Futures, Global Markets Tumble As Oil Soars Amid Fears Of Lenghty Energy Crisis

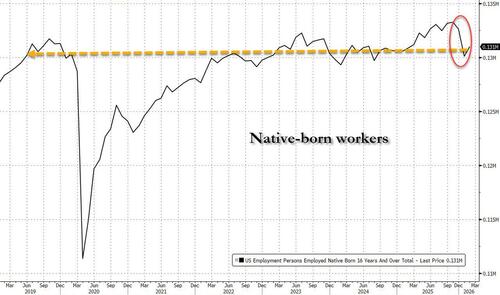

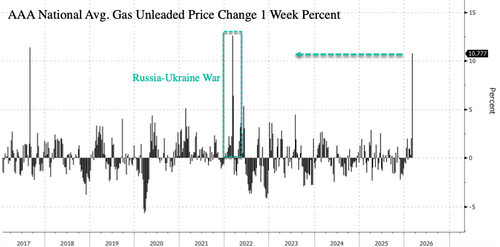

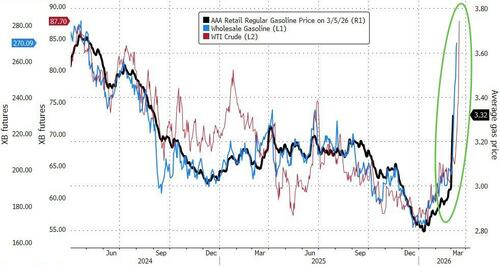

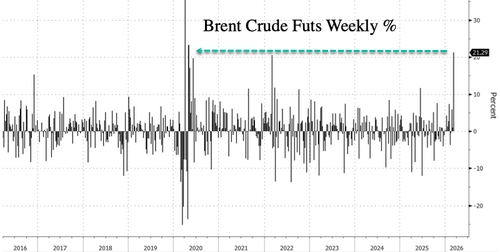

Seven days into the war on Iran and markets are getting increasingly shaky. US equity futures tumbled ahead of the February jobs report, and are on pace to close the worst week for global markets since 2020 deep in the red as the selloff in global bonds deepened after another jump in oil prices fanned fears that the war in the Middle East is fueling inflation. As of 8:00am ET, S&P 500 futures were 0.7% lower while contracts on the Nasdaq 100 fell 0.9% with all Mag7 names lower in premarket trading (NVDA -0.9%, GOOGL -0.6%). The yield on 10-year Treasuries climbed four basis points to 4.18%, on course for its biggest weekly advance since April as global government bonds tumble amid upside risks to inflation from higher energy prices. The dollar gained 0.2% while gold approached $5,100 an ounce. Commodities are mostly higher: Oil added another 6% with WTI now at $86.25; Oil prices are set for their strongest week since 2022, with the war in the Middle East effectively closing the Strait of Hormuz to shipping. Precious metals are mixed (gold down, silver +0.8%); base metals are lower. Overnight, the biggest catalysts was another escalation in Middle East with some articles pointing to potential shutdown in energy exports from Gulf states. Today's US economic data slate includes February jobs report, January retail sales (8:30am), December business inventories (10am) and January consumer credit (3pm). Fed speaker slate includes Waller (7:30am), Daly (8:30am, 10:15am), Goolsbee (9:50am), Paulson (10:15am), Miran (11:30am), Collins (1:20pm) and Hammack (1:30pm, 3:10pm).

In premarket trading, Magnificent Seven are lowe (Microsoft -0.3%, Meta -0.5%, Tesla -0.6%, Alphabet -0.9%, Apple -0.7%, Amazon -1%, Nvidia -1.3%)

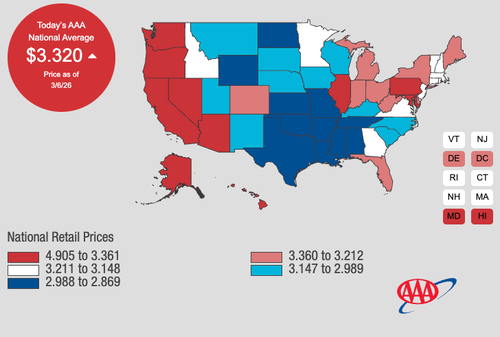

- Energy stocks are rising and airline stocks are declining as oil prices hit their highest level since 2024 and gas prices gained as the Iran conflict disrupted shipping through the Strait of Hormuz, limiting oil supply.

- Gap Inc. (GAP) falls 8% after reporting fourth-quarter sales and profit that came in slightly below expectations, as two of its apparel chains underperformed. Old Navy, the company’s biggest brand, and Athleta, its smallest, missed comparable-sales estimates.

- Guidewire Software (GWRE) rises 3% after the company reported second-quarter results that were much stronger than expected. It also raised its full-year forecast.

- Marvell Technology (MRVL) rallies 11% after the chipmaker said its year-over-year revenue growth rate will accelerate each quarter throughout fiscal 2027, a bullish target that shows soaring demand from data center-related applications.

- Nutex Health Inc. (NUTX) plunges 28% after the health-focused application software firm reported revenue for the fourth quarter that missed the average analyst estimate.

- Samsara (IOT) climbs 11% after the technology firm reported fourth-quarter adjusted earnings per share that topped the average analyst estimate.

- Trade Desk (TTD) slips 1% after Wedbush downgraded the advertising technology company to underperform — a sell equivalent — from neutral, saying the impact of an OpenAI partnership is “overestimated.”

