Guyana: The Little Caribbean Country With A Big Role To Play In Trump's Regional Shift

Authored by John Haughey via The Epoch Times,

With the U.S. capture of Venezuelan strongman Nicolás Maduro in a bold Jan. 3 military raid and a large naval force still prowling the southern Caribbean to ensure that Maduro’s successors cooperate with the Trump administration, other subtle, but key, developments in the region can be overlooked.

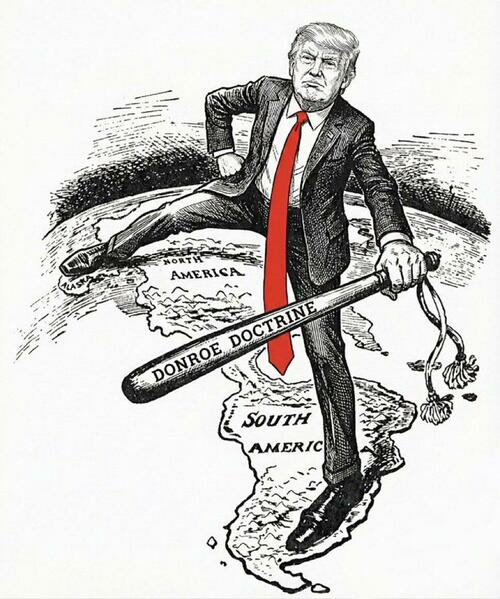

Among under-the-wire events is a December 2025 agreement between the United States and Venezuela’s neighbor, Guyana. That agreement could have profound implications, not only in the immediate context of unfolding events in Venezuela, but also for the long-term execution of the Trump Corollary to the Monroe Doctrine, unveiled in November 2025 by U.S. President Donald Trump.

A U.S. delegation led by senior Pentagon adviser Patrick Weaver and Acting Deputy Assistant Secretary of War Joseph Humire met with Guyanese President Irfaan Ali in the nation’s capital, Georgetown, on Dec. 9.

Ali told Guyanese media outlets that the nations had signed a statement of intent to “expand joint military cooperation,” a process that will be “evolving ... in the coming months.” He stated that there “will be greater discussions on more levels of cooperation and the integration of [the two countries’] work.”

The statement of intent is not a formal mutual defense treaty, he said, calling it a “reinforcement” of long-term training and collaboration between the United States and Guyana.

But such a pact could be on the table, Ali hinted, referring to the U.S. military effort dubbed Operation Southern Spear.

“The U.S. government now is launching what they call the Southern Spear of security,” he said. “They are now coming up with a strategy for the Western Hemisphere, and the U.S. government is to invest more and pay attention more to the [Caribbean] and Western Hemisphere.”

Southern Spear has been in the spotlight off Venezuela since September. The USS Gerald Ford, the world’s largest aircraft carrier, and the USS Iwo Jima, an amphibious assault ship, are the most visible components of the campaign that destroyed drug-smuggling speedboats, imposed a selective blockade on sanctioned oil tankers, and led to the Jan. 3 U.S. military operation that captured Maduro.

Guyana has a “growing role” in implementing that strategy, State Department principal deputy spokesman Tommy Pigott said in a Jan. 6 statement.

The commitment to “deepening security cooperation with Guyana to address shared challenges” was affirmed during a Jan. 6 phone call between U.S. Secretary of State Marco Rubio and Ali, Pigott said.

Secretary of State Marco Rubio (R) and Guyanese President Irfaan Ali stand for a photo opportunity as they meet on the sidelines of the U.N. General Assembly in New York City on Sept. 24, 2025. Stefan Jeremiah/POOL/AFP via Getty Images

