Stablecoins And The Rebasement Of The Dollar

Authored by Lance Roberts via RealInvestmentAdvice.com,

The “fiat is dying” argument has become a catchphrase narrative among digital asset bulls, gold bugs, and cryptocurrency advocates. That narrative’s core is that central banks have printed vast amounts of money. The “money printing” has led to currency debasement and rendered the U.S. dollar obsolete. We discussed this “debasement” narrative previously.

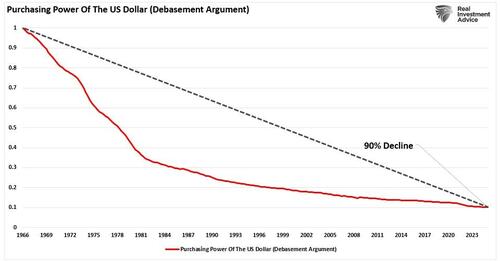

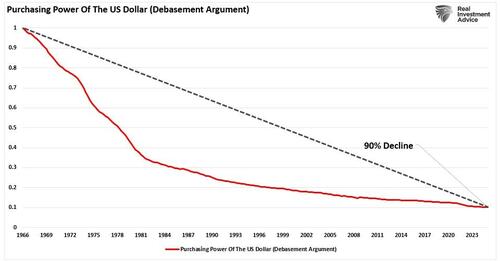

The narrative is seductive: inflation is out of control, the government is printing money, and the dollar is on its last legs. But while there are real risks to watch, most headlines sell fear rather than fact. It’s striking, and those selling gold, silver, or other doomsday assets often use it to scare individuals into taking action. One of their favorite charts used to make the “debasement” case is the classic graph showing that the U.S. dollar has lost 90% of its purchasing power since 1966.”

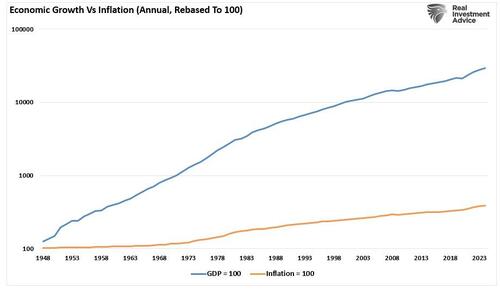

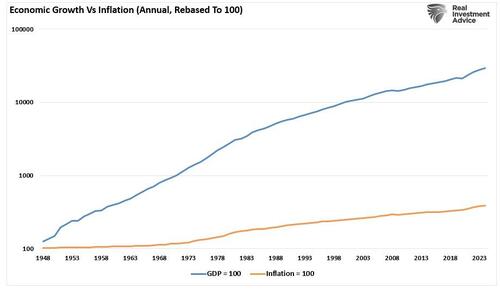

But here’s the thing: that chart doesn’t show debasement. It only reflects inflation, a well-understood and largely expected outcome in a growing economy. Prices rise over time because demand increases due to population growth, rising incomes, and growing consumption. This is especially true in a post-industrial, service-driven economy that incentivizes credit expansion and capital investment. In other words, it’s not the dollar losing value; it’s the economy expanding.

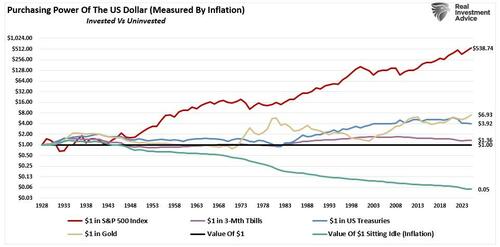

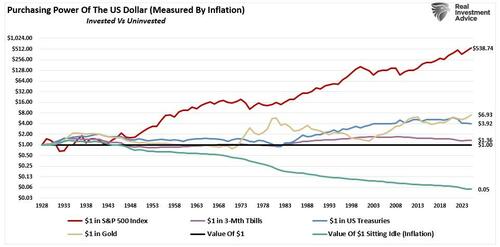

What those promoting the “debasement” argument misunderstand is how economics and modern inflation work. What the chart shows, in today’s economy, is only the loss of purchasing power of idle, or uninvested, dollars. Dollars that sit uninvested lose value relative to inflation over time. That is not a collapse of fiat currency. It is a signal to put capital to work. While the “gold bugs” argue that gold protects against debasement (i.e., inflation), which is true, so do 3-month T-bills and US Treasury bonds on a real, inflation-adjusted, total return basis. However, that same $1 invested in the S&P 500 index was by far the best protector of the purchasing power of the U.S. Dollar