In corporate news, Anthropic vowed to legally contest a Pentagon decision to declare it a threat to the US supply chain under an authority normally reserved for foreign adversaries, escalating a showdown with the Trump administration over AI safeguards.

The Iran war has entered its seventh day, with Iran firing a barrage of missiles and drones across the Persian Gulf and Israel renewing its airstrikes. Qatar’s energy minister sparked a powerful spike in energy price after he warned that war in the region could “bring down the economies of the world” and predicted that all Gulf energy exporters would shutter production within weeks, in an interview with the Financial Times. This is precisely what we warned about yesterday in "JPMorgan's New Hormuz Closure Math: Just 3 Days Until Commodity Chaos."

In the latest developments in the Middle East, Iran fired a barrage of missiles and drones targeting countries across the Persian Gulf overnight, while Israel renewed airstrikes on the Islamic Republic in a war that’s entered a seventh day with no end in sight. Saudi Arabia, Kuwait and Bahrain were among those came under renewed attack from the Islamic Republic, while Israeli airstrikes hit Tehran and Beirut.

Trump told NBC News that he wants Iran’s leadership structure fully removed, and that he has some names in mind for a “good leader.” The financial and logistical troubles the Iran war is causing for the global aviation industry are compounding by the day, with the number of canceled flights to Middle East hubs surpassing 27,000 since fighting began even as carriers look to resume some operations.

Still, US stocks are set to outperform global peers in a week that saw Middle East conflict drive fears of energy-driven price pressures, as traders awaited US jobs and retail sales data for insight into the Federal Reserve’s appetite for rate cuts.

That's the good news for Trump, the bad news is that retail gasoline hit $3.32 a gallon on Thursday as the Iran conflict disrupts energy supplies from the Middle East. At the same time, the selloff in global bonds deepened on concern the shock to energy markets could broaden and drive inflation higher.

Friday’s market moves are capping a week of sharp swings in which investors repeatedly recalibrated their outlook on the impact of the US-Israeli war against Iran. Fears that a near-complete halt in traffic through the Strait of Hormuz could trigger a new inflation spike have led investors to scale back bets on Federal Reserve interest-rate cuts.

“This is an anxiety not only about how long the conflict goes on, but what kind of effect it’s going to have on the mix between growth and inflation,” Peter Oppenheimer, chief global equity strategist at Goldman Sachs Group Inc., told Bloomberg TV. “The issue really is 20% of world supplies are going through that channel, it’s obviously very, very significant.”

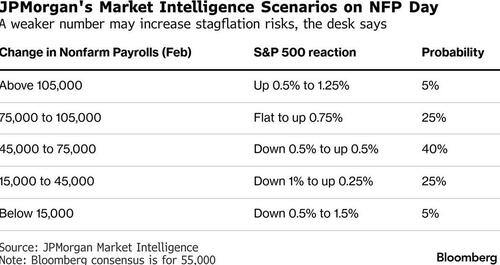

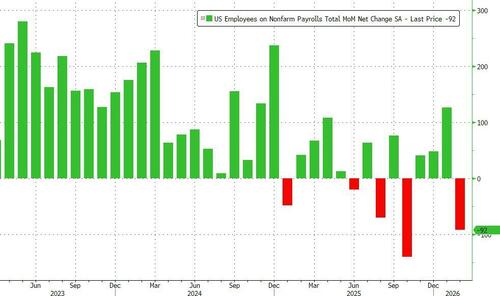

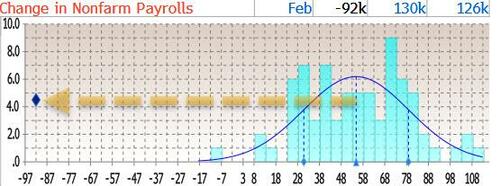

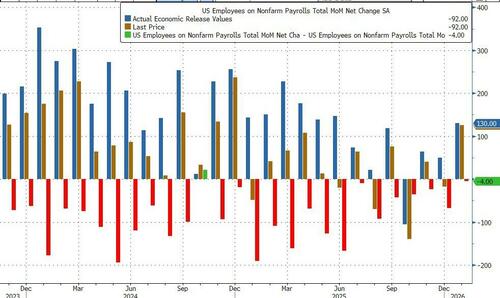

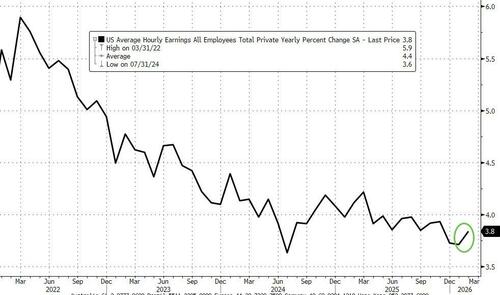

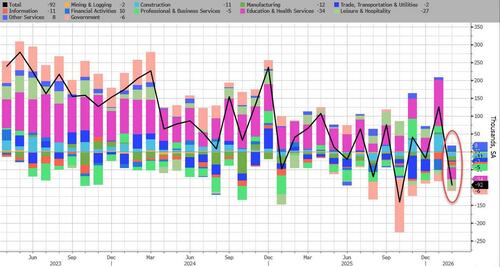

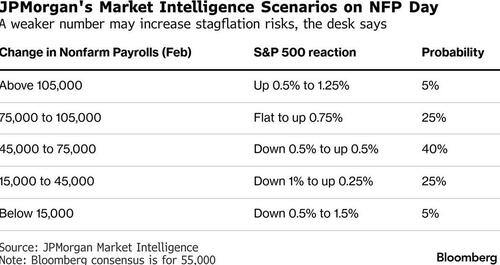

Today’s jobs report may offer more insight on the Fed’s rate path. Headline NFP print estimate is currently 55k, down from 130k last month with unemployment rate expected unchanged at 4.3%. Bloomberg whisper number for headline print is currently 55k (our full preview is here).