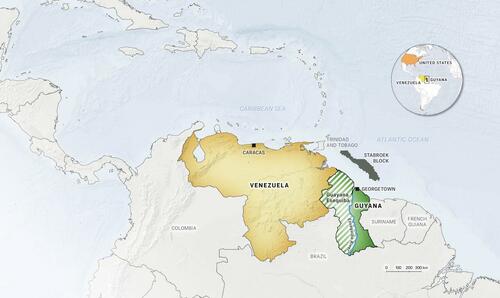

Territorial Dispute

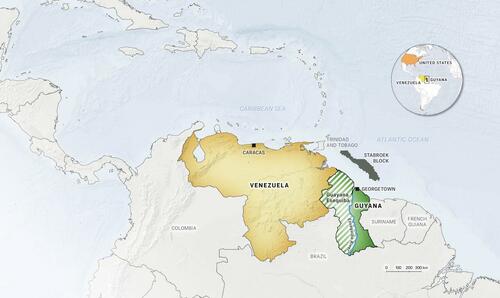

A former British colony, Idaho-sized Guyana is rich in minerals, has extensive offshore oil deposits, is perched on eastern Caribbean sea lanes, and is embroiled in an almost 200-year-old border dispute with Venezuela, used by the Maduro regime as an excuse to menace its sparsely populated neighbor with naval intrusions and troop buildups.

Venezuela has long claimed Guyana’s approximately 61,600-square-mile Essequibo region as its territory, despite a U.S.-mediated 1899 Paris ruling involving Spain, the UK, the Netherlands, and Venezuela, subsequently affirmed by the International Court of Justice.

Venezuela’s agitation over Essequibo, which spans two-thirds of Guyana, increased significantly after Exxon Mobil discovered oil in the Stabroek Block off its shores in 2008 and began drilling in 2015.

The Punta Playa deposit contains an estimated 11 billion barrels of oil, making it one of the 21st century’s largest petroleum finds. It produces 900,000 barrels daily as of November 2025, according to Exxon Mobil. Venezuela, by comparison, has an estimated 300 billion barrels of oil reserves but only produces 1 million barrels per day.

In 2013, the Venezuelan navy boarded and impounded a survey ship operated by Anadarko Petroleum, an Exxon Mobil contractor, before releasing it. In 2018, Venezuela approached and “intercepted” an Exxon Mobil survey ship, according to the Guyanese foreign ministry, forcing it to abandon explorations.

In November 2023, Maduro announced a “people’s vote” to “respond to the provocations of Exxon, the U.S. Southern Command, and the president of Guyana” with a Dec. 3, 2023, referendum asking Venezuelans to annex Essequibo.

Venezuelan leader Nicolás Maduro holds Simón Bolívar's sword as he speaks at a rally against a possible escalation of U.S. actions toward the country, at Fort Tiuna military base in Caracas, Venezuela, on Nov. 25, 2025. Leonardo Fernandez Viloria / Reuters

A map shows the Stabroek Block, an oil and gas reservoir off the coast of Guyana. Venezuela has long claimed Guyana’s 61,600-square-mile Essequibo region, despite a U.S.-mediated 1899 Paris ruling. Illustrated by The Epoch Times

Venezuelans approved the measure, paving the way for the province of “Guayana Esequiba.” The Maduro regime portrayed the outcome as a mandate by voters united by a decades-long, nationalistic, cross-party issue.

The brewing crisis spurred the UK to dispatch a warship, a U.S. Army delegation to visit Guyana, and the Pentagon’s Southern Command to begin joint flight operations with the Guyana Defence Force, actions that convinced Maduro to meet with Ali in Saint Vincent and the Grenadines to sign the Argyle Accords and agree to de-escalate tensions.

But the Maduro regime has never complied with the Argyle Accords, instead amassing troops and military equipment along its border with Guyana, according to a March report by the Center for Strategic and International Studies. How Maduro’s deputy, Delcy Rodríguez, now sworn in as Venezuela’s acting president, will proceed in honoring the Argyle Accords is uncertain.

Increasing Provocations

In February 2024, less than two months after the Maduro–Ali pact, Venezuelan naval and air aggression forced Guyana to place a moratorium on oil exploration in the western reaches of the Stabroek Block.

In April 2024, Maduro signed a bill that formally established the Venezuelan state of “Guayana Esequiba” and began enlarging a base on Anakoko Island at the confluence of the Cuyuni and Wenamu rivers. Guyana claims that Venezuela has illegally occupied the island since 1966.

