US Gasoline Demand Fell Further Amid Long-Term Structural Shift: Plunging Per-Capita Consumption

Authored by Wolf Richter via Wolf Street,

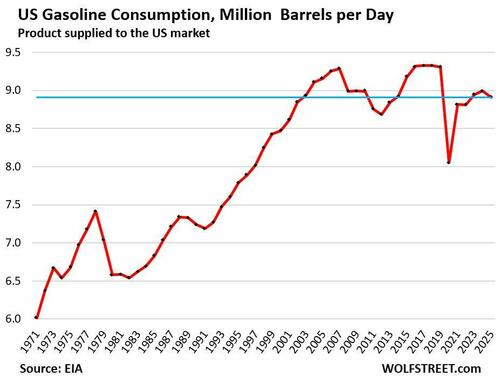

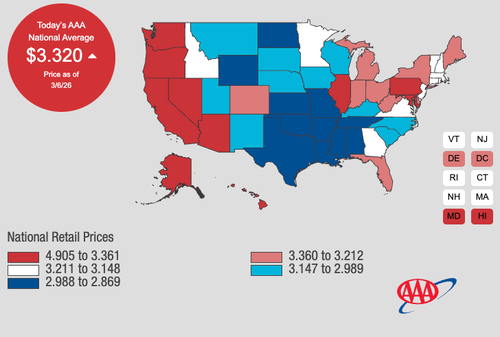

Gasoline consumption in the US, in terms of product supplied to gas stations, declined by about 1% in 2025, to 8.91 million barrels per day, according to EIA data, below where consumption had first been in 2003, even though the US population increased by 52 million people, or by 18%, over the same period.

Compared to the peak in 2018, gasoline consumption in 2025 fell by 4.5%. Compared to the prior peak in 2007, gasoline consumption is down 4.1%.

Gasoline consumption is increased by miles driven – which inched up to a record – and is slowed by the improving efficiency of gasoline-powered vehicles and the growing share of EVs.

The effects of the two Oil Shocks in the 1970s on gasoline consumption was dramatic. High gasoline prices and a recession led to fewer miles driven, but it also unleashed efforts by US automakers to make and sell smaller, more fuel-efficient vehicles. And the small fuel-efficient Japanese models became immensely popular. This wave of smaller and more fuel-efficient vehicles held down gasoline consumption, and it didn’t surpass its 1978 high until 1993, though the population grew by 18% over those 16 years.

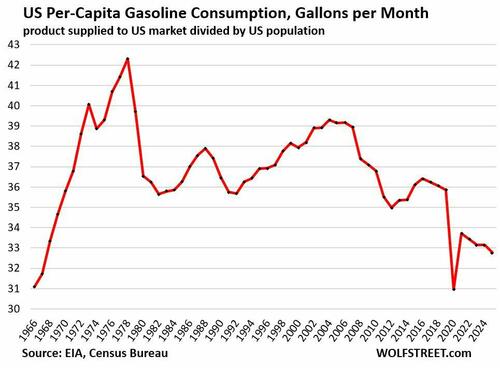

Per-capita gasoline consumption fell to 32.8 gallons per month in 2025, the lowest since 1967, except for the Covid year 2020, as a result of declining overall gasoline consumption amid a growing population.

This dynamic illustrates the structural decline in demand for gasoline.

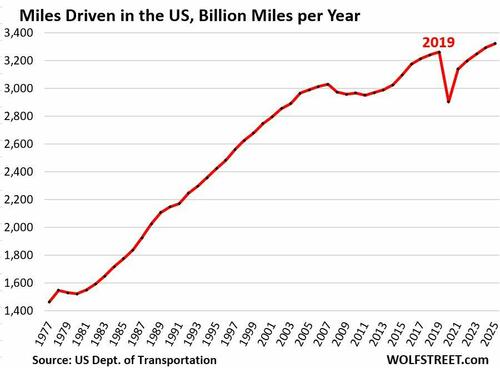

Miles driven edged up 0.9% in 2025, to a record of 3,324 billion miles, according to data from the Department of Transportation (includes miles driven by cars, light trucks, buses, motorcycles, delivery vans, and commercial trucks). But that’s only 9.7% higher than at the prior peak in 2007.

That gasoline consumption declines even as miles driven increases attests to the impact of more fuel-efficient ICE vehicles and more EVs in the vehicle mix.