“The market would likely interpret robust job creation as evidence that the US economy remains on solid footing,” said Florian Ielpo, head of macro research at Lombard Odier Investment Managers. “This would accelerate the current rapid return to US equities and further fuel the reverse rotation we’ve observed over the past two weeks.”

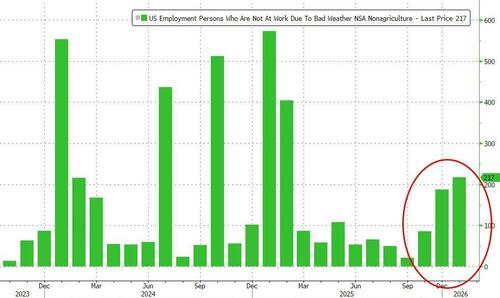

Anna Wong, Chief US Economist at Bloomberg Economics, expects a tepid job report, largely reflecting temporary disruptions.

She forecasts the US economy to have added just 13,000 jobs in February, down from 130,000 in January. The consensus among analysts is for 55,000, and the “whisper” is for 65,000.

“For this print, the stronger the better given the increase in inflation expectations due to energy prices,” the JPMorgan Market Intelligence desk led by Andrew Tyler says. “A weaker number will increase rate cut expectations, but the risk is stagflation in the near-term given the expected increase in inflation.”

Bond yields are ticking higher heading into the print, and the dollar is muted, with markets pricing in less than 40 basis points of rate cuts for the rest of this year. In another sign of risk aversion, gold remains on track for its first weekly decline in over a month, pressured by a stronger dollar and inflationary risks tied to the Middle East conflict.

Traders slashed bets on Bank of England rate cuts for 2026, pricing just about a 50% chance of a quarter-point move. The yield on two-year gilts surged 13 basis points to 3.93%. Money markets are also fully pricing in that the European Central Bank will raise borrowing costs this year, a turnaround from a week ago when a cut was viewed more likely.

European stocks are now in the red after opening higher. Energy is up, while media, construction and technology sectors fall. Here are some of the biggest movers on Friday:

- Lufthansa shares climb as much as 4% after Europe’s largest carrier reported strong results and said it sees “significant” improvement in earnings in 2026.

- SFS rises as much as 6.1%, recovering some of this week’s losses, after the maker of components for the construction and automotive industries delivered better-than-expected results, according to analysts.

- ITV shares climb as much as 8.1% after Kepler Cheuvreux analyst Conor O’Shea raised his recommendation on the stock to buy from hold as he sees the weakness in advertising demand dissipating.

- Engineer IMI shares rise as much as 4.6% after the company delivered results ahead of expectations and announced a new £500 million buyback, supported by solid cash conversion.

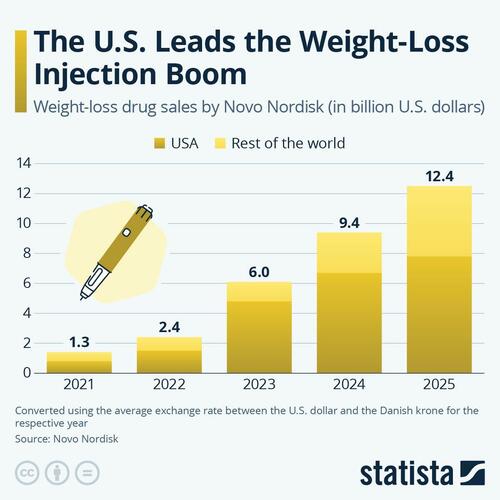

- Zealand Pharma shares sink as much as 33%, the most on record, after mid-stage trial results for its experimental obesity shot being developed with Roche fell short of expectations.

- BE Semiconductor Industries shares fall as much as 12% as traders point to an article in Korean media on high-bandwidth memory.

- Infineon shares fall as much as 4% after UBS cut the recommendation on the chipmaker to neutral from buy, seeing limited upside to the firm’s margins and 2027 AI outlook, and growing inventory risk from a slowdown in China.

- Comet shares drop as much as 13% after the supplier of radio-frequency tools reported Ebitda for the full year that missed the average analyst estimate.

- Spie shares slide as much as 5.5% after the technical services provider delivered softer fourth-quarter organic growth across the majority of divisions, while consensus had already anticipated the improved mid-term margin goal, according to analysts at Jefferies.

- UCB drops as much as 2.9% after Morgan Stanley downgrades the stock to equal-weight from overweight, citing increasing concerns around the Belgian biopharmaceutical company’s growth story

In FX, the greenback advances with the Bloomberg Dollar Spot Index rising 0.2%.

In rates, treasury futures continue to be pressured, sitting on session lows into the early US session as WTI futures extend their climb through $86 barrel, higher by another 6% on the day. US yields cheaper by 2bp to 5bp across the curve in a bear flattening move with 5s30s spread down around 2bp on the day. US 10-year yields trade close to highs of the day around 4.17%, with gilts leading the selloff in bonds with UK two-year yields up 11 bps as traders pare bets on easing by the BOE this year. In Europe, bonds underperform further with front-end gilts cheaper by 12bp on the day. US session focus includes February nonfarm payrolls at 8:30am New York. Fed cut premium continues to fade out of front-end swaps, which now price in around 32bp of rate cuts for the year and the first full 25bp move priced out to the October meeting. In Europe, a full rate hike is now priced by the end of the year. Treasury auctions resume next week with 3-, 10- and 30-year sales for a combined $119 billion.

