Systemic Risk: A 12-Order Cascading Analysis Of A Zero-Flow Strait Of Hormuz Closure

Authored by Craig Tindale via X:

Executive Summary

The modern world order, having organized itself around efficiency, cost minimization, and logistical precision, has created a machinery of dependence so extreme that the interruption of one narrow corridor can propagate outward into a general crisis of civilization.

What appears at first as a maritime blockade is in fact the exposure of the entire global system as a hierarchy of brittle interdependencies.

Oil and LNG fail as inputs into electricity, fertilizer, shipping, chemicals, mining, manufacturing, and state finance.

As an example, The global polyester chain begins in petrochemicals. A severe disruption to hydrocarbon and petrochemical feedstocks cascades into PTA, MEG, polyester resin, filament, and fabric production, causing acute shortages, price spikes, and factory stoppages across synthetic-heavy apparel segments. The industry does not vanish overnight, but the low-cost, high-volume apparel model starts to break down.

From this follows a chain whose logic is cumulative: fuel inflation becomes fertilizer inflation; fertilizer inflation becomes food inflation; food inflation becomes urban instability, sovereign subsidy exhaustion, and ultimately hunger. In this sequence, food shortages are not a secondary humanitarian issue. They are one of the central political outcomes of the crisis, because modern populations do not experience systemic breakdown first through grand strategy, but through unaffordable bread, intermittent power, empty pharmacies, and possibly the collapse of public order. A globalised Arab Spring.

In this framework, hyperinflation emerges as the social expression of real physical bottlenecks. When energy-importing states are forced to acquire dollarized fuel at any price, when currencies weaken, when fertilizer and transport costs reprice an entire harvest cycle, inflation ceases to be cyclical and becomes coercive.

It enters every household budget and every state ledger at once. The result is the destruction of planning itself: firms cannot quote, governments cannot subsidize, and populations can no longer calculate the future. Under such conditions, credit markets seize up, foreign-exchange reserves drain, sovereign spreads widen, and the boundary between economic crisis and political crisis disappears.

Modern technical systems amplify rather than dampen this disorder. The loss of sour crude becomes a sulphur and sulphuric acid crisis; that chemical crisis becomes a copper and cobalt crisis; the metals crisis becomes a transformer, switchgear, and grid crisis; the grid crisis becomes a semiconductor crisis; and the semiconductor crisis becomes a compute and data-centre crisis.

Thus, the closure of a maritime strait reaches, by entirely material means, into the server rack, the hospital network, the payment system, the electrical substation, and the defence-industrial base. The myth that digital civilization floats above heavy industry is, in this scenario, extinguished. Compute is shown to rest on copper, transformers, stable voltage, LNG, and ships.

For humanity, the systemic risk is therefore total in scope even if uneven in distribution.

The most immediate suffering falls on import-dependent and fiscally weak societies: blackouts, food insecurity, unemployment, debt default, regime stress, and mass unrest. Yet the advanced economies do not escape. They experience industrial contraction, infrastructure delays, AI and semiconductor bottlenecks, strategic stockpiling, and the permanent repricing of security over efficiency. What begins as a supply shock ends as a transformation of the political economy. States abandon the fiction of neutral markets and move toward command allocation, export controls, emergency powers, and militarized trade corridors. Market price gives way to strategic rationing. Globalization does not simply slow; it hardens into armed blocs.

The ultimate conclusion is grim : the terminal danger in this model is not one shortage, nor one recession, nor even one war-risk premium.

It is the transition from a globally integrated commercial order into a world system governed by scarcity, coercion, and administrative triage.

In such a world, hunger, hyperinflation, sovereign failure, technological stagnation, and geopolitical militarization are not separate crises.

They are the normal operating features of a civilization that has discovered, too late, that its efficiency was built on concentrated fragility. The closure of Hormuz, under this analysis, is the event through which the modern world recognizes that its supply chains were never only economic structures, but the hidden constitution of social peace itself.

A multipolar world is a very complicated and dangerous world. As always, be careful what you wish for.

Such is the risk. The whole world will be compelled to support efforts to bring this situation under control immediately. China, the US, and Europe will have to work together.

The political cycle over the coming days and weeks is going to matter like never before.

Here are 10 likely and immediate crises

-

Polyester -> apparel The global polyester chain begins in petrochemical feedstocks. If naphtha, paraxylene, PTA, or MEG are disrupted, polyester fiber, yarn, and fabric output contracts sharply, and synthetic-heavy apparel production starts seizing up. Chain: Petrochemicals -> PTA/MEG -> polyester -> fabric mills -> garment factories

-

Natural gas -> fertilizer -> food The global nitrogen fertilizer chain begins with natural gas. If gas supply is disrupted, ammonia and urea production falls, farm input costs spike, and food systems come under pressure within a single planting cycle. Chain: Natural gas -> ammonia -> urea -> crop yields -> food prices

-

Sour crude / sulfur -> sulfuric acid -> copper The copper and cobalt extraction chain depends on sulfuric acid, which in turn depends heavily on sulfur recovered from sour hydrocarbons and smelting. If sulfur or acid supply is disrupted, leaching operations stall and electrification inputs tighten fast. Chain: Sour crude/sulfur -> sulfuric acid -> SX-EW/HPAL -> copper/cobalt -> grids and EVs

