The Passive Aggressive Market: Bogle's Warning Came True

Authored by Michael Lebowitz via realinvestmentadvice.com,

Since the pandemic, the line between passive investing and aggressive speculation has blurred. The current bout of speculative fervor extends beyond financial markets. For instance, we see the same impulse in the explosion of sports betting and the surge in event-betting sites like Kalshi and Polymarket.

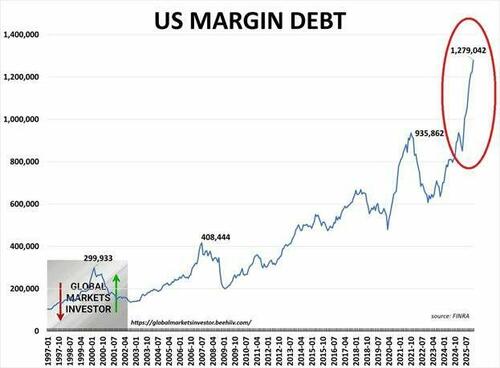

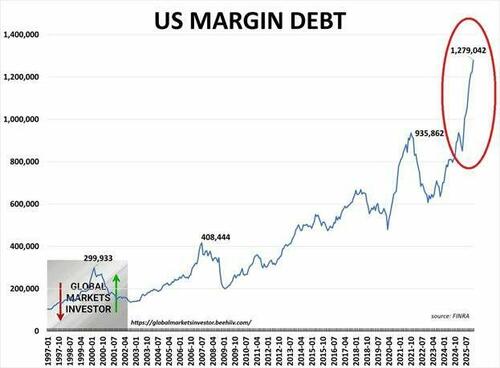

In the investment arena, margin debt is at record highs (as shown below), and zero-day-to-expiry (0DTE) stock options now account for approximately 50 percent of all options volume. Furthermore, the number of leveraged ETFs and their trading volumes have risen sharply. To wit, we share a quote from The Kobeissi Letter:

There are now a record 108 long and 31 short tech-related leveraged ETFs, 139 in total. This is 3 TIMES more than the 2nd largest sector, financials, with 47 total funds. By comparison, Consumer Discretionary has 44 ETFs, while Communication Services has 34 ETFs. In other words, tech has more leveraged ETFs than the next 3 sectors COMBINED.

While not as easy to quantify as margin debt or sports betting, this aggressive speculative behavior is showing up in passive securities. It is most visible, for instance, in the fierce rotations between sector and factor ETFs.

In this article, we explore how the speculative environment and aggressive trading in passive ETFs are playing out. We also examine how to identify and capitalize on sector and factor rotations, turning passive investors’ aggressive behavior into an opportunity.

Passive Investment Strategy Timeline

In 1952, Harry Markowitz and his Modern Portfolio Theory laid the groundwork for passive strategies. His thesis is that diversification across a broad market portfolio maximizes returns for a given level of risk. He argued for what has since been termed indexing.

John Bogle is known as the “father of indexing.” In 1976, he launched the First Index Investment Trust at Vanguard. His fund, tracking the S&P 500, was the first index mutual fund available to retail investors. The fund was mocked by competitors as “Bogle’s Folly.” Today, Vanguard manages over $12 trillion in assets, a testament to the power of Bogle’s low-cost, buy-and-hold passive investing philosophy. Ironically, Bogle warned that ETFs’ intraday liquidity would tempt investors into the active trading behavior he had spent his career arguing against.

In 1993, the SPDR S&P 500 Trust (SPY) became the first ETF available to US investors, enabling intraday trading in passive indexing securities.

Passive investment strategies and associated securities were designed to bring discipline and longer-term strategic thinking to investors. Instead of actively buying and selling individual stocks to beat the market, passive strategies are comfortable matching market returns.

Bogle’s Warning

Despite the compelling long-term case for passive investing, something has changed in how investors actually use these instruments. As Bogle warned, ETFs would lead passive investors to become more active. And indeed, that is what has happened.

