How Operation Epic Fury Unfolded

Authored by John Haughey via The Epoch Times (emphasis ours),

The Pentagon had been choreographing a prospective massive attack on Iran since 1980, but it wasn’t until December 2025 that U.S. President Donald Trump, after meeting with Israeli Prime Minister Benjamin Netanyahu in Washington, told military planners to give him that devastating option in case the fundamentalist Shia regime refused to end its uranium enrichment program.

Illustration by The Epoch Times, Public Domain, Shutterstock

Illustration by The Epoch Times, Public Domain, Shutterstock

With that request, the countdown to Operation Epic Fury kicked off.

Joint Chiefs of Staff Chair Gen. Dan Caine told reporters during a March 2 press conference that with the president’s December request, the Pentagon began “setting the force and setting the theater” and shifted forces into place over the previous 30 days to “provide the president with credible options should action be required.”

After U.S. negotiators, led by special envoy Steve Witkoff and Trump’s son-in-law Jared Kushner, left Geneva on Feb. 26 without concessions from Iranian Foreign Minister Abbas Araghchi, the die was cast.

The next day, the president called the Pentagon from Air Force One as it was en route to Corpus Christi, Texas, where he was scheduled to campaign for Republican primary candidates.

Caine recalled the exact moment he got the call: “H hour,” a military term for the time at which an operation begins, was 3:38 p.m. EST on Friday, Feb. 27, when the Pentagon “received the final go order from President Trump.”

Joint Chiefs of Staff Chair Gen. Dan Caine holds a briefing about the U.S.–Israeli conflict with Iran, at the Pentagon in Washington on March 2, 2026. Elizabeth Frantz/Reuters

Joint Chiefs of Staff Chair Gen. Dan Caine holds a briefing about the U.S.–Israeli conflict with Iran, at the Pentagon in Washington on March 2, 2026. Elizabeth Frantz/Reuters

“The president directed, and I quote: ‘Operation Epic Fury is approved. No aborts. Good luck,’” Caine said.

With that one call, he said, “across the globe, [U.S. military] operation centers came alive,” and Adm. Brad Cooper, Central Command commander at MacDill Air Force Base in Tampa, Florida, assumed operational command in the theater.

When Trump issued the “go order” at 3:38 p.m. Feb. 27, it was just after midnight Feb. 28 in Tehran. In the nearly 10 hours between H hour and the actual launch of the attack, Caine said, “in the region, every element of the joint force made their final preparations.”

“Air defense batteries readied themselves, checking their systems to respond to Iranian attacks,” he said. “Pilots and crews rehearsed their strike packages for the final time. Air crews began loading their final weapons, and two carrier strike groups began to move towards their launching point.”

Plumes of smoke rise over the skyline following explosions in Tehran, Iran, on March 1, 2026. Majid Saeedi/Getty Images

Plumes of smoke rise over the skyline following explosions in Tehran, Iran, on March 1, 2026. Majid Saeedi/Getty Images

“As dawn crept up, across the Central Command [area of operations], skies surged to life,” Caine said.

“More than 100 aircraft launched from land and sea—fighters, tankers, airborne early warning, electronic attack, bombers from the states, and unmanned platforms—forming a single synchronized wave.”

That wave arrived over Iran at 1:15 a.m. EST, 9:45 a.m. in Tehran.

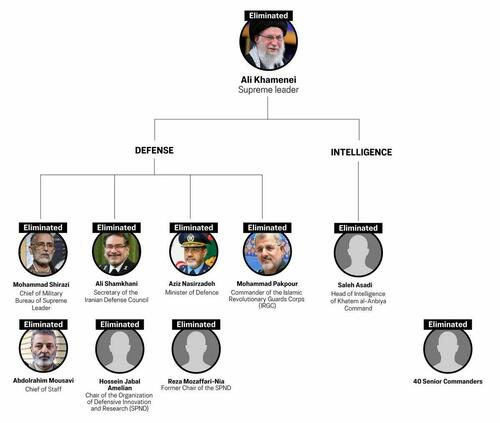

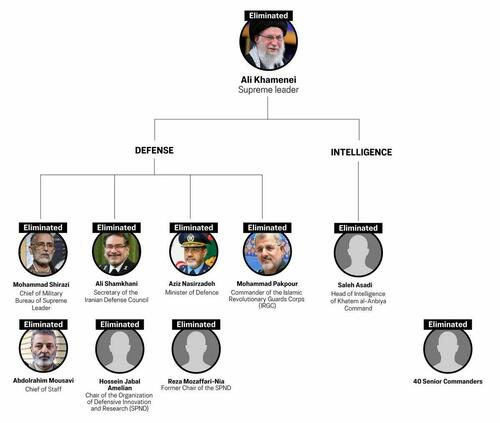

That timeline was accelerated by “a trigger event conducted by the Israeli Defense Forces, enabled by the U.S. intelligence community” from the standard night attack to a mid-morning opening salvo that killed Iranian leader Ali Khamenei and up to 48 of the nation’s military leaders at a Tehran compound.