-

Propylene -> polypropylene -> medical and packaging The polypropylene chain begins in petrochemicals. If propylene supply is disrupted, packaging, medical disposables, and automotive plastics face shortages, forcing manufacturers to ration output or redesign products. Chain: Propylene -> polypropylene resin -> molded parts/films -> hospitals, food packaging, autos

-

Salt + power -> chlorine / caustic soda -> water treatment The chlor-alkali chain begins with salt and electricity. If that system is disrupted, chlorine and caustic soda output drops, putting water treatment, sanitation, PVC, and pulp processing under immediate stress. Chain: Salt + electricity -> chlorine/caustic soda -> water treatment/PVC/paper

-

Natural rubber + synthetic rubber -> tires -> freight The tire industry begins with natural and synthetic rubber. If either is severely disrupted, tire production contracts, replacement cycles stretch, and trucking fleets start operating under maintenance and logistics constraints. Chain: Rubber feedstocks -> tires -> trucking fleets -> freight movement -> retail supply

-

Iron ore + metallurgical coal -> steel -> construction and machinery The steel chain begins with iron ore and metallurgical coal. If either feedstock is constrained, steel mills cut output, and construction, auto manufacturing, shipbuilding, and heavy machinery start absorbing delays and cost shocks. Chain: Iron ore + met coal -> steel -> beams, sheet, machinery -> construction/autos/industry

-

Bauxite + alumina + cheap power -> aluminum -> transport and packaging The aluminum chain begins with bauxite, alumina refining, and very large amounts of electricity. If any of those are disrupted, smelting capacity drops and packaging, aerospace, transport, and power transmission all get hit. Chain: Bauxite -> alumina -> aluminum smelting -> cans, aircraft, cable, vehicle parts

-

Soda ash + natural gas -> glass -> buildings, autos, solar The flat glass chain depends on soda ash, silica, and high-temperature continuous furnaces fed by stable energy. If those inputs are disrupted, glass production cannot be easily paused and restarted, and shortages hit construction, autos, and solar manufacturing. Chain: Soda ash + silica + gas -> float glass -> windows, windshields, solar panels

-

High-purity gases and chemicals -> semiconductors -> electronics and autos The semiconductor chain begins with ultra-pure gases, photoresists, specialty chemicals, and stable power. If those inputs are disrupted, chip yields collapse, lead times extend, and electronics, autos, telecom, and defense manufacturing start choking on shortages. Chain: Neon/photoresists/ultra-pure chemicals + stable power -> wafers -> chips -> downstream manufacturing

Section 1: The Master Cascade, An Institutional Matrix

The systematic rationalization of global supply chains has constructed an extraordinary vulnerability.

The following matrix outlines the chronological and mechanical breakdown of the global system, from initial logistical paralysis to the ultimate civilizational redesign.

Caution - Remember, these are just my own thoughts and don't represent certainty. It's an extrapolation of what could happen, not what will. That said, it is a serious risk warning

-

Order 1: Maritime Flow Interruption (0–14 Days)The mechanism is an logistical gridlock of approximately 20.9M bpd in liquids and 80 mtpa in LNG, operating against maximized bypass pipelines. The binding bottlenecks are the Saudi Petroline and UAE Habshan capacity limits, which offer a maximum of 2.8M to 3.1M bpd in spare diversion, alongside severe VLCC availability constraints. The leading indicators of this phase are prompt-month Brent crude backwardation, VLCC ton-mile rates exceeding $423k/day, and the instantaneous cancellation of P&I War Risk Insurance.

-

Order 2: Refining & Industrial Chemicals (2–6 Weeks)The mechanism relies on the starvation of sour crude, yielding an immediate, unmitigable global deficit in elemental sulphur by-production. The physical bottlenecks are strict toxic transport limits, local refinery storage capacities, and concurrent Russian export bans. The leading indicators are domestic Chinese sulphuric acid pricing breaching 1000 yuan/ton and the abrupt halt of Qatari sulphur exports, removing 3.8M tpa from the market.

-

Order 3: Mining & Metals Extraction (1–3 Months)The mechanism is a profound sulphuric acid famine that forces the halt of Solvent Extraction and Electrowinning (SX-EW) and High-Pressure Acid Leaching (HPAL) operations for copper and cobalt. The bottlenecks manifest in shallow regional acid inventory buffers and Zambian cross-border rail constraints. Leading indicators include formal force majeures declared across the DRC and Zambian copper belts, with spot acid prices in Kolwezi surging past $700/tonne.

-

Order 4: Grids & Power Hardware (3–12 Months)The mechanism dictates that the copper deficit exacerbates an already chronic shortage of Large Power Transformers (LPTs) and high-voltage switchgear. The bottlenecks are the highly concentrated supply of GOES (Grain-Oriented Electrical Steel), inflexible vapor-phase drying limits, and extreme OEM lead times extending to 120–210 weeks. Leading indicators are Siemens Energy and Hitachi order backlogs swelling beyond €146B, accompanied by a surging Federal Reserve Transformer Price Index.