Vehicles drive past a sign indicating the entrance to Tumeremo, the Venezuelan-created administrative capital of Guayana Esequiba, on May 26, 2025. In April 2024, then-Venezuelan leader Nicolás Maduro signed a bill that formally established the Venezuelan state of “Guayana Esequiba” and began enlarging a base on Anakoko Island at the confluence of the Cuyuni and Wenamu rivers. Pedro Mattey/AFP via Getty Images

The provocations did not cease with Trump’s return to the White House in January 2025. The Venezuelan Ministry of Foreign Affairs openly mocked Ali as “the Zelensky of the Caribbean” in a March 1, 2025, statement posted to social media, referring to Ukrainian President Volodymyr Zelenskyy. That same day, an armed Venezuelan Guaiquerí-class patrol ship entered Guyana’s waters and approached the Liza Destiny, an Exxon Mobil vessel, demanding that the crew produce documents.

In late March 2025, Rubio traveled to Guyana.

“In my meeting with [Ali], we strengthened the economic and security ties between our two nations,” he wrote on X. “The United States stands with Guyana in support of its territorial integrity against the Maduro regime.”

A month before, in February, six Guyanese soldiers had been wounded along the Cuyuni River after suspected Venezuelan gang members opened fire. Similar events occurred in the same border area in May and August.

On May 25, 2025, Venezuela held regional and gubernatorial elections, including for “Guayana Esequiba.” Neil Villamizar, an admiral in the Venezuelan navy, was named governor after what the U.S. State Department called the “latest sham election” organized by the Maduro regime.

That same day, while commemorating the 59th anniversary of Guyana’s independence from Great Britain, Ali said Guyana was ready to defend its territory against Venezuela.

“[The] abuse of our airspace and our waterways by all kinds of criminal elements, all kinds of illegitimate trade [will no longer be tolerated],” Ali said in December 2025.

“We have to do this in partnership if we are to have a region that is safe for our children 30, 40, 50 years from now,” he said.

That partnership includes a revitalized U.S. presence in Guyana that predates its independence but that has gained renewed relevance as the Trump administration refocuses the nation’s foreign policy on backyard backwaters neglected for decades. With Maduro awaiting trial in New York City, it is uncertain whether the Rodríguez administration will continue to press its territorial claims.

Aerial view of ships carrying machinery on the Demerara River in Georgetown, Guyana, on Aug. 29, 2025. The United States established two bases in the former British Guiana: a naval air station at Makouria, 20 miles from Georgetown, and an air base about 25 miles south of Georgetown along the Demerara River. Joaquin Sarmiento/AFP via Getty Images

Renewed US Presence

As part of the March 1941 Lend-Lease Act with the UK, the Soviet Union, France, China, and other Allied nations, the United States secured 99-year leases to ports and airfields across the Caribbean and elsewhere in exchange for food, oil, munitions, mothballed warships, and other assistance.

The United States established two bases in British Guiana: a naval air station at Makouria, 20 miles from Georgetown, to patrol for German U-boats menacing the Panama Canal, and an air base about 25 miles south of Georgetown along the Demerara River.

The air base, Atkinson Air Force Base, was a key transit point for U.S. aircraft, troops, and supplies heading to Africa and Europe. It was also the pivot for the “Green Project,” which the War Department described as “one of the greatest airborne troop movements in history,” with thousands of GIs passing through on their way home at war’s end.

The United States unilaterally suspended the leases in 1949. Atkinson is now Cheddi Jagan International Airport, Guyana’s biggest commercial airport, adjacent to the Guyana Defence Force’s Camp Stephenson headquarters. Makouria Naval Air Station is now Guyana’s Jungle and Amphibious Training School.

An aerial view shows the Stabroek Market in Georgetown, Guyana, on Sept. 2, 2025. A U.S. delegation met with Guyanese President Irfaan Ali on Dec. 9, 2025, and returned to Washington with an agreement to expand military cooperation between the two countries. Joaquín Sarmiento/AFP via Getty Images

It is increasingly common to see U.S. military at both former U.S. installations and at Guyana’s air base near Eugene F. Correia International Airport on the Atlantic Coast; at Eteringbang on the Cuyuni River, where an all-weather 2,100-foot runway was recently built; and at Ramp Road Ruimveldt Naval Station in Georgetown, where a U.S. Southern Command-funded multimillion-dollar project financed numerous improvements.

In July 2023, Guyana hosted U.S. Southern Command’s Tradewinds joint exercises that included soldiers, airmen, and sailors from the United States, Mexico, Canada, the UK, France, and the 15 member states of the Caribbean Community alliance.