Illustration by The Epoch Times, Public Domain

Illustration by The Epoch Times, Public Domain

That was among more than 1,000 targets struck in the first 24 hours of the aerial, missile, and drone assault.

“The full strength of America’s armed forces came together in a unified purpose against a capable and determined adversary,” Caine said.

“This deployment included thousands of service members from all branches, hundreds of advanced fourth- and fifth-generation fighters, dozens of refueling tankers, the Lincoln and Ford carrier strike groups and their embarked air wings, sustained flow of munitions, fuel supplies ... all supported with command and control, intelligence, surveillance, and reconnaissance network. And the flow of forces continues today.”

(Top) Nimitz-class aircraft carrier USS Abraham Lincoln (CVN 72), Arleigh Burke-class guided-missile destroyers USS Michael Murphy (DDG 112), USS Frank E. Petersen Jr. (DDG 121), Henry J. Kaiser-class fleet replenishment oiler USNS Henry J. Kaiser (T-AO-187), Lewis and Clark-class dry cargo ship USNS Carl Brashear (T-AKE 7), and U.S. Coast Guard Sentinel-class fast-response cutters USCG Robert Goldman (WPC-1142) and USCGC Clarence Sutphin. Jr. (WPC-1147) sail in formation in the Arabian Sea, on Feb. 6, 2026. (Bottom Left) An F/A-18E Super Hornet, attached to Strike Fighter Squadron (VFA) 14, prepares to land on the flight deck of aircraft carrier USS Abraham Lincoln (CVN 72) during Operation Epic Fury at Sea on March 1, 2026. (Bottom Right) U.S. sailors prepare to stage ordnance on the flight deck of the USS Abraham Lincoln on Feb. 28, 2026. Mass Communication Specialist 1st Class Jesse Monford/U.S. Navy via Getty Images, U.S. Navy via Getty Images

(Top) Nimitz-class aircraft carrier USS Abraham Lincoln (CVN 72), Arleigh Burke-class guided-missile destroyers USS Michael Murphy (DDG 112), USS Frank E. Petersen Jr. (DDG 121), Henry J. Kaiser-class fleet replenishment oiler USNS Henry J. Kaiser (T-AO-187), Lewis and Clark-class dry cargo ship USNS Carl Brashear (T-AKE 7), and U.S. Coast Guard Sentinel-class fast-response cutters USCG Robert Goldman (WPC-1142) and USCGC Clarence Sutphin. Jr. (WPC-1147) sail in formation in the Arabian Sea, on Feb. 6, 2026. (Bottom Left) An F/A-18E Super Hornet, attached to Strike Fighter Squadron (VFA) 14, prepares to land on the flight deck of aircraft carrier USS Abraham Lincoln (CVN 72) during Operation Epic Fury at Sea on March 1, 2026. (Bottom Right) U.S. sailors prepare to stage ordnance on the flight deck of the USS Abraham Lincoln on Feb. 28, 2026. Mass Communication Specialist 1st Class Jesse Monford/U.S. Navy via Getty Images, U.S. Navy via Getty Images

The nation’s highest-ranking military officer laid out the order of battle and what forces, as of March 2, were engaged in Operation Epic Fury, a rapid assembly of forces that “demonstrated the joint forces ability to adapt and project power at the time and place of [the United States’] choosing” that included “several combat firsts” to be made public “at some point in the future.”

Before the first missile struck, Caine said, “the first movers” were Space Force, Army, and Air Force electronics and cyber warfare technicians “layering non-kinetic effects, disrupting and degrading and blinding Iran’s ability to see, communicate, and respond.”

With Iranian communications disrupted and its air defenses “without the ability to see, coordinate, or respond effectively,” U.S. and Israeli air forces, with “swift, precise, and overwhelming strikes,” established local air superiority immediately, he said, setting the stage for a campaign the Pentagon maintains it can sustain, and expand if needed, for weeks.

Combat Firsts

With Iranian air defenses hacked or blinded before the opening salvo, the assault began with waves of Tomahawk cruise missiles—long-range precision weapons capable of striking targets hundreds of miles inland—launched by the aircraft carriers USS Abraham Lincoln in the Arabian Sea and USS Gerald R. Ford in the eastern Mediterranean Sea and their battlegroup destroyers.

The USS Gerald R. Ford, which had been deployed to the region in June 2025 during the 12-Day War that badly damaged, but did not destroy, Iran’s uranium enrichment program and was then dispatched to the southern Caribbean to lead Operation Southern Spear off Venezuela, was ordered back to the Sixth Fleet in January and is now in its eighth month of sustained operations.