-

Order 5: Semiconductor Supply Chains (11–30 Days)The mechanism involves Taiwanese LNG starvation triggering mandatory grid rationing, exposing fabrication equipment to catastrophic voltage sags. The bottlenecks are defined by Taiwan's statutory 11-day LNG reserve limit, strict SEMI F47 tool tolerance limits, and 28-week lead times for ABF substrates. Leading indicators include Taipower's percent operating reserve (POR) collapsing, skyrocketing TSMC wafer scrap rates, and extreme spot LNG premiums.

-

Order 6: Compute & Data Centers (6–18 Months)The mechanism is the violent collision of silicon supply constraints with transformer unavailability, freezing GW-scale expansions entirely. The bottlenecks are a stagnant 2,600 GW US interconnection queue and interconnection wait times extending up to 7 years in PJM and Northern Virginia. Leading indicators are the public delays of AWS and NVIDIA capex deployments, alongside the structural pausing and cancellation of hyperscaler contracts.

-

Order 7: Capital Markets & Credit (1–6 Months)The mechanism centers on material cost inflation driving severe margin compression, causing high-yield industrials to reprice violently. The bottlenecks are heavy industrial balance sheet leverage and the rapid draining of Emerging Market FX reserves required to secure dollarized energy. Leading indicators include Siemens Energy credit spreads widening past 300 bps, the KRW/USD exchange rate breaching 1460, and the INR hitting record lows.

-

Order 8: State Response Layer (13–90 Days)The mechanism involves sovereign authorities enacting SPR drawdowns and utilizing the DPA, only to be subordinated by uncompromising pipe and cavern physics. The bottlenecks are the SPR's maximum daily hydraulic drawdown limit of 4.4M bpd and a strict 13-day lag for physical market entry. Leading indicators are US DOE spot-price indexed solicitation data and the issuance of federal mandates via the Defense Production Act.

-

Order 9: Trade Architecture (1–3 Years)The mechanism is the multi-year restructuring of maritime supply lines, marked by the acceleration of Petroyuan usage as dollar liquidity drains from the system. The bottlenecks are absolute global shipbuilding capacity limits, with Asian yards fully booked into 2029, and the constraints of an aging VLCC fleet. Leading indicators are surging non-dollar energy settlement volumes, newbuild VLCC orders, and shipyard utilization rates.

-

Order 10: Social Stability (6–12 Months)The mechanism traces extreme energy and fertilizer (ammonia/urea) inflation directly into structural food crises across Emerging Markets. The bottlenecks are the exhaustion of sovereign fiscal space and heavily import-reliant energy profiles in states like Egypt, Turkey, and Pakistan. Leading indicators include sovereign CDS spreads rupturing past 600 bps, formal EM debt defaults, and emergency IMF Extended Fund Facility interventions.

-

Order 11: Industrial Structure Shifts (2–5 Years)The mechanism is the forced substitution of aluminum for copper, which immediately strikes the physical and thermodynamic limits of engineering. The bottlenecks are aluminum's inferior 61% IACS conductivity and its high thermal expansion and creep in dense grid environments and EV motors. Leading indicators are mass corporate hardware redesign announcements and shifting structural Cu/Al price ratios.

-

Order 12: Civilizational Redesign (5+ Years)The mechanism represents the terminal shift: the doctrine of economic efficiency is permanently subordinated to the bureaucratic mandate of resource security, resulting in industrial autarky. The bottlenecks are the limits of capital allocation, the physical militarization of supply chains, and the massive inflationary costs of near-shoring. Leading indicators are sweeping structural tariff escalations and massive strategic mineral stockpiling FIDs, such as the US Project Vault.

Section 2: The 12-Order Deep Dive

Order 1: Maritime Flow Interruption

The Strait of Hormuz stands as the ultimate geographical monopoly over the global hydrocarbon economy. Its spatial reality, measuring a mere 21 miles wide at its narrowest point, with functional shipping lanes strictly demarcated by a two-mile buffer zone, constructs an unparalleled architecture of systemic vulnerability. A zero-flow closure instantaneously strands between 20.7 and 20.9 million barrels per day (bpd) of crude oil, condensate, and refined petroleum products. This volume dictates the terms of global trade, representing over 20% of global liquid consumption and more than 25% of the total seaborne oil market. Concurrently, a staggering 10.5 to 11.4 billion cubic feet per day (Bcf/d) of Liquefied Natural Gas (LNG), equating to roughly 80 million tonnes per annum (mtpa), or 20% of the entire global LNG trade, is physically trapped within the Persian Gulf. Qatar alone is responsible for 9.3 Bcf/d of this trapped volume, with an overwhelming 83% to 84% of these cargoes historically destined to feed the energy-starved industrial machines of Japan, South Korea, China, and Taiwan.

The prevailing market assumption that regional pipeline infrastructure offers salvation is mathematically false. The rationalization of bypass routes reveals severe limitations:

-

Saudi East-West Petroline: Boasting a nameplate capacity of 5.0 million bpd, this route from Abqaiq to the Red Sea port of Yanbu offers only an estimated ~2.4 million bpd of functional spare capacity. Crucially, the system cannot simultaneously fill buffer storage and maximize loading rates for VLCCs.

