What A Taiwan Invasion Would Cost China

Authored by Antonio Graceffo via The Epoch Times (emphasis ours),

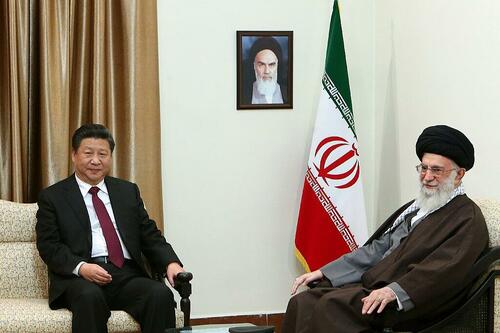

Shortly after meeting with Chinese Communist Party (CCP) leader Xi Jinping in late October, President Donald Trump said China would never attack Taiwan while he is president because Chinese officials “know the consequences.” While support from the United States is welcome news for Taiwan, Trump’s words raise a real question: Does Xi actually know the cost of invading Taiwan?

A U.S.-made F-16V fighter jet taxis on the runway at an airforce base during the annual Han Kuang military drills in Hualien, Taiwan, on July 23, 2024. Sam Yeh/AFP via Getty Images

A U.S.-made F-16V fighter jet taxis on the runway at an airforce base during the annual Han Kuang military drills in Hualien, Taiwan, on July 23, 2024. Sam Yeh/AFP via Getty Images

Much of the analysis of a potential Beijing attempt to seize Taiwan by force has centered on the Chinese military’s capabilities and Taiwan’s defenses, especially if supported by the United States. Many assessments conclude that the People’s Liberation Army (PLA) is not currently capable of defeating the U.S. military in a direct conflict.

However, analysts still warn of a worst-case scenario in which Xi, seeking to cement his legacy, launches a premature strike. Xi has tied his legitimacy to the “China Dream” of national rejuvenation by 2049 and has framed unifying Taiwan with the mainland as essential to achieving that goal.

The recent wave of purges, particularly of senior leaders such as former Central Military Commission (CMC) Vice Chairman General Zhang Youxia, has intensified speculation. With most of the commission allegedly removed and the CMC now effectively consisting of Xi and loyalist Vice Chairman Zhang Shengmin, some analysts argue that Xi has eliminated voices that could have dissuaded him from attacking Taiwan. Even if that was not his intent, the practical result may be similar. With little meaningful pushback inside the system, Xi could face fewer internal constraints if he chooses to act.

The German Marshall Fund and the Rhodium Group recently published “If China Attacks Taiwan,” a report examining the potential costs to Beijing of a prolonged war. The authors note they were not asked to adopt Xi’s personal perspective and acknowledge that Chinese authorities could misjudge the likely consequences.

Even when costs are high, national leaders sometimes proceed if perceived benefits or political pressures outweigh the risks. Xi could conclude that failing to act—particularly if he believes Taipei is moving toward permanent separation with U.S. backing—would damage his authority more than launching a risky military operation.

The study examines how a conflict would affect China’s economy, military capabilities, social stability, and international position. It warns that war could produce massive economic disruption, catastrophic military losses, serious social unrest, and severe sanctions. This brings the analysis back to three critical questions: What would the price of a Taiwan invasion be? Is Xi fully aware of that price? And does he care? The latter two only Xi can answer, but the first is measurable, and the potential impact on the CCP would be staggering.

In the report’s major war scenario, an invasion lasts several months and draws in the United States and its allies. The conflict begins with an amphibious assault and missile strikes on Taiwan as well as on U.S. forces in Japan and Guam. Although Chinese forces land on Taiwan, sustained Taiwanese and U.S. strikes disrupt resupply across the Taiwan Strait. After months of heavy fighting, the PLA withdraws to the mainland, having lost roughly 100,000 personnel. Taiwan suffers approximately 50,000 military and 50,000 civilian casualties. The United States loses 5,000 military personnel and 1,000 civilians, Japan loses 1,000 military personnel and 500 civilians, and the PLA retains control only of Kinmen and Matsu.

An aerial view of vehicles awaiting their export at a port in Nanjing, eastern Jiangsu Province, China, on Dec. 9, 2025. AFP via Getty Images

An aerial view of vehicles awaiting their export at a port in Nanjing, eastern Jiangsu Province, China, on Dec. 9, 2025. AFP via Getty Images

The report argues that a failed Chinese attack would impose severe economic, military, social, and international costs, and that it would be a mistake to assume Beijing would necessarily prevail. Even a limited military engagement could result in trillions of dollars in losses.

A 2022 Rhodium study estimated economic damage of at least $2 trillion to $3 trillion under conservative assumptions, while Bloomberg analysts projected costs closer to $10 trillion. In a prolonged war ending with Chinese withdrawal, the economic impact would extend beyond market disruption to systemic breakdown.

China is uniquely exposed because roughly 20 percent of its GDP and about 13 percent of its employment depend on exports, double the U.S. share. A major conflict would likely trigger a near-total embargo by G7 nations. After years of doubling down on high-tech manufacturing such as electric vehicles, semiconductors, and green technology instead of strengthening domestic consumption, China would have few alternative markets for its surplus output. Without export demand, large portions of its industrial base would idle, leading to a contraction in GDP potentially worse than during the COVID-19 pandemic period.

[ZH: And where, pray-tell, does the west get all of the 'shit' made during this embargo?]

Financial decoupling would compound the shock. The report anticipates the freezing of China’s roughly $3.39 trillion in foreign exchange reserves and places its $3.6 trillion in foreign direct investment at risk. Even if Beijing achieved military objectives, the global financial system could treat China as permanently uninvestable, effectively ending its role as a global financial hub. Hong Kong would likely lose its status as the primary gateway for international capital into the mainland.

Energy and food security add further strain. A months-long war could allow the United States and its allies to impose a distant blockade, cutting off 70 percent to 90 percent of the oil and roughly 40 percent of the natural gas that China imports by sea. Severe energy and food rationing could follow, increasing the risk of domestic unrest. With domestic demand already weakening, sanctions or a blockade would strike at one of China’s remaining growth engines.

The CCP’s legitimacy depends heavily on economic stability. A failed war that produces mass unemployment, shortages, a financial crisis, and long-term technological isolation could fracture the global economy into rival blocs, leaving China isolated for decades. Although the PLA has grown stronger, its economic vulnerabilities mean that the cost of a failed invasion could pose an existential challenge to the CCP itself.

Views expressed in this article are opinions of the author and do not necessarily reflect the views of The Epoch Times or ZeroHedge.

Tyler Durden Sat, 02/28/2026 - 23:40

Michelle Bowman, vice chair for supervision of the Federal Reserve Board, in Washington on July 22, 2025. Ken Cedeno/Reuters

Michelle Bowman, vice chair for supervision of the Federal Reserve Board, in Washington on July 22, 2025. Ken Cedeno/Reuters Homes for sale in Maryland on Nov. 12, 2023. Madalina Vasiliu/The Epoch Times

Homes for sale in Maryland on Nov. 12, 2023. Madalina Vasiliu/The Epoch Times

Video posted on pro-government Telegram accounts shows Iranians searching through a destroyed school in Minab, via Telegram

Video posted on pro-government Telegram accounts shows Iranians searching through a destroyed school in Minab, via Telegram

Lebanese media

Lebanese media

Recent comments