Most importantly, the term “debasement” does not refer to the collapse of currency. It is only a “reflection of inflation on uninvested dollars.” Inflation erodes purchasing power if income and returns do not keep pace. A $100 bill in your pocket today buys less than it did in 2010, only because the general price level of goods and services purchased in an expanding economy rises over time. That effect is real, but it is a natural consequence of economic activity and monetary policy interacting with growth, not a structural collapse of confidence.

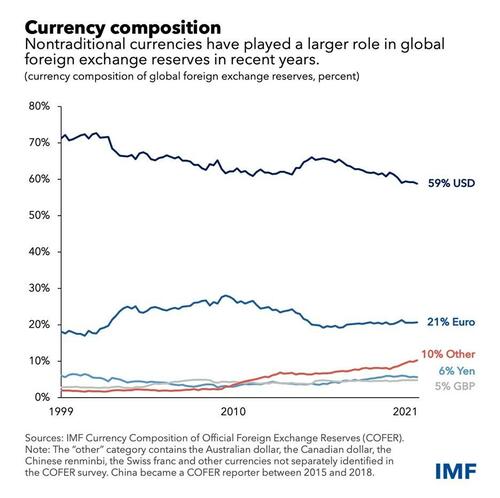

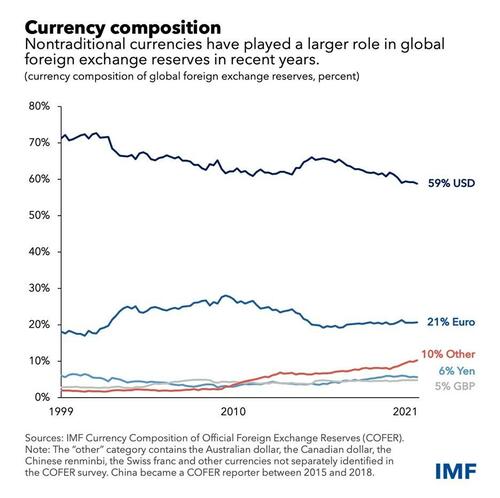

In reality, the dollar remains dominant. As we discussed in depth in “The Dollar’s Death Is Greatly Exaggerated:”

-

Roughly 80 percent of global transactions use the U.S. dollar as the unit of account or settlement.

-

The U.S. dollar still accounts for nearly 60 percent of global foreign-exchange reserves held by central banks.

-

There is no alternative currency or asset with the depth, liquidity, and institutional trust of the U.S. dollar.

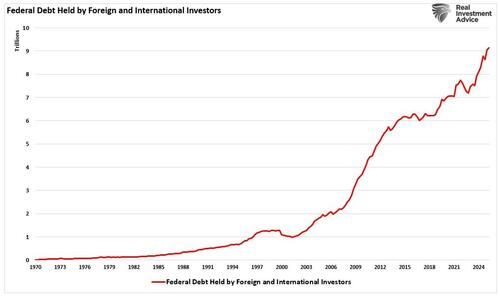

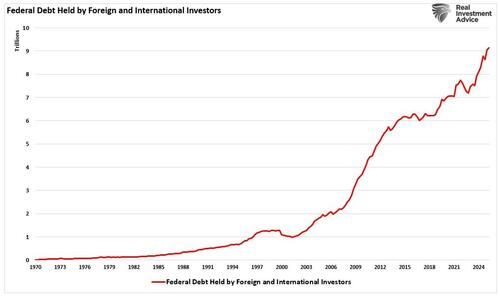

These facts contradict the idea that the world is abandoning fiat currencies or the U.S. dollar. The narrative that the dollar is dying ignores the overwhelming evidence of continued international demand and use, which is why foreign buying of US Treasuries has surged to a record.