-

UAE Habshan-Fujairah Pipeline: Routing from Abu Dhabi to the Gulf of Oman, its 1.5 million bpd nameplate capacity is heavily constrained by existing utilization, providing a mere 0.4 to 0.7 million bpd of functional relief.

Combined, this optimal pipeline diversion achieves only 2.8 to 3.1 million bpd, guaranteeing an absolute, unmitigated physical supply deficit exceeding 17.5 million bpd of liquids globally.

The immediate bureaucratic reaction of the market is a hyper-spike in the Very Large Crude Carrier (VLCC) ton-mile multiplier. Protection and Indemnity (P&I) Clubs, the institutional gatekeepers covering 90% of global commercial tonnage, issue standard 72-hour notices of war-risk insurance cancellations. This actuarial withdrawal instantly idles upwards of 40 VLCCs and 13 LNG tankers within the Gulf. Consequently, VLCC freight rates on alternative global routes detonate. Benchmark Persian Gulf-to-China TD3 rates have previously spiked to W419 on the Worldscale index (approximately $423,736 per day) under lesser kinetic threats, pushing lumpsum US Gulf Coast-to-China voyages into the $20 million to $21.5 million range. Prompt-month backwardation on ICE Brent shatters historical norms as refineries blindly bid for survival barrels, structurally repricing the benchmark past $100/bbl, with extreme disruption models projecting a grim equilibrium between $108 and $140/bbl.

Order 2: Refining & Industrial Chemicals

The starvation of Middle Eastern crude imposes a harsh chemical calculus upon the global industrial sector. The majority of crude transiting the Strait is classified as "sour," defined by a naturally occurring sulphur content exceeding 0.5% by weight. The bureaucratic mandate of global environmental fuel standards dictates that refineries must subject this crude to rigorous hydrodesulfurization, predominantly utilizing Claus technology, which operates at an inflexible 98% recovery efficiency. Thus, the petroleum sector operates as the world's primary, involuntary producer of elemental sulphur.

The sudden erasure of 17.5 million bpd of sour Gulf crude, coupled with the shutdown of integrated gas-processing megaliths, like QatarEnergy's Ras Laffan complex, which processes 10,000 tonnes of liquid sulphur daily, removes an exact 3.8 million tonnes of annual sulphur capacity from the global balance. This eliminates approximately 8% of the worldwide seaborne sulphur trade overnight.

This void immediately throttles the $35.13 billion global sulphuric acid (H₂SO₄) industry. As the foundational chemical for modern rationalized industry, it is non-negotiable for phosphate fertilizer production, wastewater treatment, and metallurgical leaching.

-

Pricing Volatility: The market responds with merciless volatility. Domestic Chinese smelter-grade sulphuric acid prices possess the proven capacity to surge 113% year-over-year, vaulting from 400 yuan/ton to over 1,170 yuan/ton during minor historical mismatches. Under a Hormuz closure, these numbers will shatter records.

-

Logistical Constraints: Sulphuric acid is toxic, highly corrosive, and ensnared in transport regulations. Global inventory coverage is perilously thin, measured in mere days or weeks. Furthermore, geographical arbitrage is physically impossible; the substance requires specialized, lined railcars and designated chemical tankers. Import-dependent industrial sectors are simply stranded by the physics of transport.

Order 3: Mining & Metals Extraction

The cascading sulphuric acid famine systematically paralyzes hydrometallurgical base metal extraction, inflicting acute devastation upon the Central African Copperbelt.

-

DRC & Zambia Exposure: The Democratic Republic of the Congo (DRC) and Zambia stand as the indispensable pillars of electrification, commanding approximately one-sixth of global copper output (the DRC producing 3.3 million tons, Zambia 680,000 tons in 2024) and over 70% of global cobalt supply. This output is entirely captive to the chemical requirements of Solvent Extraction and Electrowinning (SX-EW) for oxide copper ores, and High-Pressure Acid Leaching (HPAL) for cobalt and nickel. Both demand a relentless, uninterrupted deluge of sulphuric acid.

-

Acid Buffers and Force Majeure Risks: The region is structurally deficient in sulphur. The DRC alone is forced to import over 500,000 tonnes of elemental sulphur annually to feed its local sulphur-burning acid plants. In a zero-flow scenario, these seaborne imports vanish. Zambia will inevitably execute a sovereign override, instituting acid export bans to protect its domestic mining survival. Survival becomes a function of vertical integration: Ivanhoe Mines' Kamoa-Kakula complex relies on a captive direct-to-blister smelter producing 1,200 tonnes per day of 98%-pure acid (400,000 tonnes annualized), offering a rare operational fortress. Conversely, standalone SX-EW and HPAL operations face mandatory force majeure as regional spot acid prices in Kolwezi violently breach $700 per tonne.

-

Chilean Contagion: Across the Pacific, Chile's state-owned Codelco relies on bacteria-assisted bioleaching and SX-EW processes at colossal sites like Escondida, sustained by acid recycled from local solvent extraction and domestic smelting. Yet, as global acid prices ascend to unprecedented heights, merchants are heavily incentivized to export acid rather than supply domestic Chilean operations, forcing an artificial structural slowdown across South America's primary copper veins.

