'Rock Now Beats Paper': Making Sense Of "Silver Friday's" Utterly Rigged Nonsense

Authored by Matthew Piepenberg via VonGreyerz.gold,

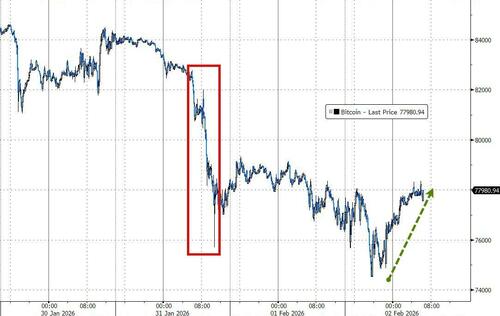

On Friday, January 30, 2026, the world learned (or rediscovered) just how grotesquely rigged the paper gold and silver markets truly are.

The Great (Yet Familiar) Fall

Despite no change whatsoever in global supply and demand forces, silver went from a $120 near-high on Thursday to a $78 low on Friday, marking this as the largest single-day crash (35%) in the silver market in 44 years.

It goes without saying that such price moves don’t happen naturally.

Something far more engineered was in play, a trick which many investors may not immediately recognize, but which anyone familiar with the nefarious insider mechanics of banking, the Chicago Mercantile Exchange, the COMEX and the London Bullion Market Association can see as plainly as a dentist sees a cavity.

So, what happened?

Look No Further than a Banker’s Rescue

As usual, whenever something so openly rigged, insider and market-distorting occurs, the very first place to look for a smoking gun, guilty child and a liar’s grin is among the banks, most of whom are and were drowning in levered silver short positions by Thursday night’s $120 silver price.

This meant that with each passing day of rising silver, the banks were getting squeezed to the point of self-destruction.

This is not fable but fact. Rising silver was literally strangling the big banks. They needed to exit their short squeeze as soon as possible, but preferably at a lower rather than higher silver price.

And then, almost by magic, silver conveniently fell like a rock to save their collectively levered @$$es.

Coincidences Galore…

But was it really any “magical” coincidence that JP Morgan was able to exit its massive (and fatally stupid) short exposure at the absolute bottom/floor of the silver price on Friday? That is, at the perfect moment?

Was it also any coincidence that the London Metals Exchange went completely dark on that very same day?

And was it just an equal coincidence that HSBC, the second largest silver short holder on the LBMA, went completely offline as the choreographed Friday massacre in silver took place?

Or do you think it may also be just another coincidence that the self-regulated COMEX raised its margin requirements yet again on that same Friday to shake out even more of the levered longs, which were otherwise pummeling the short-exposed bankers?

And finally, do you think it was just a coincidence that the announcement of a new Fed Sheriff came that very same day, on the eve of a weekend, and well after the Asian markets had closed?

Engineered Carnage

Folks, let’s be very clear. What happened on “Silver Friday” was neither normal market action nor a convergence of statistically impossible coincidences.

It was an entirely engineered flushing of the silver price to save a fatally trapped cabal of bankers caught behind the grassy knoll in the mother of all short-squeezes.

But as I had warned as recently as a month ago, such desperate measures are nothing new, especially in the more volatile silver trade. Or stated otherwise: “We’ve seen this movie before.”

Same Tricks, Different Dates

In 1980, for example, when the Hunt brothers famously sought to corner the silver market, they had caught the attention and fear of the market manipulators in the US and UK, who, for obvious reasons, feared a rising silver price.

The self-regulated US exchanges have the luxury of changing the rules in the middle of a chess match, which means they effectively always win (i.e., cheat).

As the Hunt brothers helped take silver toward an alarming $50.00 in 1980, the CME simply changed the rules mid-game by making the exchange a sell-only platform, which naturally crushed not only natural price discovery, but also took 80% off the silver price with a single rule change.

How’s that for a rigged game?

But the highlights don’t end there.

In the post 2008 crisis era, silver began to make positive strides north yet again. By 2011, silver hit the spooky $49.00 level, and so the equally spooked CME proceeded to raise the margin costs for silver trades five times in two weeks.

By effectively raising the “buy-in” to play poker with the silver exchanges, the new rules (i.e., the “House”) forced most of the silver longs to sell at mass, which directly precipitated a 48% fall in an otherwise naturally bullish silver market.

Of course, we just saw similar games played in December of 2025, when the COMEX imposed margin hikes yet again in the silver markets. As I warned just weeks ago, this was a sign of desperation but not capitulation.