The Illusion of Escape

Individuals who argue that investors are buying gold or Bitcoin by clinging to the “debasement” narrative are either intentionally trying to deceive others or are ignorant of how the monetary system, and the fundamental unit of pricing, exchange, and settlement, works in the modern economy.

We absolutely agree that investors should invest their “idle” dollars into “risk assets” like bonds, gold, stocks, or Bitcoin to protect their savings from inflation over time. However, the gains in those assets that rise in nominal terms only reflect shifts in relative valuation, not an abandonment of the dollar itself. Furthermore, while those buying into “debasement” fears, mostly due to headlines rather than the facts, seek so‑called “safe havens,” by buying Bitcoin or gold, thinking they are abandoning “fiat” money.

However, such is not the case as these assets are still priced and settled in dollars. Bitcoin trades in USD pairs, and gold’s global market price is quoted in dollars. When holders want to spend or transact outside the digital asset context, they must convert back into the dollar system. The belief that one can truly escape fiat is a philosophical idea. In practical terms, value transfer and utility still revolve around dollars. As shown above, the absolute best way to protect your purchasing power from “debasement” has been the US stock market.

While the “debasement” narrative often claims that US Treasuries are undesirable relics of a failing system, the reality is the opposite. US Treasuries remain the most liquid, trusted financial instruments on the planet. They are central to global interest rate benchmarks, risk‑free rate calculations, collateral markets, and international reserves.

Furthermore, a new development in today’s economy is about to make the US Dollar even more dominant: USD Stable Coins.

USD Stablecoins and Why They are Needed

As explained, the US Dollar is, and will remain, the backbone of global finance. That won’t change in the near or distant future, primarily because there are no realistic alternatives. However, the rise of USD stablecoins will likely cement that dominance even further.

Currently, nearly 99 percent of fiat‑backed stablecoins are pegged to the US dollar, as the US dollar dominates global foreign exchange reserves. The dollar’s share of global reserves continues to outweigh other major currencies combined, demonstrating that sovereign confidence in USD persists even amid inflation concerns. More notably, USD Stable Coins reflect the dollar’s strength, not its demise.

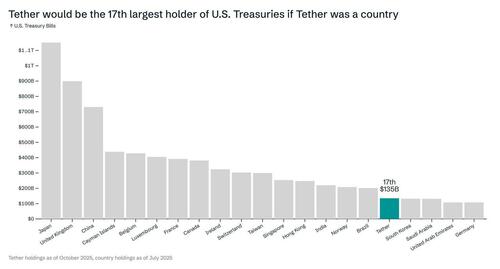

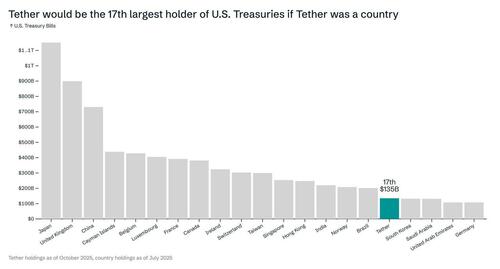

So, what are USD Stablecoins? They are digital tokens designed to maintain a 1:1 peg to the US dollar. Unlike volatile cryptocurrencies such as Bitcoin or Ether, which can swing wildly in price, stablecoins offer price stability by holding reserves of high‑quality liquid assets. The largest examples are Tether’s USDT and Circle’s USDC, which together account for over 90 percent of the USD stablecoin market. For context, as of late 2025, Tether (the issuer of the USDT stablecoin) held over $135 billion in U.S. Treasury securities, ranking it 17th globally among holders of U.S. sovereign debt. Tether’s holdings exceed those of South Korea, Saudi Arabia, Germany, and the UAE.

Here is why this is critical to the “death of the dollar” narrative.