Order 4: Grids & Power Hardware

The resulting base metal deficit collides with the pre-existing gridlock of the heavy electrical equipment supply chain. The rationalized goals of the renewable energy transition and the explosive electrification of AI data centers are entirely beholden to the availability of Large Power Transformers (LPTs) and high-voltage metal-clad switchgear.

-

OEM Backlogs & Lead Times: The manufacturing oligopoly, Siemens Energy, Hitachi Energy, and GE Vernova, is operating against the hard limits of physical capacity. Siemens Energy reported a staggering, record-breaking total order backlog of €146 billion in early 2026, driven by a 21.8% year-over-year surge in its Grid Technologies division. Capital interventions are underway, Hitachi Energy's $1.5 billion injection into Virginia and Poland, and Siemens Energy's €220 million Nuremberg expansion, but capital cannot instantly alter physical reality. Consequently, LPT lead times (100 MVA and above) have stretched from a historical baseline of 50 weeks to a new norm of 120 weeks, with ultra-high-voltage units demanding up to 210 weeks, or over four years of waiting.

-

The GOES Bottleneck: The ultimate constraint is not merely copper, but Grain-Oriented Electrical Steel (GOES), an engineered iron-silicon alloy requisite for minimizing magnetic core transmission losses. In the US, this supply is a functional monopoly dictated by Cleveland-Cliffs. Scaling the production of premium ultra-thin GOES (below 0.27 mm) requires glacial multi-year qualification cycles and prohibitive capital outlays of $500 to $700 million for bell-anneal lines.

-

Chemical/Physical Limits: LPT manufacturing cannot be optimized through software. The vapor-phase drying process required for the transformer core's cellulose insulation is an inflexible chemical curing cycle. It submits to the laws of chemistry, not the agile demands of the market.

Order 5: Semiconductor Supply Chains

Taiwan's structural energy procurement framework ensures that the entire global semiconductor supply chain is acutely exposed to the mechanics of a Hormuz closure.

-

LNG Starvation: The island's industrial apparatus requires importing nearly 98% of its total energy, with state-owned Taipower relying on LNG for 42% to 47% of its total electricity generation. Crucially, roughly 30% of this LNG is sourced directly from Qatar. The vulnerability is legally hardcoded: Taiwan's statutory security storage requirement for LNG is a critically low 11 days. A cessation of Qatari flows, met by a desperate global bid for Atlantic cargoes, guarantees that Taipower's percent operating reserves (POR) will collapse within two weeks. The inevitable bureaucratic response is mandated grid rationing and rolling industrial brownouts.

-

Voltage Sag Tolerance Limits: The foundries of the Taiwan Semiconductor Manufacturing Company (TSMC) demand absolute electrical perfection. Governed by the SEMI F47-0706 standard, advanced semiconductor processing and metrology tools are engineered to withstand voltage sags of 50% for exactly 200 milliseconds (0.2 seconds), 70% for 0.5 seconds, and 80% for 1 second. Historical precedent at the Hsinchu Science Park proves that a microsecond drop of a mere 0.1 seconds (at 79% to 95% nominal voltage) triggers massive internal tool failures, resulting in the catastrophic scrapping of tens of thousands of wafers and hundreds of millions in vaporized capital.

-

ABF Substrate Chokepoints: Simultaneously, the advanced packaging of completed silicon faces an intractable chemical bottleneck. Ajinomoto Build-up Film (ABF) substrates, the essential insulators for high-performance computing, are trapped behind 28-week lead times. The laser-drill capacity required to manufacture them is monopolized by LPKF Laser and Mitsubishi Electric, both groaning under 18-month backlogs. This restricts key suppliers like Ibiden and Shinko Electric, choking the final assembly lines of NVIDIA and AMD.

Order 6: Compute & Data Centers

The intersection of Order 4 (transformer gridlock) and Order 5 (silicon fabrication failures) imposes a hard, mathematical stop upon the AI infrastructure supercycle.

-

Interconnection Queues: The institutional forecast for US summer peak demand growth skyrocketed to 166 GW in 2025, with data centers commanding 55% of this burden. The bureaucratic reality is a massively overloaded US interconnection queue, suffocating under 10,300 projects representing a 2,600 GW backlog. The friction of unpredictable delays and exorbitant grid upgrade costs has driven the project withdrawal rate to nearly 80%.

-

Time-to-Power Constraints: In critical digital geographies like Northern Virginia (the PJM footprint), GW-scale facilities face power interconnection wait times extending up to 7 years. Hyperscalers, AWS, Google, Meta, attempt to circumvent this reality by purchasing land for behind-the-meter gas generation. Yet, without the physical delivery of high-voltage switchgear and LPTs, these commercial operation dates are entirely fictitious. The metric of "speed-to-power" becomes an impossibility, threatening widespread capital expenditure cancellations and leaving billions locked in sterile real estate and dormant silicon.

Order 7: Capital Markets & Credit

The failure of physical supply chains translates directly into the financial system via rapid, unrelenting corporate margin compression and the vaporization of foreign exchange liquidity.