This week’s spike in Treasury yields is a sharp reversal from last month when they notched their sharpest drop in a year. Swaps now price between one and two Fed cuts for 2026 compared to as many as three a week ago. The dollar, meanwhile, has reclaimed its status as the ultimate haven as it headed for its best week in more than three years.

“Unless there can be some real political breakthrough that leads to a ceasefire, the dollar won’t be ready to resume a decline anytime soon,” ING Bank strategist Chris Turner wrote in a note. “The story will remain one of governments trying to handle the fallout of high energy prices, a negative for bond markets around the world.”

In commodities, Brent crude futures climb to a fresh high this week above $88 a barrel while European natural gas futures also rise after Qatar’s energy minister told the Financial Times the Middle East conflict will likely force Persian Gulf countries to halt energy exports.

Today's US economic data slate includes February jobs report, January retail sales (8:30am), December business inventories (10am) and January consumer credit (3pm). Fed speaker slate includes Waller (7:30am), Daly (8:30am, 10:15am), Goolsbee (9:50am), Paulson (10:15am), Miran (11:30am), Collins (1:20pm) and Hammack (1:30pm, 3:10pm).

Market Snapshot

- S&P 500 mini -0.6%

- Nasdaq 100 mini -0.8%

- Russell 2000 mini -0.5%

- Stoxx Europe 600 -0.4%

- DAX -0.2%

- CAC 40 -0.3%

- 10-year Treasury yield +3 basis points at 4.17%

- VIX +0.4 points at 24.19

- Bloomberg Dollar Index +0.1% at 1205.77

- euro -0.2% at $1.158

- WTI crude +3.9% at $84.13/barrel

Top Overnight News

- U.A.E. Explores Freezing Iranian Assets to Punish Tehran for Attacks: WSJ

- Oil Soars as Iran War Threatens Long Energy Outage; WTI Crude Tops $85 a Barrel as War Paralyzes Hormuz Traffic: BBG

- Israeli Military Moving to ‘Next Phase’ of Iran Campaign: WSJ

- Iran barrage sweeps Mideast as Trump weighs in on succession: BBG

- Iran says countries have begun mediation efforts: WSJ

- Iran’s Attacks on the UAE Are Costing It Access to Vital Imports: BBG

- Tehran Is Fighting With Jets That Date Back to the Vietnam War: WSJ

- Trump on rising gas prices during Iran operation - 'If they rise, they rise': RTRS

- SoftBank Seeks Record Loan of Up to $40 Billion for OpenAI Stake: BBG

- Drone strike drives calls to end British military presence on Cyprus: RTRS

- Trump Faces Criticism From UAE Business Community Over Iran War: BBG

- Israel targets bunker beneath Khamenei's compound in new wave of attacks: RTRS

- Israel's Hezbollah attacks are likely to continue beyond Iran war: RTRS

- Turkey asks Britain's MI6 to step up protection of Syria's Sharaa: RTRS

- Wealthy Moscow cuts investment, revealing Russia's deeper budget problems: RTRS

- Axel Springer Strikes $770 Million Deal for U.K.’s Daily Telegraph: WSJ

- Texas Republican Ends Re-Election Bid After Affair: AP

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded somewhat mixed following the risk-averse mood in the US as geopolitics continued to dominate headlines, and with participants also cautious heading into key US jobs data. ASX 200 was dragged lower as the heavy losses in miners, materials and resources sectors offset the gains in tech and telecoms, while recent higher energy prices stoke inflationary concerns and narrow the policy space for the RBA. Nikkei 225 traded indecisively and swung between gains and losses with very little fresh macro catalysts for Japan. Hang Seng and Shanghai Comp trade higher, albeit to varying degrees, with the mainland rangebound, while Hong Kong outperforms amid tech strength and as participants reflected on recent earnings from the likes of JD.com and Bilibili.

Top Asian News

- Japan's Finance Minister Katayama said Japan is ready to take timely steps against the economic impact from the Iran conflict, adds Japan is not fully out of deflation. Japan is ready to act on market volatility while consulting international authorities. Bank of Japan's monetary policy is focused on inflation and not on currency intervention. Wage gains are not BoJ's direct target but is key to price stability.

- PBoC adviser Huang Yiping said China's push to shift its economy towards consumer spending will take a long time, according to Bloomberg. Investors should dampen expectations for “aggressive” stimulus as the government doesn’t view it as a “crisis time”.

European bourses (STOXX 600 -0.1%) initially traded mixed, but now hold a strong negative bias as the risk tone soured. Little driving the latest downturn, but with focus remaining on the geopolitical situation. European sectors were initially mixed, but now hold a negative bias. Energy takes the top spot, buoyed by strength in underlying energy prices, whilst Industrials is lifted by Defence names. To the downside, Media lags, hampered by post-earning losses in UMG (-5.5%).