USD Stablecoins operate on blockchain networks, enabling real‑time settlement and global transfer of digital dollars without traditional banking intermediaries. This capability is especially valuable for cross-border transactions, remittances, and markets with less developed banking infrastructure. The International Monetary Fund notes that while most current stablecoin turnover is tied to crypto trading, cross‑border flows are rapidly growing, suggesting future use in broader financial systems. As noted by Chainstack:

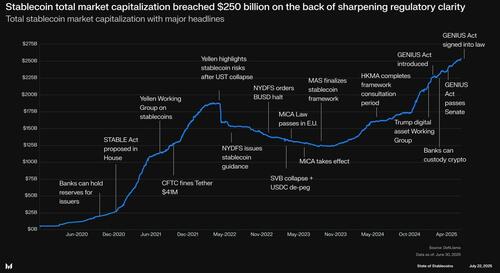

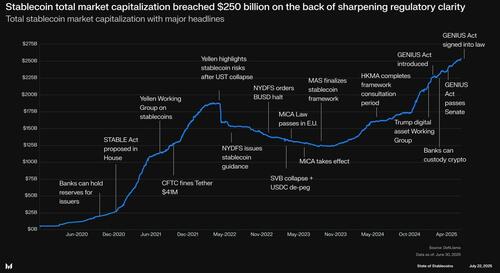

“Stablecoins have moved into mainstream finance, linking bank systems with digital asset networks. Dollar-pegged tokens already move volumes on par with major payment networks, with transactions rivaling those of ACH, Visa, and PayPal. In mid-2025, the supply of stablecoins crossed $250B, reflecting demand for quicker, always-on payments.”

While transaction volume still remains very small (about 1% of the current global cross-border payment volume, a $2 quadrillion annual market, there are several reasons why many expect the USD Stable Coin market to grow substantially in the future.

These use cases appeal to global finance as it modernizes payment systems. If USD Stable Coins realize broader adoption, they could become core infrastructure for digital money flows, making US Treasuries even more important to the global financial system.

How USD Stablecoins Could Make US Treasuries Even More Important

The presence of these assets in USD Stablecoin reserves underscores that the digital dollar infrastructure is intertwined with US sovereign debt markets rather than outside them. As the USD Stable Coin market grows, its relationship with US Treasuries could become more significant as issuers must hold liquid, low‑risk assets to maintain dollar pegs and meet regulatory and market expectations. Because short‑term Treasuries are widely accepted collateral and deeply liquid, they are a natural choice.

Regulatory developments, such as the GENIUS Act, passed in 2025, require stablecoin issuers to back their tokens with high‑quality liquid assets, such as USD or short‑dated Treasury instruments, increasing the likelihood that reserves remain closely tied to US sovereign debt. Furthermore, if and when the STABLE Act passes, it would impose additional requirements on stablecoin issuers to maintain safe, highly liquid assets as backing.

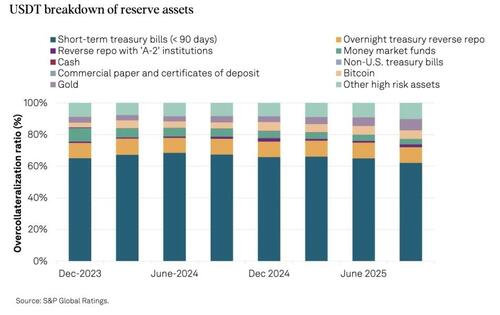

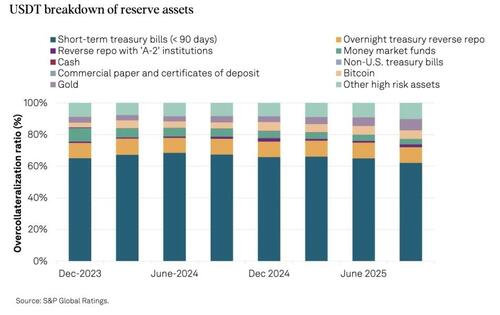

As such, Industry projections suggest the USD Stablecoin market could reach $2–$3 trillion by 2030, driven by clearer regulation and broader financial adoption. In that scenario, stablecoin reserve demand for Treasuries could become a meaningful incremental buyer in money markets, potentially supplementing traditional Treasury demand. Reuters reported that up to 80 percent of the existing stablecoin market’s reserves are in Treasury bills and repos, indicating that current reserve practices already lean heavily toward Treasuries.

Lastly, academic research suggests USD Stablecoin demand has already been large enough to influence short‑term yields. For example, one study found stablecoin purchases of Treasury bills correlated with measurable downward pressure on one‑month yields, highlighting how digital dollar reserve demand can affect real markets.