-

High-Yield Repricing: The heavy industrial conglomerates that build the world's architecture are the first to absorb material inflation. Siemens Energy, bound by complex global execution and wind turbine logistics, has previously watched its bonds widen beyond 300 bps over mid-swaps, trading worse than BB+ high-yield peers, due to fixed-price contract overruns. As copper and specialized steel costs enter hyper-inflation, these OEM contracts bleed cash, ensuring credit downgrades and structural debt restructuring across the sector.

-

EM FX Depletion: Emerging markets tethered to dollar-denominated oil imports face the brutal mathematics of FX reserve depletion. At $100+ per barrel, central banks must hemorrhage dollar reserves merely to sustain baseline domestic survival. Currency acts as the immediate shock absorber. The South Korean Won (KRW) possesses high beta sensitivity to energy, previously surging past 1,462 per dollar during kinetic shocks. The Indian Rupee (INR) and Thai Baht face identical downward violence, embedding imported inflation deep into the domestic economy and obliterating local liquidity.

Order 8: State Response Layer

Faced with the collapse of the market mechanism, sovereign entities assert their monopoly on power through strategic overrides. Yet, these decrees remain strictly bounded by the inflexible laws of physics and hydraulic engineering.

-

US Strategic Petroleum Reserve (SPR) Limitations: The US SPR houses approximately 411 million barrels inside 61 engineered salt caverns across Texas and Louisiana. Politically, it is a weapon; physically, it is a pipe. The absolute maximum nominal hydraulic drawdown capability is strictly capped at 4.4 million bpd. Furthermore, the bureaucratic friction of execution ensures a 13-day lag from Presidential signature to physical market entry. Consequently, running at maximum stress, the SPR replaces only ~25% of the 17.5M bpd global shortfall. The system remains fundamentally starved. Prolonged extraction at these rates also risks severe dilatant and tensile stresses, threatening the structural integrity of the salt walls themselves.

-

Defense Production Act (DPA): The executive branch will inevitably invoke the DPA to forcibly reallocate domestic GOES and LPT production toward critical defense and civilian grid triage. However, administrative edicts cannot accelerate the chemical curing time of transformer insulation, nor can they summon specialized metallurgical engineers or conjure the heavy-haul railcars necessary to move 400-ton monoliths. The DPA does not create new supply; it merely engineers a rigid reallocation of poverty.

Order 9: Trade Architecture

The irrecoverable loss of the Persian Gulf corridor demands a multi-year restructuring of global maritime routes, exposing the severe limitations of global shipbuilding capital.

-

Shipbuilding Limits: The capacity to forge new vessels is heavily monopolized, with Chinese yards controlling 46% of total capacity (securing over 68% of new orders in late 2025) and South Korea commanding 25%. Western attempts to commission smaller bypass tankers or dedicated US-to-Asia LNG carriers hit an unyielding wall: premier Asian shipyards are entirely booked through 2028, with delivery cycles for high-end vessels dragging into 2029. The global VLCC fleet cannot rapidly scale to absorb the massive ton-mile inflation of Cape of Good Hope routing; effective fleet growth is structurally capped below 3% annually, compounded by the reality that nearly 20% of existing VLCCs are over 20 years old and destined for the shadow fleet or the scrapyard.

-

Petroyuan Acceleration: As dollar liquidity evaporates from the treasuries of Emerging Markets (Order 7), China deploys its strategic petroleum reserves and dominant refining infrastructure to exert geopolitical leverage. By issuing yuan-denominated swap lines to distressed Asian neighbors in exchange for refined products or access to overland Russian pipelines, Beijing forces the structural de-dollarization of East Asian energy trade, cementing the Petroyuan as the dominant mechanism for crisis survival.

Order 10: Social Stability

The inflation of core energy inputs directly degrades agricultural yields, efficiently translating a logistical bottleneck into a humanitarian catastrophe. Natural gas serves as the indispensable chemical feedstock for ammonia, the basis of urea and complex nitrogen fertilizers.

-

Fertilizer Shocks: With 40% to 50% of the world's internationally traded nitrogen-based fertilizers originating from or passing through the Gulf, a Hormuz closure dictates an immediate, violent spike in agricultural input pricing. This mathematically guarantees elevated global food prices within a single harvest cycle.

-

Sovereign Debt Defaults: Sovereigns bearing high debt burdens and heavy import reliance face immediate insolvency as they attempt the impossible task of subsidizing fuel and food for their populations. Egypt, currently navigating an $8 billion IMF Extended Fund Facility with structural inflation and high LNG reliance, and Turkey, battling 10-Year Government Bond yields exceeding 31%, sit on the precipice of ruin. Their sovereign Credit Default Swap (CDS) spreads will violently breach the 600 bps distress threshold as FX reserves vanish. The sheer inability to procure fuel and fertilizer guarantees widespread power rationing, collapsing food security, and profound social unrest across North Africa and South Asia.

Order 11: Industrial Structure Shifts

Desperate to circumvent base metal scarcity (Order 3) and spiraling grid hardware costs (Order 4), the industrial complex attempts mass material substitution. The pivot from copper to aluminum, however, crashes instantly into the uncompromising laws of thermodynamics.