It is to be relieved eventually by the USS George H.W. Bush, a Nimitz-class carrier undergoing post-overhaul sea trials.

With missiles outbound, hundreds of Air Force F-15s, F-16s, and stealth F-22 Raptors merged with carrier-launched F/A-18 Hornets, stealth F-35s, and EA-18G electronic warfare jets in the massive aerial attack against Iranian air defenses and missile-launch sites.

The fighters were later joined by Air Force stealth B-2 Spirit bombers that flew 17 hours from Whiteman Air Force Base in Missouri, which had struck suspected nuclear complexes with 30,000-pound “penetrator” munitions in June 2025.

(Top Left) A U.S. F-15 fighter plane prepares for landing in Mildenhall, England, on Jan. 7, 2026. (Top Right) B-2 Spirit Bombers fly over the White House on July 4, 2025. (Bottom Left) A U.S. F-35 fighter plane takes off in Mildenhall, England, on Jan. 7, 2026. (Bottom Right) A U.S. Air Force F22-Raptor takes off in Ceiba, Puerto Rico, on Jan. 4, 2026. Dan Kitwood/Getty Images, Eric Lee/Getty Images, Miguel J. Rodriguez Carrillo / AFP via Getty Images

(Top Left) A U.S. F-15 fighter plane prepares for landing in Mildenhall, England, on Jan. 7, 2026. (Top Right) B-2 Spirit Bombers fly over the White House on July 4, 2025. (Bottom Left) A U.S. F-35 fighter plane takes off in Mildenhall, England, on Jan. 7, 2026. (Bottom Right) A U.S. Air Force F22-Raptor takes off in Ceiba, Puerto Rico, on Jan. 4, 2026. Dan Kitwood/Getty Images, Eric Lee/Getty Images, Miguel J. Rodriguez Carrillo / AFP via Getty Images

In the opening phases of the Feb. 28 assault, they targeted ballistic missile sites with 2,000-pound precision-guided bombs, confirming that the focus was on degrading Iran’s air defenses and communications.

Ground-based Army precision strike missiles from the M142 high-mobility artillery rocket system mounted on “shoot and scoot” mobile launchers added to the fray, lobbing short-range ballistics into Iran from bases in the Gulf states, the first time the short-range ballistic missile system was used in combat.

The Pentagon has acknowledged that Operation Epic Fury is also the debut of a new low-cost uncrewed combat attack system (LUCAS) drone—a one-way “suicide” drone reverse-engineered to mimic Iran’s Shahed 136 drone, which it has exported en masse to Russia for use in Ukraine.

Among the forces participating in the attack are Air Force MQ-9 Reaper drones carrying Hellfire missiles and guided bombs, twin-engine A-10 attack aircraft directed by E-3 Sentry and E-2 Hawkeye airborne surveillance and EA-11A BACN “Wi-Fi in the sky” reconnaissance jets, and KC-135 and KC-46 aerial refueling tankers.

Under attack from Iranian and Shia militias, there are about 2,400 U.S. soldiers in Syria and Iraq, including in Erbil, Iraq.

About 2,000 are from the Iowa National Guard, who are to be relieved by a unit from the 10th Mountain Division this spring.

At least 250 guardsmen left Iraq in mid-February, and on Feb. 27—before the attack was launched—the Iowa National Guard announced that 650 more were headed home.

It is uncertain what their status is now.

The U.S. base in Erbil is among installations across the region under sporadic Iranian and militia attacks.

Trump and War Secretary Pete Hegseth have not ruled out dispatching “boots on the ground,” although there is no indication that Army and Marine infantry forces have been ordered to deploy.

Read the rest here...

Tyler Durden

Wed, 03/04/2026 - 23:20

Karlsruhe: The Second Senate of the Federal Constitutional Court gathers. Photo: Uli Deck/dpa (Photo by Uli Deck/picture alliance via Getty Images)

Karlsruhe: The Second Senate of the Federal Constitutional Court gathers. Photo: Uli Deck/dpa (Photo by Uli Deck/picture alliance via Getty Images) U.S. Marine Corps. Lt. Gen. Francis Donovan looks on during a Senate Armed Services Committee Confirmation Hearing on Capitol Hill on Jan. 15, 2026. Tom Brenner/Getty Images

U.S. Marine Corps. Lt. Gen. Francis Donovan looks on during a Senate Armed Services Committee Confirmation Hearing on Capitol Hill on Jan. 15, 2026. Tom Brenner/Getty Images Military personnel patrol a market as they carry out weapons and drug checks in Quito, Ecuador, on Feb. 10, 2026. Rodrigo Buendia/AFP via Getty Images