Over the past few years, for example, we have seen sharp divergences in the returns between various broad-market indexes, sector ETFs, and factor ETFs. Investors are not buying broad market ETFs and holding them. Instead, it is becoming increasingly popular to rotate aggressively between index ETFs (S&P, Nasdaq, Dow), sector ETFs (technology, staples, financials), and factor ETFs (momentum, value, market cap) in response to short-term market narratives. This is active management despite the use of passive securities.

Another example is leveraged ETFs. These products reset daily, eroding returns over time and making them unsuitable for anything but short-term active trading strategies. Eroding returns are called volatility decay and are an SEC-mandated warning in every leveraged ETF prospectus, as we share from the Direxion ETF prospectus below:

If a Fund’s shares are held for a period other than a calendar month, the Fund’s performance is likely to deviate from the multiple of the underlying exchange-traded fund performance for the period the Fund is held. This deviation will increase with higher underlying volatility and longer holding periods

The explosive growth of leverage ETFs, as we noted in the opening, is evidence of short-term speculative behavior inside the passive universe.

Lastly, there is a sharp increase in the number of thematic ETFs. ETFs tied to themes like artificial intelligence, clean energy, and precious metals attract massive inflows when a narrative is hot. Fund outflows are equally powerful when the narrative fades. This is momentum-chasing dressed in passive clothing.

Many investors who describe themselves as passive would, if they examine their transaction history honestly, likely find behavior that looks a lot more like active trading.

Rotation Analysis

Understanding that investors are using passive instruments to trade aggressively across sectors and factors is one thing. Profiting from it is another. For our part, we use technical analysis on our SimpleVisor website to identify when these rotations begin, accelerate, end, and reverse.

We introduced the value of rotation analysis and trading in 2023 with our article: Relative Rotation- Unlocking The Hidden Potential. The most compelling argument for rotation analysis comes from the following graph in the article, which compares the relative performances of VYM and MGK to the S&P 500 (SPY). The takeaway from the graph is that when one ETF outperforms the market, the other tends to lag, creating a predictable rotation pattern that technical analysis can identify and exploit

To better appreciate how we use SimpleVisor for this task, we share an article written last year entitled: Growth To Value- Which Rotation Is Next? The article walks through our tools in detail and shows how we use them to position ahead of rotations in real time.

The more aggressively passive investors rotate, the more reliable these patterns and our tools become.

Narrative Analysis

Technical analysis, like the SimpleVisor tools we described, indicates when a rotation is probable or underway. Narrative analysis helps us understand the driving force behind investors’ collective actions. Importantly, researching the narrative helps us assess whether a narrative is built on solid ground or speculative momentum. In a market increasingly driven by aggressive trading in passive instruments, narratives spread faster and with greater force than ever before. A compelling narrative can trigger billions in ETF flows within days, long before the underlying fundamentals catch up — if they ever do.

Not all narratives are created equal. Some rotations are driven by genuine shifts in economic conditions or monetary policy. These rotations tend to be durable and worth following. Others are driven purely by momentum and media attention. A narrative heats up, aggressive passive investors pile into ETFs reflecting that theme, and the rotation feeds on itself until it no longer attracts investors.

Distinguishing between the two is as important as identifying the rotation itself. A technically strong signal supported by a fundamentally weak narrative is a trade not likely to last long.

Summary

The irony of modern passive investing is that the securities built for patience and longer-term discipline have become tools for short-term speculation. Passive investors, often without realizing it, are behaving more like active traders, rotating aggressively between sectors and factors in response to narratives.

Understanding this dynamic is the first step toward better investment discipline. For those looking to turn it into an opportunity, SimpleVisor’s rotation analysis tools help you identify and act on these shifts before the crowd does. Additionally, our blog articles, Daily Commentary, podcasts, and the weekly Bull Bear Report help separate the signal from the noise of current market narratives.

Tyler Durden

Thu, 03/05/2026 - 15:05

Recent comments