However, any discussion of USD Stablecoins must recognize the risks. Most importantly, this thesis assumes that USD stablecoins will become a broader global transaction utility. That is a “possible” future, not a certain one. Currently, high usage of USD stablecoins is concentrated in crypto trading and settlement, not in mainstream commerce or sovereign payments. Adoption depends on regulatory frameworks, institutional engagement, and global trust.

Custodial risk remains a valid concern. S&P Global Ratings recently downgraded Tether’s stability assessment, noting that only 64% of its reserves were held in short‑term US Treasuries and that transparency issues persist. This underscores the importance of clearer reporting, stronger governance, and more regulated custody solutions if stablecoins are to scale safely.

“Bitcoin represents 5.6% of USDT in circulation, exceeding the 3.9% overcollateralization margin associated with a collateralization ratio of 103.9%. A decline in the price of bitcoin or the value of other higher-risk assets could therefore reduce collateral coverage.” – S&P Global

There is also competition from central bank digital currencies (CBDCs). Governments might choose their own digital money rails, which could reduce the appeal of private USD Stable Coins in certain use cases; however, even if CBDCs gain substantial traction, they will likely also be backed by US Treasuries for the reasons listed herein.

Another risk is that as demand for Treasuries rises, yields will fall. However, while issuers of USD Stable Coins would likely shift reserve composition, the underlying assets remain dollar‑linked securities. This distinction is critical, as whether stablecoin issuers hold T‑bills, repos, or other short‑term dollar assets, the peg to the dollar persists. The system will continue to operate within the dollar monetary framework, not in an alternate monetary universe.

Finally, there is ALWAYS a risk that none of this materializes at the expected scale. Regulatory setbacks, technological barriers, or shifts in macroeconomic conditions could stall growth. While the future is never certain, the framework of USD Stable Coins and the current trajectory of technological developments suggest that how we currently transact business globally will change in the near future, and, most importantly, the US dollar will be at the center of it.

Conclusion and Investment Thesis

The narrative that “fiat is dying” is not supported by the data or reality. Inflation, while real, is not debasement in the historical sense. It’s the erosion of purchasing power on uninvested dollars in an expanding economy. The U.S. dollar remains the foundation of global finance, dominating in trade, reserves, and settlement. No alternative currency, asset, or system currently matches its liquidity, institutional trust, or market depth.

The illusion that one can escape fiat by moving into gold or Bitcoin misunderstands how the monetary system works. While those assets protect savings against inflation, they are not independent of the fiat currency system, as they are priced, settled, and used in U.S. dollars. Any claim of “escape” is more ideological than practical.

What’s emerging now is not the death of the dollar, but its “rebasement,” through the transformation of how it circulates, settles, and functions through digital infrastructure. USD Stable Coins are not a threat to the U.S. monetary system; rather, they are an extension of it. By facilitating real-time digital payments on blockchain networks while holding reserves in U.S. Treasuries and cash equivalents, USD stablecoins reinforce the dollar’s central role.

If USD stablecoins mature into a mainstream transaction utility, something that remains a forward-looking assumption, the demand for U.S. Treasuries could increase significantly. With a projected market size of $2–$3 trillion by 2030, stablecoin issuers could become significant buyers of US Treasuries. Such would deepen liquidity, support lower yields, and embed Treasury instruments even further into the plumbing of global finance.

But investors must recognize the risks. Stablecoin adoption is not a guarantee. Regulatory frameworks could stall. Custodial risks remain, particularly with non-transparent issuers. Central bank digital currencies may create competition. And if USD Stable Coins fail to expand beyond trading use cases, their impact will remain limited.

Still, the investment thesis is compelling:

-

US Treasuries remain critical. Continued and diversified demand, from both traditional buyers and digital dollar issuers, supports their role as a core asset.

-

USD stablecoin infrastructure offers opportunities for firms that provide custody, liquidity, and regulatory-compliant digital payment rails. (CRCL, COIN, PYPL, FI, V, and MA)

-

Banks and fintechs positioned at the intersection of blockchain settlement and fiat compliance may become integral to the rebasement architecture. (JPM, BK, C, SQ, and Stripe)

The dollar is not dying. It’s evolving. Notably, USD Stable Coins may serve as the bridge connecting the analog financial world to its digital future. The regulatory and technological framework is evolving. And the future of USD Stablecoins has the full weight of U.S. sovereign credit behind it. For investors willing to bet on that evolution, the opportunity lies in understanding the future of the dollar.