Military personnel patrol a market as they carry out weapons and drug checks in Quito, Ecuador, on Feb. 10, 2026. Rodrigo Buendia/AFP via Getty Images

Illustration by The Epoch Times, Public Domain, Shutterstock

Illustration by The Epoch Times, Public Domain, Shutterstock Joint Chiefs of Staff Chair Gen. Dan Caine holds a briefing about the U.S.–Israeli conflict with Iran, at the Pentagon in Washington on March 2, 2026. Elizabeth Frantz/Reuters

Joint Chiefs of Staff Chair Gen. Dan Caine holds a briefing about the U.S.–Israeli conflict with Iran, at the Pentagon in Washington on March 2, 2026. Elizabeth Frantz/Reuters Plumes of smoke rise over the skyline following explosions in Tehran, Iran, on March 1, 2026. Majid Saeedi/Getty Images

Plumes of smoke rise over the skyline following explosions in Tehran, Iran, on March 1, 2026. Majid Saeedi/Getty Images Illustration by The Epoch Times, Public Domain

Illustration by The Epoch Times, Public Domain (Top) Nimitz-class aircraft carrier USS Abraham Lincoln (CVN 72), Arleigh Burke-class guided-missile destroyers USS Michael Murphy (DDG 112), USS Frank E. Petersen Jr. (DDG 121), Henry J. Kaiser-class fleet replenishment oiler USNS Henry J. Kaiser (T-AO-187), Lewis and Clark-class dry cargo ship USNS Carl Brashear (T-AKE 7), and U.S. Coast Guard Sentinel-class fast-response cutters USCG Robert Goldman (WPC-1142) and USCGC Clarence Sutphin. Jr. (WPC-1147) sail in formation in the Arabian Sea, on Feb. 6, 2026. (Bottom Left) An F/A-18E Super Hornet, attached to Strike Fighter Squadron (VFA) 14, prepares to land on the flight deck of aircraft carrier USS Abraham Lincoln (CVN 72) during Operation Epic Fury at Sea on March 1, 2026. (Bottom Right) U.S. sailors prepare to stage ordnance on the flight deck of the USS Abraham Lincoln on Feb. 28, 2026. Mass Communication Specialist 1st Class Jesse Monford/U.S. Navy via Getty Images, U.S. Navy via Getty Images

(Top) Nimitz-class aircraft carrier USS Abraham Lincoln (CVN 72), Arleigh Burke-class guided-missile destroyers USS Michael Murphy (DDG 112), USS Frank E. Petersen Jr. (DDG 121), Henry J. Kaiser-class fleet replenishment oiler USNS Henry J. Kaiser (T-AO-187), Lewis and Clark-class dry cargo ship USNS Carl Brashear (T-AKE 7), and U.S. Coast Guard Sentinel-class fast-response cutters USCG Robert Goldman (WPC-1142) and USCGC Clarence Sutphin. Jr. (WPC-1147) sail in formation in the Arabian Sea, on Feb. 6, 2026. (Bottom Left) An F/A-18E Super Hornet, attached to Strike Fighter Squadron (VFA) 14, prepares to land on the flight deck of aircraft carrier USS Abraham Lincoln (CVN 72) during Operation Epic Fury at Sea on March 1, 2026. (Bottom Right) U.S. sailors prepare to stage ordnance on the flight deck of the USS Abraham Lincoln on Feb. 28, 2026. Mass Communication Specialist 1st Class Jesse Monford/U.S. Navy via Getty Images, U.S. Navy via Getty Images (Top Left) A U.S. F-15 fighter plane prepares for landing in Mildenhall, England, on Jan. 7, 2026. (Top Right) B-2 Spirit Bombers fly over the White House on July 4, 2025. (Bottom Left) A U.S. F-35 fighter plane takes off in Mildenhall, England, on Jan. 7, 2026. (Bottom Right) A U.S. Air Force F22-Raptor takes off in Ceiba, Puerto Rico, on Jan. 4, 2026. Dan Kitwood/Getty Images, Eric Lee/Getty Images, Miguel J. Rodriguez Carrillo / AFP via Getty Images

(Top Left) A U.S. F-15 fighter plane prepares for landing in Mildenhall, England, on Jan. 7, 2026. (Top Right) B-2 Spirit Bombers fly over the White House on July 4, 2025. (Bottom Left) A U.S. F-35 fighter plane takes off in Mildenhall, England, on Jan. 7, 2026. (Bottom Right) A U.S. Air Force F22-Raptor takes off in Ceiba, Puerto Rico, on Jan. 4, 2026. Dan Kitwood/Getty Images, Eric Lee/Getty Images, Miguel J. Rodriguez Carrillo / AFP via Getty Images

Recent comments