses on economic processes and observes geopolitical events from the perspective of the capital markets. His publications follow a philosophy that focuses on the individual and their right to self-determination.

Tyler Durden

Mon, 03/02/2026 - 02:00

Britain's Prime Minister Keir Starmer makes a statement from Downing Street in central London on Feb. 28, 2026, following the U.S. and Israeli strikes on Iran. Jonathan Brady/POOL/AFP via Getty Images

Britain's Prime Minister Keir Starmer makes a statement from Downing Street in central London on Feb. 28, 2026, following the U.S. and Israeli strikes on Iran. Jonathan Brady/POOL/AFP via Getty Images

Source:

Source:

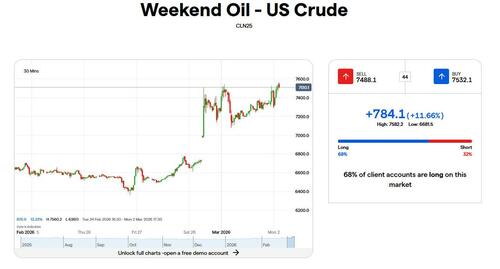

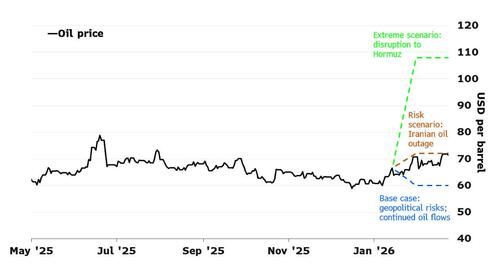

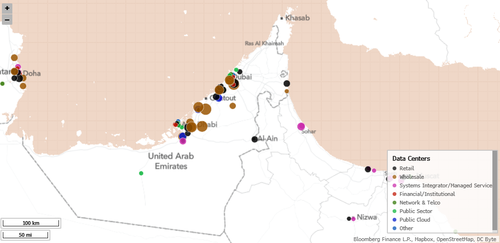

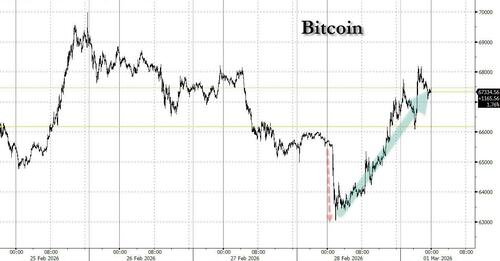

Source: Bloomberg

Source: Bloomberg

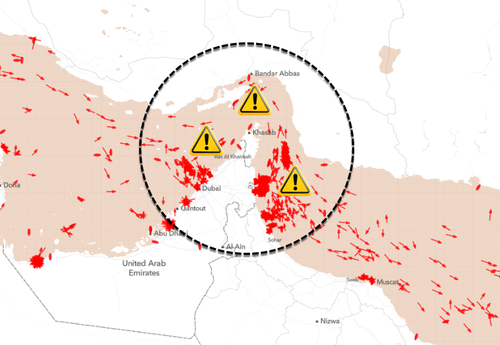

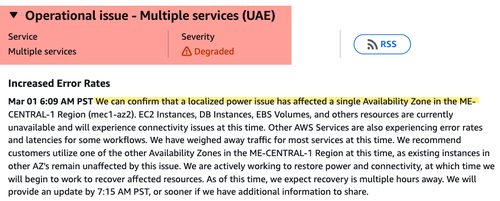

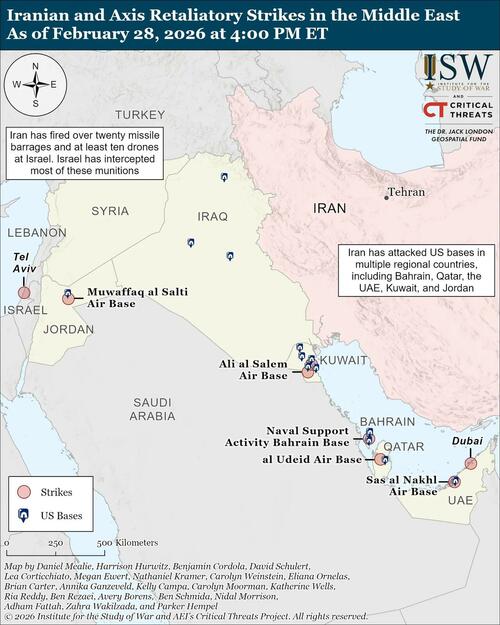

Explosions at Dubai International Airport following Iranian strike.

Explosions at Dubai International Airport following Iranian strike.

Recent comments