Top European News

- EU GDP Growth Rate YoY 3rd Est (Q4) Y/Y 1.2% vs. Exp. 1.3% (Prev. 1.4%, Low. 1.3%, High. 1.3%)

- EU Employment Change QoQ Final (Q4) Q/Q 0.2% vs. Exp. 0.2% (Prev. 0.2%)

- UK Halifax House Price Index YoY (Feb) Y/Y 1.3% vs. Exp. 0.9% (Prev. 1.1%, Rev. From 1%, Low. 0.5%, High. 0.9%).

- UK Halifax House Price Index MoM (Feb) M/M 0.3% vs. Exp. 0.3% (Prev. 0.8%, Rev. From 0.7%).

- Norwegian Manufacturing Production MoM (Jan) M/M -0.3% (Prev. -0.1%).

FX

- DXY is relatively flat with a mild upward bias after a session of gains on Thursday. Thursday's action was spurred by a haven bid, and as yields climbed on firmer oil prices, in addition to well-received data ahead of NFP.

- EUR/USD returned below the 1.1600 handle after initially reclaiming the level in APAC trade, with downside exacerbated by the ongoing geopolitical and energy-related concerns, alongside the firming USD as traders flock to the haven. Little reaction to the rhetoric from ECB officials. Meanwhile, traders fully price in a 25bps ECB hike this year, Bloomberg reported. EUR/USD trades in a 1.1583-1.1621 range, within Thursday’s 1.1559-1.1647.

- GBP/USD is subdued amid the recent USD strength but remains tucked within yesterday’s 1.3297-1.3387 range. News flow for the UK remains light, but recent headlines centre around UK PM Starmer's shift from initially refusing to assist US military operations against Iran to later granting access to British military bases for "limited" and "defensive" purposes.

- USD/JPY is firmer with the JPY the underperforming G10 amid a rise in US yields and given Japan’s exposure to energy imports. The pair traded sideways for most of the APAC session, given the indecisive mood in Japan; although, it gradually edged higher as domestic sentiment stabilised.

- Antipodeans are mixed, the AUD mildly outperforms amid gains in copper and gold prices and as recent inflationary concerns spurred some outside bets for a rate hike by the RBA this month. AUD/USD trimmed gains after hitting an intraday peak of 0.7047 (vs low 0.7015). NZD/USD hit a current low of 0.5881 (vs high 0.5916), with the 200 DMA (0.5876).

Central Banks

- BoJ Deputy Governor Himino said Japan is seeing inflation in terms of rising consumer prices, adds BoJ is keeping monetary conditions accommodative and gradually adjusting degree of monetary accommodation. Will continue to scrutinise market moves and their impact on the economy and prices. Rising import costs from a weak yen may affect inflation trends. BoJ policy is not aimed at FX rates, yet FX shifts impact inflation and the economy.

- ECB's Escriva said it is highly unlikely the ECB touches rates at its next meeting.

- ECB's Sleijpen said the ECB policy is still in a good place and data dependent.

- PBoC Governor said the central bank will flexibly use various monetary policy tools including interest rates and RRR cuts; PBoC said China has no intention to, not necessary to use FX rate to gain trade competitiveness.

Fixed Income

- USTs are lower. US paper spent much of the overnight session trading sideways, alongside weakness across the crude complex. However, as energy prices turned positive – the benchmark also dipped off best levels in the European morning. The geopolitical situation remains unchanged, with missiles being launched from both sides – but updates related to the Strait of Hormuz helped to improve sentiment, including; a) China is in talks with Iran to allow safe oil and gas passage through Hormuz, b) US allowed India to purchase Russian oil for 30-days. USTs now trade at the lower end of a 112-03 to 112-14+ range.

- Bunds follow peers, for the same reasons as above, and currently towards the bottom end of a 126.96 to 127.32 range. European newsflow has seen a few ECB speakers take to the wires, to generally touch on the Iran situation, whilst Escriva said it is “highly unlikely” that the ECB touches rates at it next meeting. From a yield perspective, the 10yr yield now trades at 2.868% (vs YTD high at 2.909%). Thereafter, 2.938%, a peak spurred by the mini-banking crisis surrounding the collapse of First Brands.

- Gilts underperform, lower by around 75 ticks and trades at the bottom end of a 90.43 to 91.25 range. Underperformance which can be explained by, a) net-importer of energy, b) BoE rate cut expectations entirely priced out for the year; pre-war pricing indicated a cut in either March or April. A lot of focus has been on the front-end Gilt situation, with the 2yr yield now surging beyond 3.90%, to now approach the 4% mark from mid-October 2025 – back where traders were increasingly sceptical of Chancellor Reeves and her Autumn Budget.

Commodities

- Crude benchmarks remain firmer, though are off their best levels seen yesterday, which saw Brent firmer by 4.9%, marking the highest close since the conflict between the US, Israel, and Iran began. As the conflict reaches its seventh day, there’s been little sign of a reprieve following comments by the Iranian Foreign Minister via NBC News that Iran is ready for a US ground invasion of the country, with further comments this morning via Al Arabiya where the FM said that Iran has no choice but to continue fighting. WTI and Brent are trading in the upper end of USD 78.24-82.93/bbl and 83.16-86.35/bbl, ranges respectively.

- In the precious metals space, spot gold briefly reclaimed the USD 5,100/oz level after facing pressure yesterday, when reports indicated the NBP is considering gold sales for defence funding, which saw the yellow metal fall below the USD 5000/oz mark. A slightly softer dollar and the Iranian conflict boosted haven appeal for gold during the APAC session. However, as the European session gets underway, the yellow metal has slipped below USD 5100/oz due to recent USD strength as the USD continues to be the preferred haven amid ongoing geopolitical tensions. XAU and XAG are trading within the upper end of USD 5066.93-5143.84/oz and 81.80-84.76/oz, ranges respectively.

