Construction Spending On Data Centers, Factories, Powerplants, And Office Buildings: Boom, Bust, And In Between

Authored by Wolf Richter via Wolf Street,

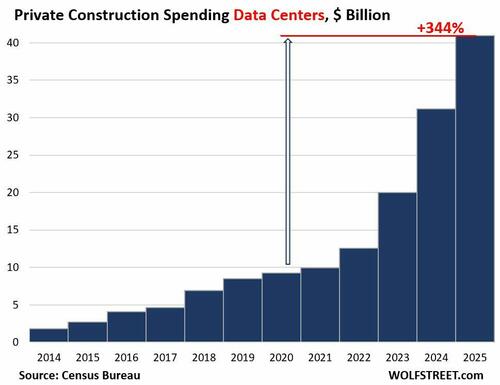

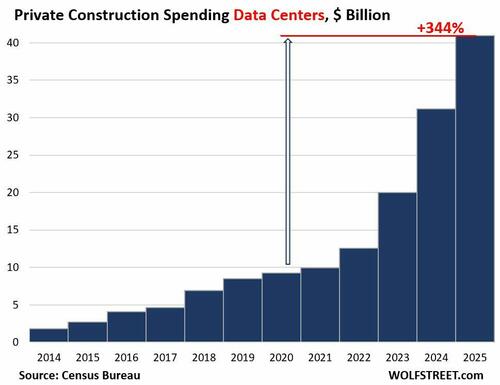

Construction spending on data centers in 2025 exploded by 32% from the prior year, by over 100% in two years, and by 344% from 2020, to $41 billion, according to the Census Bureau on Friday. Spending on construction costs of data centers used to be buried in office construction and was minimal compared to office construction. But more recently, the Census Bureau split out data-center construction spending going back to 2014.

Construction costs of data centers are only a relatively small portion of the immense amounts spent on AI infrastructure, most of which goes into electronic and electrical equipment, from AI servers to power generation equipment. Construction spending on data centers does not include the costs of the servers and racks but does include the cooling systems in the building and other built-in electrical equipment.

It takes years from the decision to build a data center to the data center being actually operational. And the massive amounts of capital expenditures announced by AI-related Corporate America in 2025 and the plans for 2026 haven’t yet shown up in the construction costs.

The amounts of capital expenditures being thrown around for 2026 are fantastical. Five companies alone – Amazon, Alphabet, Microsoft, Meta, and Oracle – have announced plans for $700 billion in capital expenditures for 2026, largely for AI-related projects. And how will they get this cash next year?

So this construction boom is not slowing down, unless tripped up by further the shortages of all kinds, such as power from the grid, power generators when there is no grid power, electrical equipment, electricians, specialized labor, etc.

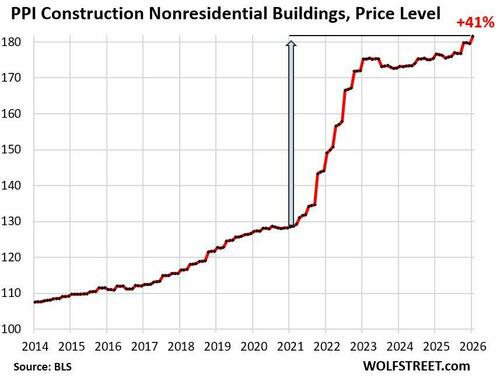

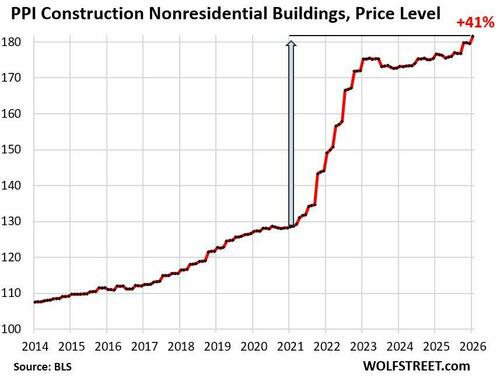

Inflation for construction costs for nonresidential buildings jumped by 1.1% in January from December, according to the Producer Price Index (PPI) for nonresidential construction, released by the Bureau of Labor Statistics on Friday (it was hot all around). Year-over-year, the nonresidential construction PPI was up by 2.8%, almost all of which occurred over the past four months.