It’s not its destruction, but the digitization of dollar dominance.

Views expressed in this article are opinions of the author and do not necessarily reflect the views of ZeroHedge.

Tyler Durden

Sat, 03/07/2026 - 15:15

AFP/Getty Images

AFP/Getty Images

Occupied northern Cyprus, Shutterstock/Middle East Forum

Occupied northern Cyprus, Shutterstock/Middle East Forum Boats are docked at the Aqualand Marina as emissions spew out of a stack at the Morgantown Generating Station on June 29, 2015, in Newburg, Md. The PJM Interconnection’s market monitor on March 4, 2026, urged federal regulators to reject an application from GenOn to sell the power plant to TeraWulf. Mark Wilson via Getty Images

Boats are docked at the Aqualand Marina as emissions spew out of a stack at the Morgantown Generating Station on June 29, 2015, in Newburg, Md. The PJM Interconnection’s market monitor on March 4, 2026, urged federal regulators to reject an application from GenOn to sell the power plant to TeraWulf. Mark Wilson via Getty Images

A member of the Metropolitan Police patrols the Oxford Street retail district in London on Oct. 2, 2025. Leon Neal/Getty Images

A member of the Metropolitan Police patrols the Oxford Street retail district in London on Oct. 2, 2025. Leon Neal/Getty Images The constituency offices of Joani Reid, the Scottish Labor MP for East Kilbride and Strathaven, in East Kilbride, Scotland, on March 4, 2026. Jeff J Mitchell/Getty Images

The constituency offices of Joani Reid, the Scottish Labor MP for East Kilbride and Strathaven, in East Kilbride, Scotland, on March 4, 2026. Jeff J Mitchell/Getty Images Source: Yle

Source: Yle

Image source: Come Back Alive Foundation

Image source: Come Back Alive Foundation

(L–R) Speaker of the House Mike Johnson, Energy Secretary Chris Wright, and President Donald Trump in the Eisenhower Executive Office Building on the White House campus on March 4, 2026. Andrew Caballero-Reynolds/AFP via Getty Images

(L–R) Speaker of the House Mike Johnson, Energy Secretary Chris Wright, and President Donald Trump in the Eisenhower Executive Office Building on the White House campus on March 4, 2026. Andrew Caballero-Reynolds/AFP via Getty Images Illustration by The Epoch Times, Shutterstock

Illustration by The Epoch Times, Shutterstock An employee sets up a laptop for a job application page during a hiring fair for postal workers and mail carrier assistants at a U.S. Postal Service facility in Inglewood, Calif., on July 18, 2022. Patrick T. Fallon/AFP via Getty Images

An employee sets up a laptop for a job application page during a hiring fair for postal workers and mail carrier assistants at a U.S. Postal Service facility in Inglewood, Calif., on July 18, 2022. Patrick T. Fallon/AFP via Getty Images A hiring ad is displayed at a store in Columbia, Md., on Sept. 18, 2025. Experts say job seekers must optimize their resumes for relevant skills to pass automated screening systems and reach employers. Madalina Kilroy/The Epoch Times

A hiring ad is displayed at a store in Columbia, Md., on Sept. 18, 2025. Experts say job seekers must optimize their resumes for relevant skills to pass automated screening systems and reach employers. Madalina Kilroy/The Epoch Times Microsoft Bing is displayed on a monitor during an event introducing AI-powered Bing and Edge at Microsoft in Redmond, Wash., on Feb. 7, 2023. As generative AI becomes more common in hiring, specificity has grown more important for job applicants. Jason Redmond/AFP via Getty Images

Microsoft Bing is displayed on a monitor during an event introducing AI-powered Bing and Edge at Microsoft in Redmond, Wash., on Feb. 7, 2023. As generative AI becomes more common in hiring, specificity has grown more important for job applicants. Jason Redmond/AFP via Getty Images

Recent comments