- Base metals have rebounded from the prior day's trough, largely underpinned by firmer APAC stocks. However, copper prices have seen slight pressure since the European session began, tracking headwind in European equities, thus weighing down the red metal. 3M LME copper trades within the lower end of a USD 12.87-12.91k/t range.

- US-sanctioned gas tanker reportedly transited the Strait of Hormuz this morning, according to Bloomberg; The Danuta I, sailed under the flag of Palau.

- US has issued a temporary 30-day waiver to allow sale of Russian oil currently stranded at sea to India, according to a report citing two officials. Officials say general licence only authorises transactions involving Russian oil already stranded at sea, unlikely to provide significant financial benefit to Russia.

- Trump admin reportedly rules out deploying Treasury Department to trade oil futures for now amid belief that it will have a limited meaningful effect, Bloomberg sources report.

- Japan is reportedly considering a release from its national oil stockpile, even without coordinated international action, Kyodo reported.

- Gold is being sold at a discount of as much as USD 30/oz in Dubai, Bloomberg reported citing sources; due to elevated shipping and insurance costs.

- Qatar Energy Minister al-Kaabi cautions that the Middle East conflict could cause all Gulf energy producers to have to shut production within weeks, increasing oil to USD 150/bbl, FT reported.

- India has asked all its refiners to maximise production of liquefied petroleum gas and make the fuel available only to three state-run companies - Indian Oil (IOCL IS), HPCL (HPCL IS) and BPCL (BPCL IS), a government cited by ET order showed.

- Reliance (REL IS) is looking to buy Russian oil after the US granted India a licence to temporarily buy cargoes, Bloomberg reported citing sources.

Geopolitics

- US President Trump said oil appears to have pretty much stabilised, and further action to reduce pressure on oil is coming, also said Iran wants to ‘make a deal’ to end the conflict.

- Iran reportedly targeted US bases in Kuwait with drones, according to Iranian State Media; Iran’s army says drone attacks against US bases in Kuwait to continue in the coming hours.

- Iran to use newer missiles in the coming days, Fars News reported.

- US Secretary of War Hegseth said US has just begun to fight in Iran and that Iran is wrong in its calculations if it thinks we can't continue the war. Firepower used in Iran is to increase significantly.

- Maersk (MAERSKB DC) said it has decided to temporarily suspend services connecting the Middle East to the far East and Europe; decision has been taken as a precautionary measure.

- Iranian Foreign Minister said Iran has no choice but to continue fighting, Al Arabiya reported.

- US and Israel have increased airstrikes on Iran’s border with Iraq as US President Trump called on the Kurdish minority there to rise up against Iran's government, according to Washington Post.

- Satellite imagery taken Tuesday shows extensive damage to Iran’s Khojir missile production site, according to Washington Post.

- US Central Command Commander said our operation against Iran is going well and we are moving at a fast pace. said:. Ballistic missile attacks by Iran have decreased by 90% since day one. As we transition to the next phase of the operation, we will dismantle Iran's missile production capability.

- US House votes 219-212 to reject the war powers resolution on Iran.

- Foreign ministers of Arab League member states will hold an emergency meeting on Sunday to discuss Iran’s attacks on several countries in the region, WSJ reported. The meeting will be held via video conference, was requested by Saudi Arabia, according to Arab sources.

- Israeli PM's aide said "so far the operation is proceeding as planned; we are seeing the first cracks in the regime, but patience is needed"; adds that US President Trump and Israeli President Netanyahu speak daily.

- Republicans are preparing to confront a huge price tag for the Middle East war following closed-door briefings which detailed the fast consumption of munitions and lack of any firm deadline for the campaign, Politico reported citing sources. Senior Republicans expect the administration to request tens of billions of dollars, with some lawmakers hearing estimates that the Pentagon is spending as much as USD 2bln/day.