From January 2021 through December 2022, over those two years, prices had exploded by 34%. From the beginning of 2023 to mid-2025, prices flattened out. But they’re now taking off again.

Over the years 2021-2025, the PPI for nonresidential construction rose by 41%. With spending on data center construction up by 344% over the same period, the red-hot construction spending boom is not a result of inflation – but of the AI investment mania.

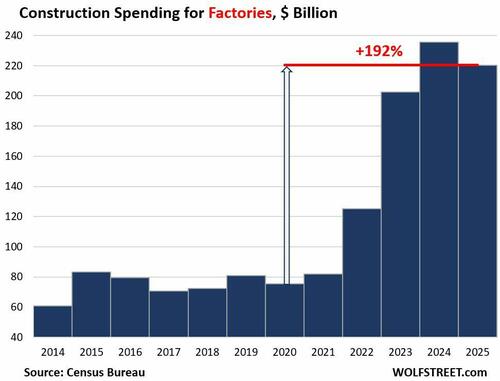

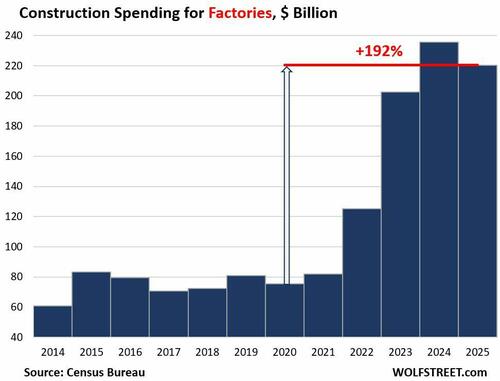

Construction spending on manufacturing plants has soared coming out of the pandemic. In 2025, at $220 billion, it was up by 192% from 2020.

This $220 billion in 2025 is over five times the amount spent on data centers ($41 billion).

The production equipment in the plant, such as the industrial robots, is not part of the construction costs. And they’re much more costly than the building itself.

Though still running at a red-hot pace, construction spending on factories has backed off from the spike in 2024, possibly as construction resources have been pulled away by the boom in data center construction, and amid reports of bottlenecks, shortages of skilled labor, and ICE hauling off workers from construction sites.

After decades of globalization, there is now a widespread rethink underway about production in the US.

These factories will all be highly automated to where manual labor is only a relatively small part of the product costs. Every year, year after year, decade after decade, automation improves, and companies try to cut their labor costs by expanding automation.

Within factory construction, spending on factories for computers, electronic, and electrical equipment exploded by 1,300% since 2020, from $9 billion in 2020 to $104 billion in 2025. This includes semiconductor plants and plants that build electrical equipment for the AI infrastructure boom.