In late 2025, the Pentagon announced that components of the U.S. Army’s 800-man 1st Security Force Assistance Brigade would begin rotational deployments to Guyana “as demand for army advisors in the region continues to grow.”

In late January and early February 2024, 12th Air Force Maj. Gen. Evan Pettus, now deputy U.S. Southern Command commander, went to Georgetown to meet with Guyanese military commanders. In December 2024, Ali visited Southern Command headquarters near Miami.

In November 2025, in one of his tenure’s last overseas trips, Navy Adm. Alvin Holsey, former Southern Command commander, met in Georgetown with senior government leaders.

Guyanese army soldiers carrying Russian-made AK-47 7.62mm caliber rifles march as they participate in joint military exercises with U.S. Southern Command troops at Camp Stephenson in Timehri, Guyana, on July 26, 2023. Keno George/AFP via Getty Images

Military Bases

After Maduro’s December 2023 summit with Ali in Saint Vincent and the Grenadines, a top Guyanese official who attended the meeting told The Associated Press that the Venezuelan leader was “convinced Guyana could host” a permanent U.S. military base, which would dissolve the Argyle Accords.

“We have not been approached by the United States to establish a military base in Guyana,” Guyanese Vice President Bharrat Jagdeo said after a January 2024 visit by then-U.S. Deputy Assistant Secretary of Defense Daniel Erikson.

Since April 2024, Maduro has claimed that the United States operates “secret military bases” in Essequibo, justifying Venezuela’s increased military presence along its borders.

“We have information proving that in the territory of Guayana Esequiba, temporarily administered by Guyana, secret military bases of the (U.S.) Southern Command ... a body of the CIA ... have been installed,” he said, accusing the United States of “aggression” designed “to prepare for an escalation against Venezuela.”

Jagdeo, in a Dec. 19, 2025, news conference, said a military confrontation between the United States and Venezuela appeared imminent. However, unlike the year before, he did not respond to questions about U.S. forces operating from Guyana or whether there was renewed talk about the United States establishing military bases there.

Now-Guyanese Vice President Bharrat Jagdeo delivers a speech during the last day of a summit in Brazzaville, Republic of Congo, on June 3, 2011. Jagdeo, in a Dec. 19, 2025, news conference, did not respond to questions about U.S. forces operating from Guyana or whether there was renewed talk about the United States establishing military bases there. Guy-Gervais Kitina/AFP via Getty Images

In the context of unfolding events, most analysts focus on Venezuela, Cuba, Mexico, and nations to the south when pondering how the Trump Corollary will be unfurled.

“The Guyana aspect is one of the hidden gems in this, as far as the U.S. is concerned, because the U.S. has the majority of the offshore energy reserves off Essequibo,” said Gregory Copley, president of the Washington-based International Strategic Studies Association and editor-in-chief of Defense & Foreign Affairs publications.

“I think the Guyanese would welcome increased cooperation with the United States,” he told The Epoch Times.

Anders Corr, publisher at Journal of Political Risk and principal at Corr Analytics in Pittsburgh, who is also a contributor to The Epoch Times, said, “It would certainly make sense for Guyana to request a U.S. military base because that would give Guyana’s oil resources, other energy resources, a protection it won’t get anywhere else.”

“Trump is very much over spending money to protect other countries without getting something for it,“ he told The Epoch Times. ”So he would probably ask for some kind of a concession on the part of Guyana for that sort of protection. And he might very well get it.”

Tyler Durden

Thu, 01/08/2026 - 23:30

via AFP

via AFP

Nuuk, Greenland

Nuuk, Greenland Nigel Farage

Nigel Farage

German President Frank-Walter Steinmeier delivers a speech at his Bellevue Palace residency in Berlin, Germany, November 9, 2025. Maryam Majd/Pool via REUTERS/File Photo

German President Frank-Walter Steinmeier delivers a speech at his Bellevue Palace residency in Berlin, Germany, November 9, 2025. Maryam Majd/Pool via REUTERS/File Photo

The section of a Boeing 737 Max where a door plug fell while Alaska Airlines Flight 1282 was in flight on Jan. 7, 2024. NTSB via AP

The section of a Boeing 737 Max where a door plug fell while Alaska Airlines Flight 1282 was in flight on Jan. 7, 2024. NTSB via AP

Recent comments