US Event Calendar

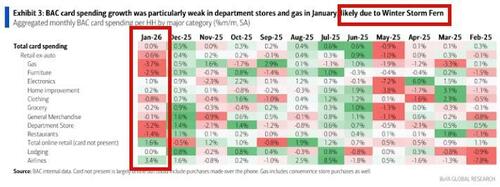

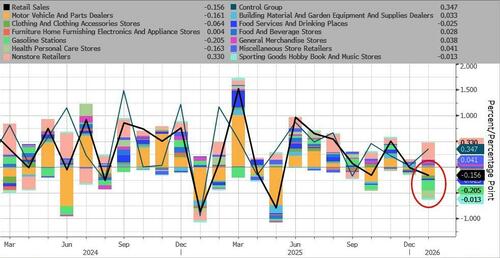

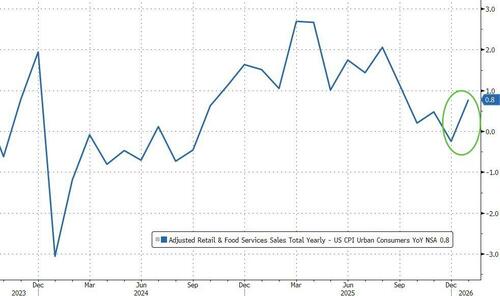

- 8:30 am: United States Jan Retail Sales Advance MoM, est. -0.3%, prior 0%

- 8:30 am: United States Jan Retail Sales Ex Auto MoM, est. 0%, prior 0%

- 8:30 am: United States Feb Change in Nonfarm Payrolls, est. 55k, prior 130k

- 8:30 am: United States Feb Change in Manufact. Payrolls, est. -1.5k, prior 5k

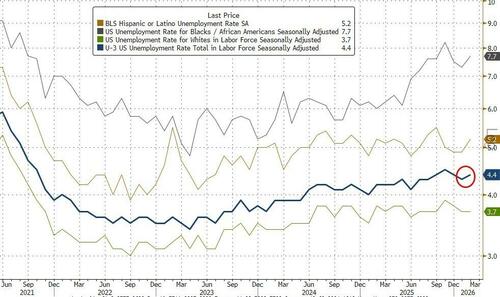

- 8:30 am: United States Feb Unemployment Rate, est. 4.3%, prior 4.3%

- 7:30 am: United States Fed’s Waller on Bloomberg TV

- 8:30 am: United States Fed’s Daly on CNBC

- 9:50 am: United States Fed’s Goolsbee on Bloomberg TV

- 10:15 am: United States Fed’s Daly & Paulson Participate in Panel Discussion

- 11:30 am: United States Fed’s Schmid Speaks on Policy and Outlook

- 11:30 am: United States Fed’s Miran on CNBC

- 1:20 pm: United States Fed’s Collins Delivers Keynote Address

- 1:30 pm: United States Fed’s Hammack Speaks at Monetary Policy Forum

- 3:10 pm: United States Fed’s Hammack Appears on Bloomberg TV

Main Rating Changes:

DB's Jim Reid concldues the overnight wrap

There's not much synchronisation in markets at the moment as we welcome in another payrolls Friday today. This one will be obviously overshadowed by events in the Middle East. Indeed, the market selloff resumed over the last 24 hours, with equities and bonds posting fresh declines as the war in the Middle East showed no sign of ending. That’s raising fears about a more protracted conflict, with investors increasingly alarmed that the oil price spike will become entrenched, pushing up inflation around the world. Indeed, Brent crude was up another +4.93% yesterday to $85.41/bbl, closing at its highest level since mid-2024. And in turn, that’s meant investors have kept pricing out the chance of further rate cuts, leading to another spike in bond yields on both sides of the Atlantic. Indeed, 10yr bund yields (+9.0bps) posted their biggest daily jump in exactly a year, back when the debt brake reforms were announced. There has been some respite in the Asia session as there are some hopes that the US is looking at options to address the energy price spike.

The reality is though that we continue to trade competing headlines, with risk appetite swinging back and forth over the past 24 hours. At the outset yesterday, there was actually some optimism after Iran’s IRNA reported that the deputy foreign minister said they were ready to get rid of their uranium stockpile in the US talks, “provided we get something good in return”. However, any optimism that some kind of negotiated settlement could be enroute faded as the session went on, with signs that, if anything, the conflict was spreading. In fact, Azerbaijan was the latest country to be hit by Iranian drones, and their Defense Ministry said that “These acts of aggression will not go unanswered”. And elsewhere across the region, a refinery was struck in Bahrain and the US evacuated its embassy in Kuwait, while the UAE told Abu Dhabi residents to seek immediate shelter. Around the same time Trump suggested he wanted a say in the Iran leadership succession which potentially complicates prospects of a diplomatic resolution. And Iran’s Foreign Minister said that it currently saw no reason to engage in talks with the US.

We did see some improvement in market sentiment late in the US session, as Interior Secretary Doug Burgum said that the administration is looking at options to address the spike in oil and gasoline prices, with Reuters reporting that this could include potential action involving the oil futures market. Later in the evening the US issued a 30-day waiver for Indian purchases of Russian oil. According to Treasury Secretary Bessent, the measure is aimed at Russian oil that is already stranded at sea, so should be viewed as more of a short-term relief for Asian refiners. Coupled with Burgum’s comments, this has supported some reversal in oil price gains overnight, with Brent down -0.94% to $84.61/bbl as I type. S&P 500 futures (+0.22%) are a touch higher, while the dollar index is down -0.37% after yesterday’s +0.55% gain.

But net net, it’s been only a partial offset from yesterday’s news flow that saw Brent crude (+4.93%) rise to $85.41/bbl, whilst WTI (+8.51%) rose to $81.01/bbl, its biggest increase since May 2020. What’s been notable is that investors are increasingly pricing in an extended conflict, and we can see that from energy futures further out the curve. For instance, the Brent crude oil future for 12 months’ time was up another +1.58% yesterday to $69.90/bbl, which is their biggest increase so far this week. So in other words, there’s growing doubt that this is going to be over quickly.

With oil prices continuing to rise, investors grew more doubtful about central bank rate cuts this year, with the prospect of hikes even coming into view. That was particularly clear for the ECB, where a hike by December moved up to a 63% chance by the close, which is the first time in 2026 that it’s been above 50%. A 55% probability of a cut was priced in as recently as last Friday. So that contributed to a sharp selloff for European sovereign bonds, with yields on 10yr bunds (+9.0bps), OATs (+11.7bps) and BTPs (+13.2bps) all moving higher. Meanwhile, ECB officials struck a watchful tone over the situation, with Banque de France Governor Villeroy saying he didn’t see any reason today to raise rates, while ECB Vice President de Guindos said an extended war could raise inflation expectations and prompt a change in the policy stance.