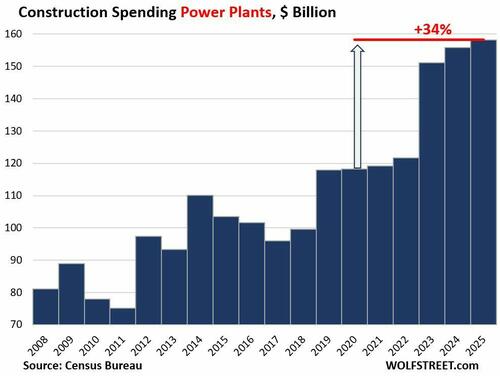

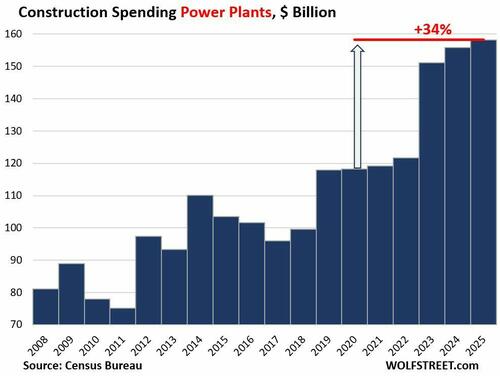

Powerplant construction is a highly regulated process in terms of permitting and approvals, and it takes years from the decision to build a power plant to having a functional power plant hooked to the grid.

In 2025, a record $158 billion was spent on building power plants, up by 34% from 2020.

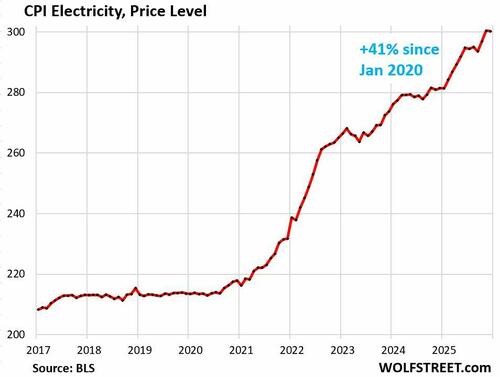

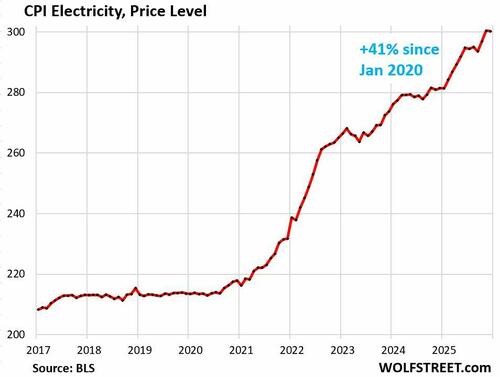

Electricity prices have soared by 41% over the past five years as demand for electricity has surged, after being roughly flat for 14 years. This increase in demand was largely driven by the new data centers.

But utilities and power generators are leery of spending billions of dollars on generation and distribution capacity for data centers that might never work out after the AI investment mania fizzles, which would turn these investments into stranded assets.

This leeriness is fed by the many hedge funds with ag land that want a utility to commit billions of dollars to run a high-voltage powerline to it, and possibly build a power plant to supply it with power, so that the hedge fund can then sell the ag land at a huge profit as data-center ready to some hyperscaler. If that deal doesn’t happen, the utility ends up with an expensive stranded asset.

Office building construction has taken a massive hit after it became clear that office landlords were getting into serious trouble as demand for office space collapsed during the pandemic. Countless landlords defaulted on their office mortgages, and numerous buildings were seized by lenders and sold in foreclosure sales for cents on the dollar. The going rate for office building transactions is now at discounts of 30% to 70% from pre-pandemic prices. The delinquency rate for office CMBS spiked to record 12.3% in January. And there are efforts underway in expensive markets to convert office towers into residential towers, while smaller office buildings get torn down and replaced with housing. Office CRE has been in a depression since 2022.

In a way, it seems surprising that anyone would still spend good money on office buildings, but it’s the old office towers that are in trouble, while the latest and greatest office towers see more demand from the flight to quality that high vacancy rates made possible.

So spending on office construction (not including data centers) dropped further in 2025, to $49 billion, the lowest since 2015, and down by 32% from the peak in 2020.

Some of this spending is for buildings that were planned years ago and that are being completed now. For example, JP Morgan’s $3-billion tower at 270 Park Avenue in Manhattan was announced in 2018, was formally topped off in November 2023, and had its grand opening in October 2025.

Tyler Durden

Mon, 03/02/2026 - 13:20

Recent comments