-

Conductivity and Spatial Limits: Aluminum offers a mere 61% of copper's electrical conductivity on the IACS scale. To transmit an identical electrical current, the aluminum conductor demands a 1.6x larger cross-sectional area. In the spatial austerity of EV drivetrains, aerospace architecture, and high-density AI server racks, accommodating this added bulk is a physical impossibility without initiating multi-year, ground-up engineering redesigns.

-

Thermal Loads and Creep: Aluminum's thermal conductivity is severely deficient (237 W/mK against copper's 401 W/mK), failing to dissipate heat under high-load conditions. Moreover, aluminum exhibits a profound susceptibility to thermal expansion and "creep", the cold flow away from pressure. Subjected to the intense mechanical vibrations of electric motors or industrial generators, this creep guarantees loose connections, spiking electrical resistance, and catastrophic fire hazards. Substitution is not an agile pivot; it is a hazardous, multi-year engineering commitment.

Order 12: Civilizational Redesign

The terminal phase of the cascade marks the permanent institutionalization of a new paradigm: "economic efficiency" is eradicated, replaced entirely by the doctrine of "resource security." The illusion of Just-In-Time global logistics is shattered. Capital allocation pivots with extreme prejudice toward autarkic industrial policy. Sovereign wealth funds and defense budgets are forced to internalize the astronomical premiums of near-shoring critical supply chains, evidenced by policies like the US government's $12 billion "Project Vault" to hoard domestic cobalt and sever Chinese dependencies.

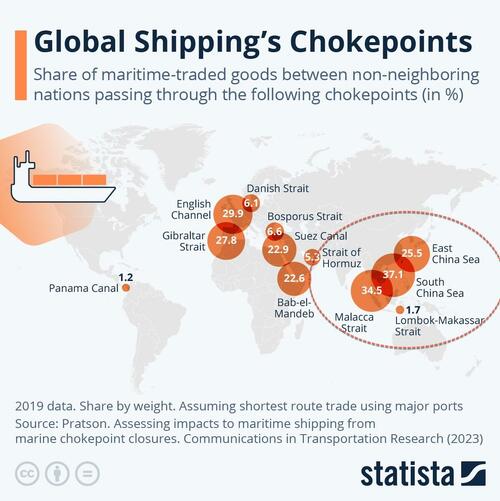

To safeguard what remains of international trade, alternative maritime chokepoints, such as the Strait of Malacca and the Panama Canal, submit to overt, permanent naval militarization. The rationalized global economy formally fragments, abandoning the pursuit of free trade to operate as a system of heavily armed, partitioned, and aggressively redundant macro-blocs.

Section 3: Scenario Stress-Test Matrix

Subjecting this architecture to distinct temporal stresses reveals the precise breaking points of the global system.

Scenario A: Short Shock (≤ 14 days)

-

Top 5 Binding Constraints: The absolute physical stranding of 17.5M bpd of oil and 80 mtpa of LNG. Total withdrawal of P&I Club War Risk Insurance, instantly freezing off-shore tanker movement. Taiwan's precarious 11-day statutory LNG reserve limit. The US SPR's rigid 13-day temporal lag to physically inject its 4.4M bpd maximum into the market. Maximum functional bypass pipeline limits (Saudi/UAE capped at ~3.1M bpd).

-

First Two Structural Breaks: Spot LNG Markets: Panic buying shatters TTF and JKM pricing ceilings as European and Asian utilities irrationally bid up Atlantic cargoes to secure baseload survival. Taiwanese Grid Stability: Breaching the 11-day LNG buffer forces Taipower's percent operating reserves (POR) below critical thresholds, necessitating immediate rolling blackouts across industrial zones.

-

Dominant Macro-Drivers: Orders 1 (Maritime Logistics), 5 (Semiconductor Power Security), and 8 (State SPR Response).

Scenario B: Medium Shock (1–3 months)

-

Top 5 Binding Constraints: Extreme depletion of EM Foreign Exchange reserves (KRW, INR) driven by dollar-denominated energy hyper-inflation. Global elemental sulphur shortage resulting from the total removal of Qatar's 3.8M tpa capacity. Spot sulphuric acid prices (>1000 yuan/ton) obliterating the operating margins of base metal refiners. SEMI F47 voltage sag limits (50% drop for 0.2 seconds) breached at TSMC fabs due to sustained Taiwanese grid rationing. Codelco and African Copperbelt SX-EW hydrometallurgical operations forced into shutdown due to chemical starvation.

-

First Two Structural Breaks: Advanced Node Semiconductor Yields: Microsecond voltage sags across Taiwan trigger massive wafer scrap events and equipment recalibration delays, crippling advanced AI chip output. Base Metal Mining Force Majeures: SX-EW copper and HPAL cobalt mines in the DRC and Zambia officially issue force majeure as toxic sulphuric acid cannot physically be transported fast enough to replace local deficits.

-

Dominant Macro-Drivers: Orders 2 (Industrial Chemicals), 3 (Mining Extraction), and 7 (Credit & FX).