It was a similar story in the US, where markets are now pricing in just 40bps of Fed cuts by December, the fewest so far this year. That came as Fed officials acknowledged the potential for inflation to rise, with Richmond Fed President Barkin saying “Gas prices, obviously, if they’re up, that is inflationary”. And remember that core PCE was already 3.0% before this latest shock, so investors have become increasingly sceptical that the Fed will be able to deliver rapid rate cuts under a new Chair. In addition, the latest weekly initial jobless claims were slightly beneath expectations, at 213k in the week ending Feb 28 (vs. 215k expected), so that added to the optimism ahead of today's jobs report. And we saw more positive comments on the labour market from Fed Vice Chair Bowman, who said it showed more “signs of stabilizing”. So collectively, that data and the latest rise in oil prices pushed Treasury yields higher, with the 2yr yield (+3.1bps) up to 3.58%, whilst the 10yr yield (+3.9bps) moved up to 4.14%.

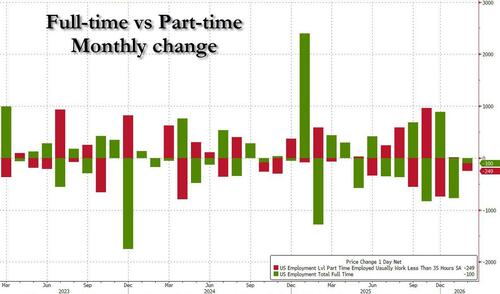

The US labour market will remain in the spotlight today, as we’ll also be getting the latest jobs report for February. In terms of what to expect, our US economists think that payrolls will be up +30k, coming down from the 13-month high of +130k in January. Then for unemployment, they see that remaining at 4.3%, but they note that carries elevated risks in both directions given that the BLS will implement their annual population controls. For more details, click here for their preview.

For equities, it was another rough day as fears mounted about a sustained oil shock. So the S&P 500 (-0.56%) moved back into negative territory for 2026, though it did recover from an intra-day low of -1.44% after the news that the US could intervene in energy markets. Interestingly, software and services stocks were the standout outperformer (+1.84%), with that component of the index hitting a one-month high. This included a +1.59% gain for Oracle as Bloomberg reported that it is planning a round of job cuts. By contrast the Philadelphia semiconductor index fell -1.17% as Bloomberg reported that US officials were mulling regulations that would require approval for exports of AI chips to anywhere in the world. And it was a rough session more broadly, with consumer staples (-2.27%) and materials (-2.43%) stocks leading on the downside in the S&P amid the concern over energy costs. There were even bigger declines in Europe given their greater exposure to any energy shock. So the STOXX 600 (-1.29%) fell back, alongside declines for the DAX (-1.61%), the CAC 40 (-1.49%) and the FTSE 100 (-1.45%).

In Asia, the Nikkei (+0.51%) is recovering from initial losses but is still on course for a weekly decline exceeding -5.5%. Meanwhile, Chinese related stocks are making gains, with the Hang Seng (+1.85%) leading the way as it benefits from a rally in recently weakened technology shares, while the CSI (+0.20%) and the Shanghai Composite (+0.25%) are also experiencing modest increases. The KOSPI has recovered from earlier larger losses and is -0.15%, but still heading towards a weekly drop of more than -10%, and the S&P/ASX 200 (-1.03%) is trading notably lower, on track for a weekly loss of approximately -4.0%.

Finally, this weekend, there’s a German state election taking place in Baden-Württemberg, which will be the first of five regional elections this year. Our economists in Germany have a preview of the votes (link here), where they outline why the election outcomes matter for the stability of the Merz government. They point out that victories for the governing parties might positively impact reform momentum at the federal level over the spring/early summer. But they also point out that heavy losses have been a catalyst in the past for early federal elections, as seen in 2005 (after the SPD lost the key state of North-Rhine Westphalia) and in 2024 (after a series of electoral losses for the FDP).

Looking at the day ahead, the main data highlight will be the US jobs report for February, but we’ll also get US retail sales for January and German factory orders for January. From central banks, we’ll hear from the Fed’s Daly, Paulson, Collins and Hammack, long with the ECB’s Cipollone and Schnabel.

Tyler Durden

Fri, 03/06/2026 - 08:28

Smoke rises from a reported Iranian strike in the industrial district of Doha, Qatar, on March 1, 2026. Mahmud Hams/AFP via Getty Images

Smoke rises from a reported Iranian strike in the industrial district of Doha, Qatar, on March 1, 2026. Mahmud Hams/AFP via Getty Images

Anthropic CEO Dario Amodei. Photos: Getty Images

Anthropic CEO Dario Amodei. Photos: Getty Images

A black plume of smoke rises from a warehouse at the industrial area of Sharjah City in the United Arab Emirates following reports of Iranian strikes in Dubai, United Arab Emirates, March 1, 2026. (AP Photo/Altaf Qadri)

A black plume of smoke rises from a warehouse at the industrial area of Sharjah City in the United Arab Emirates following reports of Iranian strikes in Dubai, United Arab Emirates, March 1, 2026. (AP Photo/Altaf Qadri)

Russian Foreign Ministry image/Flickr

Russian Foreign Ministry image/Flickr

Senate Minority Leader Chuck Schumer (D-N.Y.) speaks at a news conference on Capitol Hill in Washington on Jan. 14, 2025. Madalina Kilroy/The Epoch Times

Senate Minority Leader Chuck Schumer (D-N.Y.) speaks at a news conference on Capitol Hill in Washington on Jan. 14, 2025. Madalina Kilroy/The Epoch Times

Recent comments