The rigged game against silver would not end so easily.

Silver Friday…

Which brings us to Silver Friday, one of the greatest price spoofs ever witnessed in the totally rigged, and now totally desperate paper metals markets.

As silver hit $120, the levered bankers and the incestuous system they rigged went into open panic and cheat mode against that otherwise revered notion of dying capitalism, which the rest of us call “free price discovery.”

By adding more margin hikes on Friday, the insiders forced a sell-off in the paper silver markets and covered their embarrassing shorts at a 35% discount off natural price action.

This was the market equivalent of Lance Armstrong conducting his own drug tests…

What’s Next?

If some of you are glad to understand the twisted plumbing behind the manipulation of silver (and gold) in the COMEX cesspool, a theme we’ve covered numerous times elsewhere, you may nevertheless be concerned.

That is, you may be glad to see how the game is rigged, but your next question, naturally, is how does that help you as a silver or gold investor if the House always wins?

After all, it may be nice to call out a dirty cop, but that doesn’t mean it’s easy to beat one.

Or stated even more simply, if the game is so openly rigged, how does one ever win? What can you do with your gold and silver in such a corrupt backdrop?

Fair Question

In fact, the disconcerting tricks behind Silver Friday are by no means the end of the longer story for silver in particular or precious metals in general, as the exchanges are clearly terrified of silver and gold’s inevitable direction northwards.

They see what we see.

If anything, the desperation behind this headline move only signals a stronger silver and gold market ahead.

Why?

Supply & Demand Gets the Last Laugh

Because the crash of Silver Friday did not solve the much larger problem (or more powerful forces) of basic supply and demand.

Silver has seen five consecutive years of 200M ounces/year of supply deficits, totaling over 1B ounces in collective silver supply deficits.

All Silver Friday achieved was a flushing out of uber-levered speculators and a classic butt-saving of those ever-so-stupid commercial banks who found themselves trapped (and now rescued) from the mother of all short-squeezes.

A rigged system which favors insider bankers is nothing new. We’ve written about their staggering games for years.

But here’s the rub.

Rock Now Beats Paper

What we just witnessed on Silver Friday is pure confirmation that the silver (and gold) paper markets are dying before our watering yet wide-open eyes.

In October, for example, the London exchange effectively seized up. They were out of physical silver. In the summer of 2025, the COMEX saw 100% delivery of gold, leaving an exchange whose typical delivery percentage was 1%.

In short: The world wants physical metals, not paper tricks.

The CME and COMEX cheaters may be able to brazenly manipulate the paper price of silver, but they have yet to find an alchemist’s ability to create actual silver.

Moving forward, actual buyers of real silver will move further and further away from the now discredited and increasingly desperate and openly rigged paper markets in the US and UK.

The physical metals will be in greater demand, and the once-powerful paper exchanges will lose their leverage and influence.

Industrial as well as monetary demand for silver will continue to push demand and physical pricing higher.

As for gold, the rising demand for real money (physical gold) over paper currencies will continue its secular and historical momentum north for all the reasons we’ve already covered.

This rising preeminence of physical gold and silver over levered paper gold and silver will steadily outpace the increasingly desperate and disclosed mechanizations on the paper exchanges.

Or stated more simply: The CME may have won a paper battle on Silver Friday, but rising demand for physical silver and gold will win the war on paper systems losing credibility, power and options with each tick of a global debt bubble and currency timebomb.

For those who hold physical gold and silver as part of a long game of wealth preservation against the short game of desperate yet dying paper money, Friday’s speedbump was nothing more than that: A bump in an otherwise wide-open road forward.

Views expressed in this article are opinions of the author and do not necessarily reflect the views of ZeroHedge.

Tyler Durden

Mon, 02/02/2026 - 15:05

Adrian Alexander Conejo Arias, the father of Liam Ramos, left, is being detained with his son in Texas after being arrested by federal immigration authorities. (Obtained by Columbia Heights Public Schools; Department of Homeland Security) via Fox News

Adrian Alexander Conejo Arias, the father of Liam Ramos, left, is being detained with his son in Texas after being arrested by federal immigration authorities. (Obtained by Columbia Heights Public Schools; Department of Homeland Security) via Fox News

U.S. District Judge Fred Biery

U.S. District Judge Fred Biery

via AP

via AP

Source: Roscongress Photobank

Source: Roscongress Photobank

Recent comments