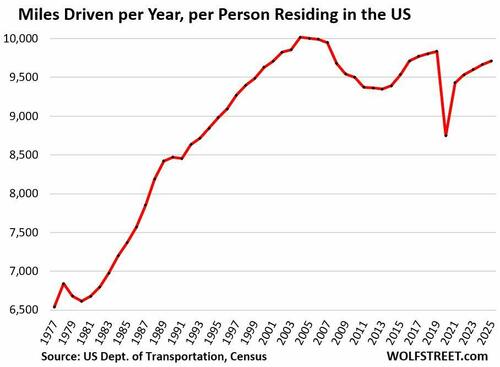

But people drive a little less: Miles driven per person residing in the US, at 9,710 miles in 2025, was 3.1% below the peak in 2004.

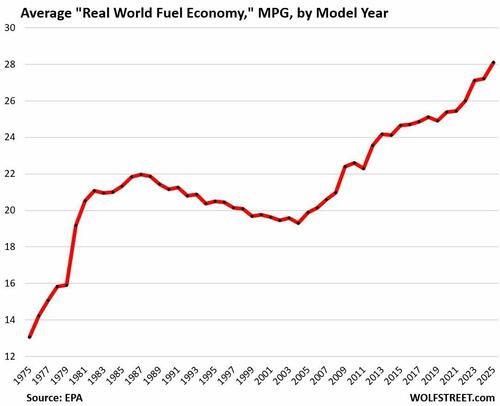

And average fuel economy keeps improving: that has been a big part of the long-term structural demand issue for gasoline.

Over the past 25 years, the average fuel economy of all passenger vehicles sold in the US rose by 43%, to a record of 28.1 “real world” MPG for the 2025 model year, according to preliminary data from the EPA last month.

Note the spike in average fuel economy coming out of the Oil Shocks, as compact Japanese vehicles made huge inroads, and as US automakers began offering smaller vehicles with better mileage.

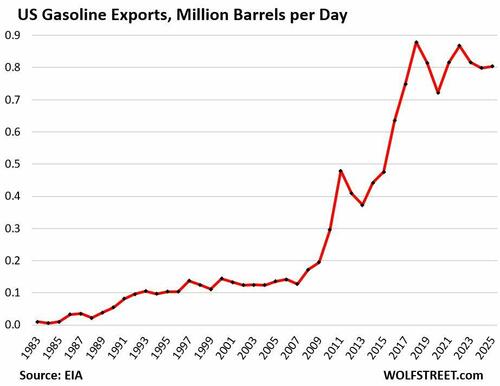

Exports of gasoline have become an outlet for refiners.Crude oil production in the US has surged by 172% since 2008, to a record 13.6 million barrels per day (MMb/d) in 2025, according to EIA data. Over the years, exports of crude oil and petroleum products (diesel, gasoline, jet fuel, petroleum coke, and many others) have soared, and imports have fallen. In 2020, the US became a net exporter of crude oil and petroleum products, exporting more than importing. In 2025, net exports of crude oil and petroleum products rose to a record 2.8 MMb/d (detailed analysis and charts here).

Gasoline exports have become a big profitable trade for US refiners, and an outlet to replace falling demand at home. Many refiners import crude oil and export value-added products, such as gasoline, including refineries in California which face steeply dropping gasoline demand amid the rapidly growing prevalence of EVs and hybrids in the state.

For example, the US had a trade surplus of 590,000 barrels per day in crude oil and petroleum products with Mexico in 2025, importing 500,000 barrels a day of crude oil and exporting 1.1 MMb/d in value-added petroleum products, largely diesel and gasoline.

Gasoline exports started soaring in 2008, surpassed 700,000 barrels per day for the first time in 2017, hit 879,000 barrels per day in 2018, and have stayed in that range since then. In 2025, gasoline exports edged up to 804,000 barrels per day.

Tyler Durden Fri, 03/06/2026 - 19:15

Smoke rises from a reported Iranian strike in the industrial district of Doha, Qatar, on March 1, 2026. Mahmud Hams/AFP via Getty Images

Smoke rises from a reported Iranian strike in the industrial district of Doha, Qatar, on March 1, 2026. Mahmud Hams/AFP via Getty Images

Anthropic CEO Dario Amodei. Photos: Getty Images

Anthropic CEO Dario Amodei. Photos: Getty Images

A black plume of smoke rises from a warehouse at the industrial area of Sharjah City in the United Arab Emirates following reports of Iranian strikes in Dubai, United Arab Emirates, March 1, 2026. (AP Photo/Altaf Qadri)

A black plume of smoke rises from a warehouse at the industrial area of Sharjah City in the United Arab Emirates following reports of Iranian strikes in Dubai, United Arab Emirates, March 1, 2026. (AP Photo/Altaf Qadri)

Russian Foreign Ministry image/Flickr

Russian Foreign Ministry image/Flickr

Recent comments