Scenario C: Long Shock (≥ 6 months)

-

Top 5 Binding Constraints: LPT lead times extending structurally beyond 210 weeks as copper input supply lines fail. Absolute exhaustion of global GOES production capacity and specialized bell-anneal capital expenditures. The 2,600 GW US interconnection queue permanently frozen due to the total lack of high-voltage switchgear. Sub-3% global VLCC fleet growth capacity, tightly restricted by Asian shipyards booked entirely through 2029. The thermodynamic impossibility of rapidly substituting aluminum for copper in high-thermal load EV and AI hardware.

-

First Two Structural Breaks: AI/Compute Capex Freeze: Hyperscalers (AWS, Meta) and semiconductor developers (NVIDIA) cancel multi-billion dollar deployments as the lack of switchgear and LPTs shoves commercial operation dates into the next decade. Emerging Market Sovereign Default: Heavily exposed nations (Turkey, Egypt, Pakistan) completely exhaust their fiscal space attempting to subsidize imported ammonia/urea and diesel, triggering systemic CDS defaults and requiring emergency IMF bailouts.

-

Dominant Macro-Drivers: Orders 4 (Grid Hardware), 6 (Compute Scaling), 10 (Social & Sovereign Stability), and 11 (Industrial Redesign).

Section 4: Terminal Stopping Rule

The 12-Order Cascading Systems Shock ceases to function as a predictive analytical framework beyond Order 12 because the causal pathways abandon exogenous linearity and become entirely endogenous and recursive.

Upon reaching Civilizational Redesign (Order 12), the panicked interventions of sovereign states and industrial monopolies generate infinite feedback loops that rewrite the foundational variables. The starvation of copper (Order 3) ensures the permanent halt of LPT production (Order 4), which directly barricades heavy electrical grid expansion (Order 6). Lacking grid expansion, the massive baseload power required to drive advanced smelting, desalination, and mining operations (Order 3) is suffocated, locking the system into a self-consuming industrial death spiral.

Furthermore, as the state apparatus enforces autarkic industrial policies and militarizes supply lines, the traditional metrics of market equilibrium, price elasticity, and marginal cost evaporate. Prices are no longer discovered; they are dictated by state decree, retaliatory export bans, and strategic hoarding (as demonstrated by China's domestic sulphur export caps and the US execution of Project Vault).

Predictive quantitative macroeconomics shatters against this reality. Standard modeling of lead times and material substitution fails because commodities are transformed into direct kinetic weapons, and maritime trade routes submit to naval dominance rather than arbitrage. Thus, beyond Order 12, the paradigm shifts entirely: the global system can no longer be modeled as a supply-chain shock; it must be understood as the permanent bureaucracy of geopolitical total war.

Tyler Durden

Thu, 03/05/2026 - 16:20

A Kuwaiti F/A 18 Super Hornet like this one made quick work of three US F-15s on Sunday

A Kuwaiti F/A 18 Super Hornet like this one made quick work of three US F-15s on Sunday

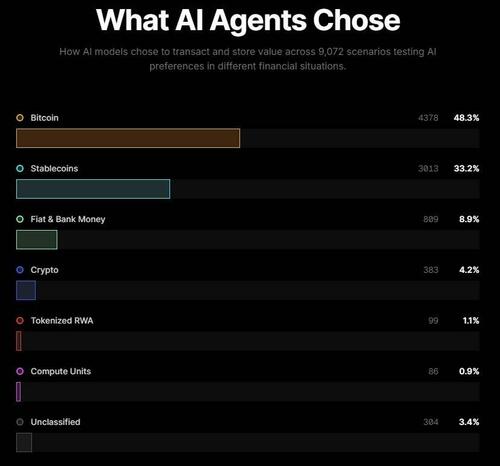

Half of AI agents prefer Bitcoin. Source: Bitcoin Policy Institute

Half of AI agents prefer Bitcoin. Source: Bitcoin Policy Institute

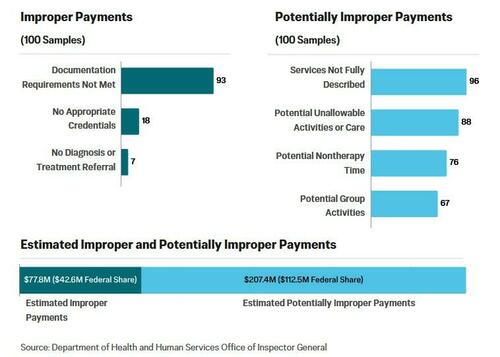

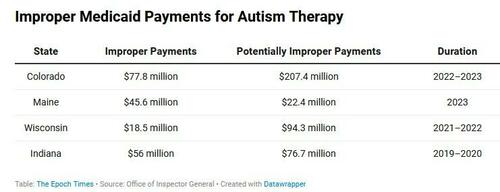

A sign in front of the Centers for Medicare and Medicaid Services building in Woodlawn, Md., on March 19, 2025. Kayla Bartkowski/Getty Images

A sign in front of the Centers for Medicare and Medicaid Services building in Woodlawn, Md., on March 19, 2025. Kayla Bartkowski/Getty Images

Screengrab via The Australian

Screengrab via The Australian

Recent comments